Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsSri Mulyani defends tax bill

The bill would introduce higher income taxes on wealthy citizens, tiered value-added tax (VAT) rates, a second tax amnesty and carbon taxes on high-emission goods and services, among other things.

Change text size

Gift Premium Articles

to Anyone

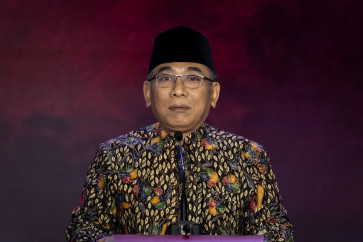

Finance Minister Sri Mulyani Indrawati speaks during a working meeting with House of Representatives Commission XI at the House complex in Jakarta on June 29, 2020. In the meeting, Sri and members of the Financial System Stability Committee (KSSK) explained the policy of placing state money in commercial banks in the context of accelerating national economic recovery. (Antara/Aditya Pradana Putra)

Finance Minister Sri Mulyani Indrawati speaks during a working meeting with House of Representatives Commission XI at the House complex in Jakarta on June 29, 2020. In the meeting, Sri and members of the Financial System Stability Committee (KSSK) explained the policy of placing state money in commercial banks in the context of accelerating national economic recovery. (Antara/Aditya Pradana Putra)

F

inance Minister Sri Mulyani Indrawati has defended an upcoming controversial tax bill as a must to keep the state budget sustainable and to create a just taxation system.

She said the bill would achieve the two goals by, among other things, introducing higher income taxes on wealthy citizens, tiered value-added tax (VAT) rates, a second tax amnesty and carbon taxes on high-emission goods and services.

“This is how we continuously reform tax policies and bureaucracy to reflect the principles of justice, inter-sectoral justice between income groups, and to create legal certainty,” Sri Mulyani told lawmakers during a hearing with the House of Representatives on Monday.

The bill, known as the proposed amendment to Law No. 6/1983 on general tax provisions and procedures, was also presented as a plan to fix state revenue as the government had to reimpose fiscal discipline starting 2023.

Existing regulations allow the government to push the budget deficit up to 5 percent of gross domestic product (GDP) in financing COVID-19 relief efforts but it has to return to below 3 percent starting 2023.

Read also: Tax office defends proposed food tax

Sri Mulyani said current VAT rules were ineffective as Indonesia’s VAT rate was much lower than the world average of 15.4 percent and they gave too many exemptions. Thus, the government can only collect about 63 percent of its targeted revenue each year.