Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsTaxing robots: Bold fiscal strategy for an automated era

As Indonesia is poised to increasingly adopt automation and AI, it needs to take a balanced, careful approach to formulating a robot tax as part of a comprehensive strategy to tapping the benefits of advanced technologies toward their equitable distribution.

Change text size

Gift Premium Articles

to Anyone

A

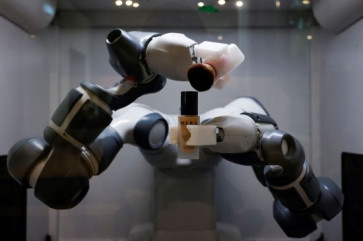

s Indonesia races toward Industry 4.0, the nation faces a critical juncture in its economic development. The rapid advancement of automation and artificial intelligence (AI) presents both unprecedented opportunities and challenges.

At the heart of this technological revolution lies a pressing question: How can Indonesia harness the benefits of automation while mitigating its potential negative impacts on employment and tax revenue?

The global context paints a stark picture. Bank of America Merrill Lynch predicts that by 2025, AI could eliminate US$9 trillion in employment costs by automating knowledge work. This projection underscores the urgency for Indonesia to develop a comprehensive strategy to address the automation wave.

Automation undeniably brings significant benefits. It increases productivity, generates wealth and can create new jobs. Indonesia's growing tech sector and digital economy stand to gain immensely from these advancements.

However, the dark side of automation cannot be ignored. It can lead to unemployment, exacerbate income inequality and, most critically for a developing nation like Indonesia, substantially reduce tax revenue.

The government relies heavily on taxes from its workforce to fund public services and development projects. As machines replace human workers, the country faces a potential crisis in tax collection. This scenario is particularly alarming for Indonesia, where a significant portion of the population still lives in poverty and relies on state assistance.

Indonesia's current tax system, like many others globally, inadvertently favors automation over human labor. This bias stems from several factors.