Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsForeign participation in banking M&A can enhance capital and efficiency

Many smaller banks do not possess unique business models or strong and steady cash flows to amass buffers like the big banks do.

Change text size

Gift Premium Articles

to Anyone

M

ergers and acquisitions (M&A) activity is heating up in Indonesia’s banking industry after a relatively slow period in 2009-18. Acquisitions worth Rp10 trillion (US$7 billion) have taken place since the start of 2019, and foreign banks have dominated these acquisitions with 99 percent share by value.

This reminds us of a similar trend in 2003-05, when foreign banks were very active in M&A following the recapitalization of Indonesia’s banking system after the Asian Financial Crisis in the late 1990s.

The recent increase in M&A is being driven by foreign banks’ ambitions to expand into Indonesia, as well as support from the regulators through relaxation of the 40 percent shareholding cap for a few M&A cases where the foreign banks were helping with the banking system consolidation.

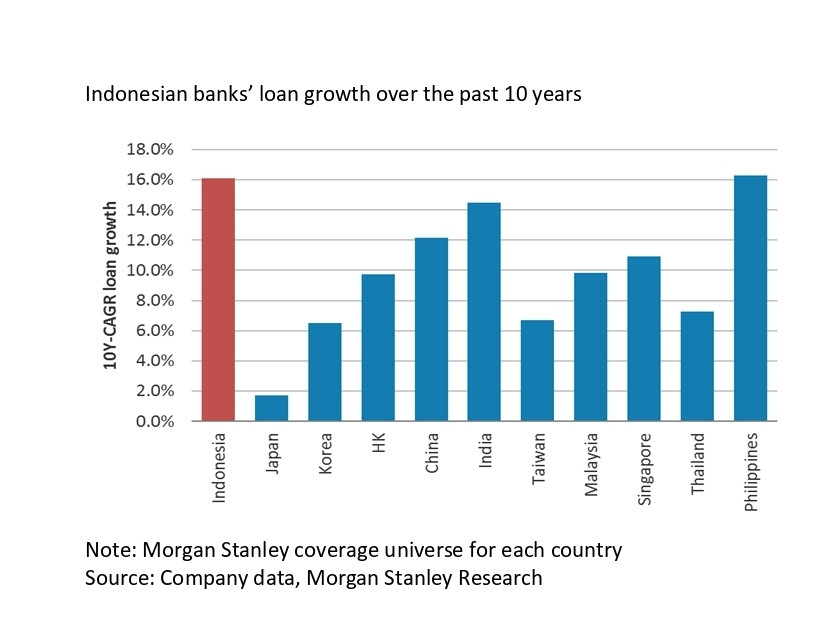

Growth and regional diversification appear to be the main motivations for foreign banks to acquire Indonesian banks, particularly for the Japanese and South Korean banks that have been active in the country recently. This is supported by a comparison of regional data, as Indonesian banks look attractive with 16 percent compounded annual loan growth in 2009-19 compared to 2 percent and 7 percent for Japanese and Korean banks under our coverage. Net interest margins for major Indonesian banks were also high at 5.9 percent in 2019, compared with 1.0 percent and 1.9 percent for Japanese and Korean banks.

We think higher foreign participation in the banking system will bring about more good than bad, in at least three ways:

Accelerating bank consolidation. The foreign banks that acquire Indonesian banks could help accelerate consolidation in the banking system by merging subsidiaries following acquisitions. We have seen this in the last few acquisitions, in which the acquirers merged the newly acquired banks with their existing operations, or the foreign banks acquired more than one bank and then merged them. This has reduced the number of banks in Indonesia from 116 in 2018 to 110 currently.

Higher efficiency through increased competition. Despite their strong loan growth and net interest margins, Indonesian banks have lagged regional peers in terms of cost efficiency. The major banks’ average cost-to-assets ratio was 3.3 percent in 2019 — the worst among major Asian bank peers, which ranged from 0.7 percent to 2.6 percent. We expect foreign banks to ultimately instill their good cost control in their Indonesia subsidiaries. This would raise efficiency in the system, pressuring other major Indonesian banks to respond.

Solid capital and liquidity support. Foreign banks that are allowed by the regulators to acquire Indonesian banks are among the most solid banks in their home countries. Their consolidated asset size can be up to 30 times more than Indonesia’s biggest bank. This implies that they can comfortably provide solid capital and liquidity support to the Indonesian banks they acquire.

The third point above is particularly important in the current environment, as banks are facing headwinds from borrowers’ impaired repayment capacity and potential liquidity needs amid the COVID-19 pandemic.

While the big banks are more equipped to deal with these headwinds given the ample buffers on their balance sheets, the smaller banks need to fight harder to stay sound. Many smaller banks do not possess unique business models or strong and steady cash flows to amass buffers like the big banks do. A lack of expertise, experience, and talent could be among the key reasons.

Regulators have been encouraging the smaller banks to merge or obtain additional capital from their shareholders, but there has as yet been little self-driven consolidation. That leaves acquisitions as an effective catalyst for consolidation. The big local banks have been helping by acquiring some smaller banks, but, as there are still too many small banks, M&A by foreign banks appears to be another sensible solution.

As strong foreign banks acquire small banks and consolidate them, these smaller banks could eventually turn around through revamped business models, higher adoption of technology, increased efficiency, and improved risk management.

Yet, foreign banks would still need to adapt.

There is no guarantee that every foreign bank that expands to Indonesia will succeed, though. They may be champions in their home countries, but not everything they do will be applicable in Indonesia because of the different environment and banking businesses. Although they excel in cost efficiency and technology, they likely need to adapt their lending and deposit-taking strategies to adapt to Indonesia’s banking system.

Banks in more advanced countries generally focus on retail consumer and corporate loans, but in Indonesia consumer loans represent just 28 percent of system loans. Indonesia is instead dominated by business lending, with loans to small and medium enterprises and micro lending playing an important role. Unlike corporate loans, SME and micro loans need a different approach due the absence of proper collateral and book-keeping.

On deposit strategy, the system is traditionally controlled by the incumbent big banks due to their large networks and long history in the market. Foreign banks' subsidiaries would likely need to come out with either distinguished deposit franchise strategies or ways to mobilize funding in their home countries to fund lending growth in Indonesia at relatively favorable costs.

Adapting new lending and deposit-taking strategies will be key success factors for foreign banks in Indonesia. Nevertheless, the infusion of good cost cultures and risk management systems should eventually lead to healthier smaller banks, and therefore a healthier banking system.

***

The writer is Morgan Stanley’s Indonesia head of research. This is personal opinion.