Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBI vows to keep rate low in 2021

The central bank has cut its benchmark interest rate five times this year to 3.75 percent, its lowest level in history, to support an economy reeling from the pandemic.

Change text size

Gift Premium Articles

to Anyone

B

ank Indonesia (BI) will maintain its loose monetary policy stance and keep its benchmark interest rate low in 2021 to support the economic recovery while pledging to strengthen and develop the country’s digital payment system.

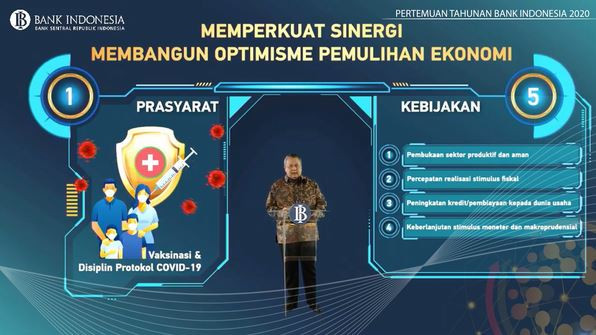

BI Governor Perry Warjiyo said the central bank would continue to use all its policy instruments to pursue economic recovery next year, projecting the economy to rebound by 4.8 percent to 5.8 percent of growth.

“Monetary stimulus will continue in 2021 while the benchmark interest rate will remain low until inflation picks up,” he said during the BI annual meeting on Thursday.

The rupiah slightly weakened by 0.11 percent on Thursday while the Jakarta Composite Index (JCI) gained 0.15 percent.

The central bank has cut its benchmark interest rate five times this year to 3.75 percent, its lowest level in history, to support an economy reeling from the pandemic. It has also taken quantitative easing measures to support the economy, including buying government bonds, cutting the reserve requirement ratio and undertaking monetary expansion.

BI has bought government bonds worth Rp 483.5 trillion (US$34.4 billion) through a burden-sharing agreement with the government and as the non-competitive bidder to help fund the country’s fiscal deficit and reduce the government’s borrowing costs.

The central bank is committed to continuing buying government bonds through auctions as the non-competitive bidder in 2021, Perry said, while ruling out the possibility to continue the burden-sharing agreement, in which BI returns to the government all yields it receives from certain sovereign debt papers.

The government has allocated a large stimulus as Indonesia has plunged into recession for the first time since the 1998 Asian financial crisis. The central bank now expects the economy to shrink by 1 percent to 2 percent this year, while the government expects the economy to shrink by 0.6 percent to 1.7 percent.

Perry said the economy might rebound in 2021, driven by improvement in exports in line with global economic recovery, higher people’s mobility thanks to mass vaccinations, as well as improvement in domestic consumption because of the government’s stimulus spending, among other factors.

The central bank’s governor also urged banks to lower their credit rates and expand lending in support of economic recovery, expecting the loan growth to reach 7 to 9 percent in 2021. Banks loan disbursement contracted 0.47 percent year-on-year (yoy) in October as demand weakened amid cooling economic activity.

“We are committed to accelerating lending both from the demand and supply sides to solve the credit crunch […] monetary and fiscal stimulus are needed,” he went on to say.

The central bank also pledges to speed up economic and finance digitization through the implementation of the 2025 Indonesia Payment System Blueprint, aiming to boost the implementation of the Quick Response Indonesia Standard (QRIS) to reach 12 million merchants by 2021, push the use of digital banking and encourage open application programming interfaces (API) and enhance cooperation between banks and financial technology companies.

President Joko “Jokowi” Widodo, who gave his remarks during the meeting, urged the central bank to take a more significant role in the country’s “fundamental reforms”, particularly to support the real sector, boost job creation and help businesses recover from the pandemic impact.

“We need to move fast and throw away sectorial ego, not build high walls and find shelter in our own authority,” the President said. “We need to share the burden and responsibility so that the country can transform into a new economic powerhouse in the region and the world.”

The government and the House of Representatives are currently working on the omnibus bill on the financial sector, which will mandate the central bank to pursue sustainable economic growth and employment, among other provisions.

Separately, Bank Permata chief economist Josua Pardede expected the benchmark interest rate to remain low until the end of 2022 or early 2023, as he projected inflation to be within the central bank’s target range of 2 to 4 percent next year.

“There is only a small possibility that inflation will overshoot BI’s target as the country will continue to struggle with the pandemic at least in the first half next year,” he told the Post. “As long as the inflation is within the central bank’s range, there is no urgency to raise rates.”

On the growth side, Bank Central Asia (BCA) chief economist David Sumual warned that the country’s full economic recovery might be slower compared to other countries going forward.

“Indonesia usually takes longer to recover during an economic downturn and, therefore, the government needs to provide a boost through the Job Creation Law and sector-based stimulus,” he said on Thursday. “The government’s support is crucial to restoring business confidence, including commercial banks, to get in line in pushing for economic recovery.”