Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsNatural rubber outlook: Average price may fall in 2022

We estimate an average TSR20 price of $1.54 per kg in 2022, lower than the 2021 average price of $1.67.

Change text size

Gift Premium Articles

to Anyone

I

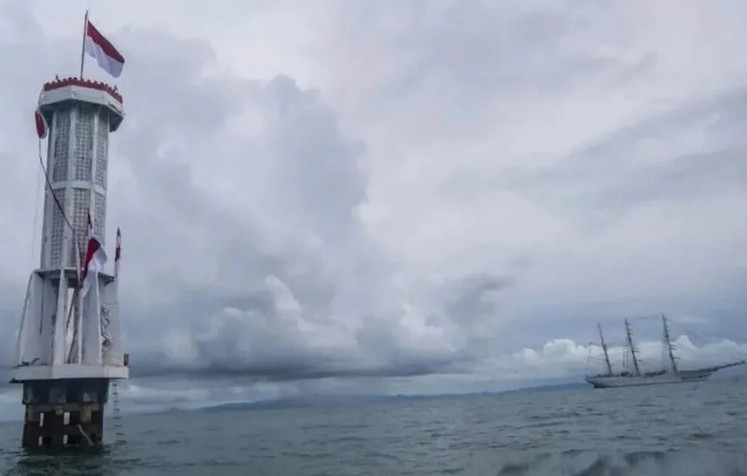

ndonesia is very rich in natural resources. No wonder that Indonesia is among the world’s important resource-exporting countries.

Indonesia produces massive amounts of crude palm oil (CPO), coal, nickel, natural rubber, copper and many other commodities. The reopening of the global economy in 2021 created huge demand for such commodities, and hence drove up the prices of most commodities.

For example, coal and CPO prices rose significantly by 109.2 percent year-to-date (ytd) and 21.0 percent ytd, respectively. As a result, Indonesia’s export performance reached record highs in October and November. Cumulatively, Indonesia’s export value grew an impressive 42.6 percent year-on-year (yoy) in the January-November period.

The natural rubber industry also benefited from the global economic reopening. The global reference price for TSR20 rubber on the Singapore Exchange (SGX) was US$1.7 per kilogram on Monday, an increase of 13.7 percent ytd.

However, rubber prices increased at a relatively lower rate compared to other Indonesian commodities. In a more detailed view, rubber prices moved sideways throughout 2021 in the range of $1.5 to $1.8.

Unlike other commodities, rubber failed to break its record price in 2021. So why did rubber price move differently compared to other commodities?

First, approximately 55 percent of the world’s rubber is absorbed by the automotive sector, especially in China, the United States and Japan. This is followed by the glove (19 percent) and footwear (11.15 percent) sectors.

Car sales in China, the US and Japan contributed more than 59 percent of global car sales in 2020, when these same countries imported more than 43 percent of the total natural rubber output. So it is clear that the automotive sectors in China, the US and Japan play a significant role in global rubber demand.

However, 2021 car sales in these countries have not been that good.

Car sales in the January-November period in China and the US only grew 4.5 percent yoy and 6.8 percent yoy, respectively. Car sales in Japan even contracted minus 2.5 percent yoy in the same period. It is highly likely that full-year car sales for 2021 in those countries will not reach their pre-COVID levels.

In conclusion, demand for natural rubber in the global automotive sector improved in 2021, but was still below the normal level.

Second, the highest monthly average price for TSR20 was recorded in December 2016 at over $2 per kg, specifically $2.30.

Prices started tumbling in January 2017 and never reached that level again.

It was also in the 2016 that China started importing more synthetic rubber than natural rubber, or 3.3 million tons of the former compared to 2.5 million tons of the latter. The gap grew even wider in 2017, reaching a difference of more than 1.5 million tons.

China continued to import more synthetic rubber until now, while the price of natural rubber has never rebounded to its peak levels.

We believe there is some sort of substitution between natural rubber and synthetic rubber, especially when producing tires for low-level passenger vehicles. Even though heavy vehicles like trucks and aircraft favor a higher natural rubber blend in their tires, in terms of volume, tires for passenger vehicles still dominate demand.

Looking forward, how do natural rubber prices look in 2022?

Moody’s has projected that global car sales in 2022 will grow 6.2 percent to approximately 85 million units. This figure is still lower than the normal level in 2019, which reached 90.3 million units. However, public mobility has a significant influence on global car sales.

Mobility restrictions to control the spread of the new COVID variant might yet hamper global car sales again and eventually impact the demand for natural rubber. The natural rubber supply will recover, but still not reach its normal level.

Our interview with several Indonesian rubber farmers found that a portion of rubber plantations still experienced leaf fall disease. Consequently, rubber production at these plantations was still far below normal, with some saying they experienced production loss of between 15 percent and up to 40 percent in the most affected plantations.

Furthermore, global rubber production also declined 6.5 percent from 13.8 million tons in 2018 to 13 million tons in 2020.

Unfortunately, the most recent production data, available only from Malaysia, recorded a 5.6 percent yoy production decline in January-October.

The US Federal Reserve’s tapering plan might absorb liquidity from the commodity market to the US and reduce speculative motives. As a result, 2022 might see a potential drop in global commodities prices, including rubber.

We estimate an average TSR20 price of $1.54 per kg in 2022, lower than the 2021 average price of $1.67. However, this price would still be relatively safe for Indonesia’s rubber farmers and producers.

Historically, we saw natural rubber prices reach a critical level of $1.30 per kg in 2013. At this level, level-2 loan collectability and non-performing loans (NPLs) in the rubber sector increase, as seen in 2015-2016 when rubber prices dropped to near $1.30.

Additionally, strengthening Indonesia’s downstream rubber sector might be a long-term solution.

Downstream rubber products have higher value added and more stable price movements. For example, Indonesia is a net importer of rubber contraception, booking a deficit of more than $5.5 million in 2020.

Other products that should be focused on are medical rubber gloves, automotive rubber seals and high-grade tires.

Furthermore, improving Indonesia’s downstream rubber sector could also create domestic demand to potentially maintain rubber prices for the long term.

--

Industry analyst at Bank Mandiri