Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsHow CBDC could transform Indonesia’s financial ecosystem

Close attention will be paid to the emerging situation in China, as well as that of regional neighbor Singapore.

Change text size

Gift Premium Articles

to Anyone

F

inancial institutions have traditionally viewed blockchain as a technology destined to orbit on the fringes of our finance industries, but renewed focus on central bank digital currencies (CBDC) is now challenging that belief.

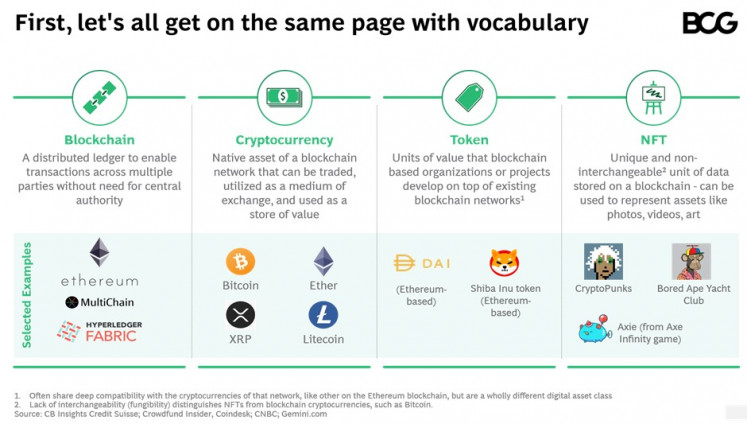

The blockchain ecosystem gives birth to a number of key use cases. Blockchain itself leverages a concept of digital trust through a shared ledger validated across multiple participating parties without the need for a central authority.

Digital coins (cryptocurrency) such as Bitcoin and Ether are prominent examples of native assets built on a blockchain network. These native coins can act as a digital currency secured through cryptography developed within a blockchain ecosystem.

Digital tokens are another face of the blockchain ecosystem. These tokens represent equity created and distributed through initial coin offerings (ICOs) and are usually tradeable. These are units of value developed by blockchain-based organizations that build on top of existing blockchain networks.

Another prominent form of digital ownership that hit the headlines this year is the concept of non-fungible tokens (NFTs). These digital tokens offer a unique certificate of ownership built on the blockchain, and have been increasingly used to sell control of assets such as photos, videos and art.

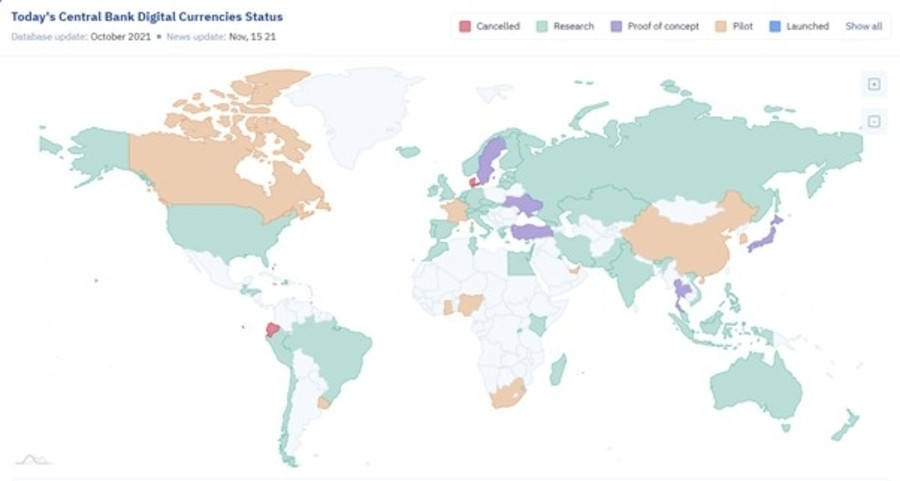

CBDCs mark a new evolution in these emerging financial systems, integrating central bank financial oversight with innovative digital currencies. Boston Consulting Group (BCG) estimates that around 80 percent of all central banks are now investigating CBDCs.

There are more than 80 countries around the world with some level of CBDC exploration currently underway. Just one—the Bahamas—has gone live, six are exploring proof of concepts and 14 others have actively launched a pilot.

Exploring the world of CBDCs

CBDCs broadly fall into one of two models. A wholesale model leverages digital currencies to facilitate inter-bank settlements between banks and a central bank. The volume of these transactions tends to be limited, offering perhaps a gentler introduction to digital currencies for regulators.

A retail model represents a more widespread transformation, enabling end-customers to leverage central bank digital currencies for their financial transactions both between each other and with businesses. This could incorporate up to hundreds of millions of daily transactions.

It is clear why digital currencies present an enticing proposition for central banks. They offer the possibility of more efficient and resilient payments, reduced transfer and settlement times and could act as a promoter of economic growth, while also offering valuable resilience if established electronic systems are disrupted.

The mode of function for digital currencies could help improve the effectiveness of monetary policy, providing more direct control of money supply in comparison to traditional interventions such as quantitative easing or interest rates.

Furthermore, digital currencies offer a pathway to improve financial inclusion, with easy-to-access accounts or digital tokens reaching populations with less mature adoption of financial products. This is a particularly enticing prospect in Indonesia, where almost half the population remain unbanked and just 6 percent use credit cards.

Global CBDC adoption

The attractions of digital currencies have led to numerous countries developing proposals in recent years, often in partnership with technology firms who bring their technical expertise to the table.

The Eastern Caribbean Central Bank announced a pioneering CBDC pilot in 2020, marking a world-first for CBDC implementation.

Central banks across Europe have also been testing the digital waters for CBDCs. France, Sweden, the United Kingdom and others have progressed with road maps and pilot schemes for a range of schemes, riding the wave of digital engagement triggered by growing adoption of e-wallets and mobile payment systems.

More significantly for Asia, China’s central bank is developing a centralised digital currency under its Digital Currency Electronic Payment (DCEP), partly based on blockchain technology.

The People’s Bank of China (PBOC) began its research back in 2014, going on to establish a Digital Currency Unit in 2016. China’s central bank aims to drive forward digital payment innovation, promote financial inclusion, level the playing field for banks and enable them to expand customer bases, and, crucially, accelerate the targeted globalisation of the national currency.

DCEP will act as a sovereign digital currency administered by PBOC. It is available via a mobile wallet app and is pegged 1:1 with the nation’s fiat currency. PBOC worked in partnership with six state-owned banks to roll out the pilot, with tech support provided by major telecoms providers including China Mobile, China Telecom and China Unicom.

The DCEP pilot is now underway in major cities such as Beijing, Shanghai and Chengdu, incorporating both online and offline merchants, and is expected to feature prominently in the 2022 Beijing Winter Olympics. That offline-online integration will be a valuable functionality if Indonesia is to pursue its own effective adoption of CBDC.

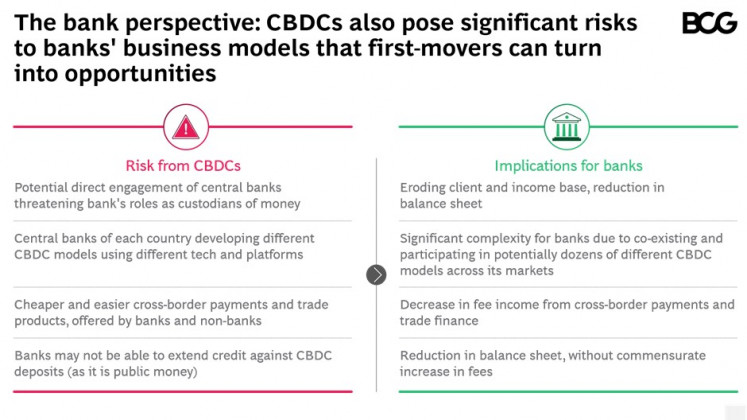

The risks. (BCG/-)Balancing the risks for banks

Banks across the world are watching on carefully to understand where CBDC focus may ultimately fall, aware of a number of risks that could emerge.

The potential direct engagement of central banks could threaten the role of banks as traditional custodians of money, eroding client and income bases and ultimately reducing the balance sheet.

With respective central banks each developing their own CBDC strategy, there are also concerns about interoperability across different models and platforms. This could significantly increase the complexity of operations for banks.

Simpler, cheaper cross-border payments and trade products offered by banks and non-banks also have the potential to decrease fee income and trade finance, an established revenue model of many incumbent institutions.

Finally, there remains a fundamental question of how digital currencies could affect bank lending systems, with uncertainty about the ability to extend credit against CBDC deposits.

With recent reports of Bank Indonesia’s interest in exploring CBDCs, it’s clear that sorting through the balance of challenge and opportunity will be a priority for the regulator. Close attention will be paid to the emerging situation in China, as well as that of regional neighbour Singapore, which is exploring the use of blockchain for cross-border transactions under its Project Ubin pilot.

This remains an extremely complex area of the global financial ecosystem, and one that continues to evolve at a rapid pace. It is clear that digital currencies could offer attractive benefits to central bank adopters around the world, but the true picture of what effective implementation looks like will vary by country and financial system.

In Indonesia, the attractiveness of easy-access digital currencies that boost financial inclusion and streamline adoption under a managed central banking authority is obvious. But it is a careful tightrope to walk if we are to unlock those benefits without causing punitive disruption to incumbent financial institutions that underpin the current financial ecosystem.

--

Managing director and partner, Boston Consulting Group