Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsSinar Mas unit to invest $200 million in e-wallet DANA

The investment makes Sinar Mas the latest conglomerate to enter a crowded e-wallet market after Lippo Group and Astra International.

Change text size

Gift Premium Articles

to Anyone

E

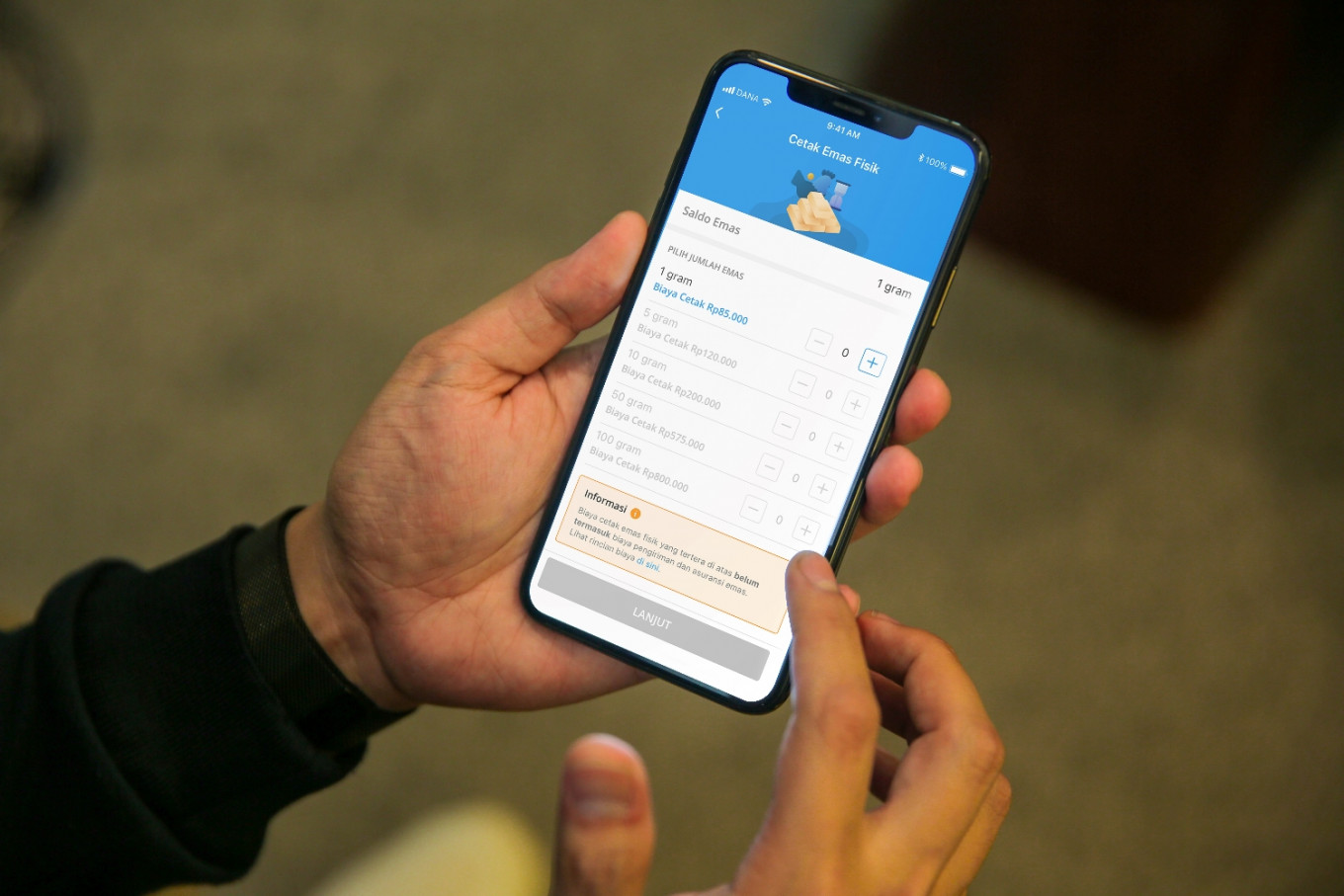

nergy and mining contractor PT Dian Swastatika Sentosa (DSSA), part of the Sinar Mas conglomerate, has announced it will invest US$200 million in PT Elang Andalan Nusantara, the firm that operates Indonesian e-wallet DANA.

The two companies signed an agreement on the matter on Monday, according to a filing with Indonesia Stock Exchange (IDX) published on Tuesday.

“This strategic development is expected to have a positive impact on the digital ecosystem development of the company and its stakeholders,” said DSSA.

DSSA, through subsidiary holding firm PT DSST Dana Gemilang, “will be one of the largest shareholders of DANA” after the acquisition, which is subject to approval from regulatory authorities.

The investment makes Sinar Mas the latest conglomerate to join the fray in a crowded e-wallet market. Lippo Group launched OVO in September 2017, while PT Astra International launched e-wallet AstraPay in September 2021. Astra has a market capitalization of Rp 225.70 trillion (US$15.6 billion).

“This investment plan is part of a collaboration to develop digital businesses,” said DANA in a statement on Wednesday.

Singapore-headquartered ShopeePay currently dominates the Indonesian e-wallet market, partly thanks to aggressive pricing with vigorous discounts and cashback offers.

Read also: Shopee reigns over Indonesia’s e-wallet market with price cuts, good looks

ShopeePay had the highest user penetration at 68 percent, outperforming other e-wallets such as OVO (62 percent), DANA (54 percent), GoPay (53 percent) and LinkAja (23 percent), in a survey conducted by market research firm NeuroSensum from November 2020 to January 2021.

Analysts say “discount wars” remain key to capturing the Indonesian market, owing to domestic consumers’ price sensitivity. ShopeePay benefits from the financial support of publicly listed parent company Sea Ltd., which has a market cap of $70.55 billion.

GoPay parent company GoTo has an estimated valuation of $18 billion.

According to the Mobile Wallet Report 2021 published by United States-based mobile payment company Boku, Indonesia is one of the fastest-growing mobile payment markets in the world, with e-wallet users set to more than triple to 202 million in 2025 from 63.6 million last year.