Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsGovernment to start slapping VAT on peer-to-peer lending, e-wallet services

Taxes will be imposed on gains from P2P lending and on service fees from e-wallets.

Change text size

Gift Premium Articles

to Anyone

I

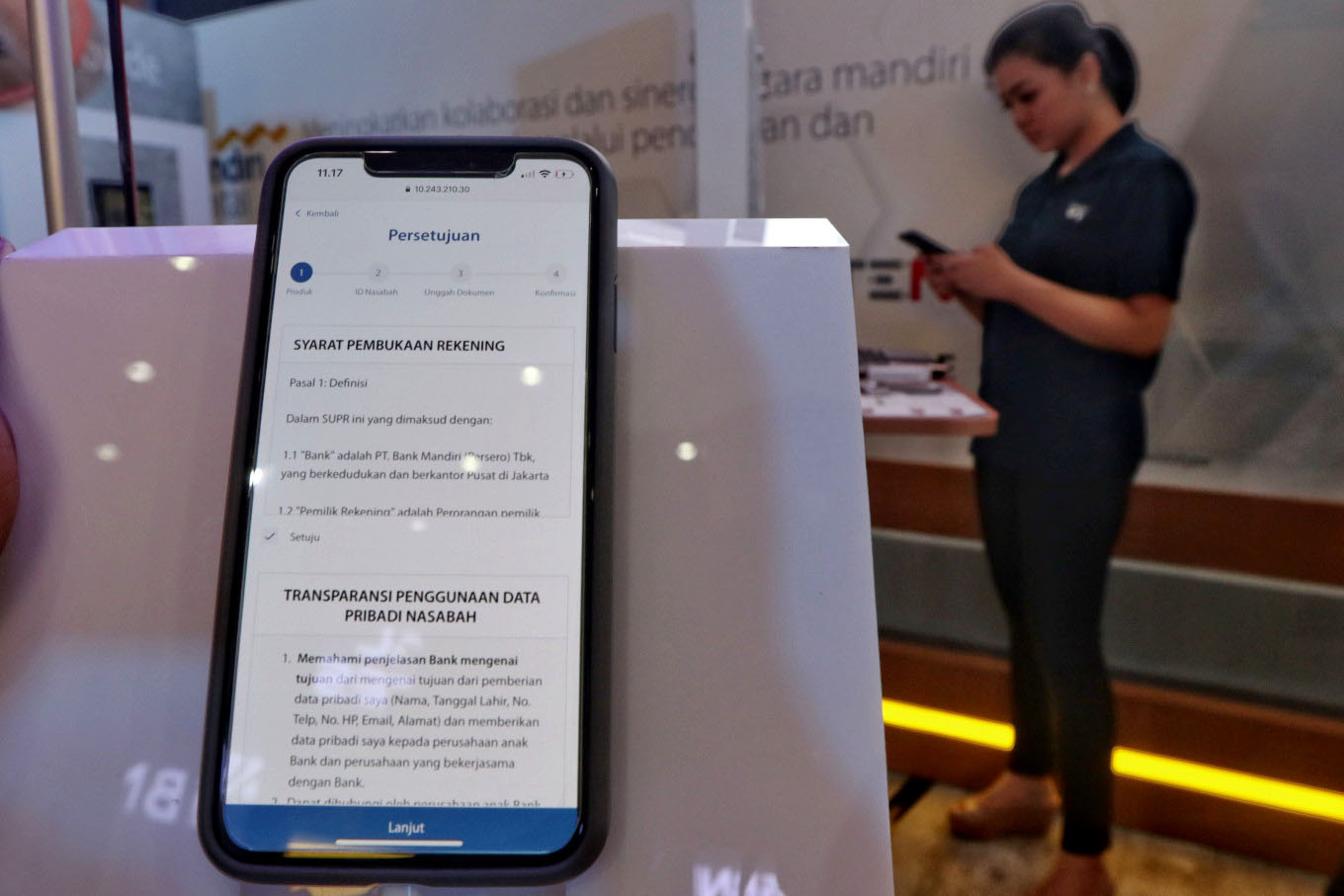

ndonesia is to start imposing taxes on services provided by fintech companies starting May 1 in the hope of leveling the playing field with conventional financial companies.

The tax comprises income tax on interest generated through peer-to-peer (P2P) lending services and value added tax (VAT) for commission, fees and cuts obtained by other fintech services like payment gateways, digital wallets, e-money, settlement on investment and insurance technology (insurtech), among many others.

The tax is stipulated in Finance Ministerial regulation No. 69/2022 on VAT and income tax for fintech companies. The regulation also requires fintech companies to collect the tax from users, and hand it over to the government.

“There is nothing new on taxing services provided by fintech companies. These services used to be subject to VAT, but we decided to rearrange the regulation again,” said Bonarsius "Bonar" Sipayung, head of the VAT, trade, services and other indirect taxes sub-directorate at the Finance Ministry, on Wednesday.

Read also: Indonesia to impose VAT, income tax on crypto from May

The decision to tax fintech services came after the passing of the Harmonized Tax Law last year, which aims to boost state revenue in achieving fiscal consolidation plans, including by reinstating a budget deficit ceiling of 3 percent of gross domestic product (GDP) in 2023.

Two years ago, the government started imposing VAT on certain transactions facilitated by electronic system providers like Google, Facebook and Amazon. It has also introduced taxes on crypto assets.

Bonar reiterated that the VAT tax rate of 11 percent would only be imposed on service fees, and not on transactions themselves.

“For example, if you wanted to top up Rp 1 million [US$69.60] and there was a Rp 1,500 fee charged by fintech companies, then the 11 percent tax would be on the Rp 1,500. Not the top-up amount,” Bonar said.

“So, it does not mean Rp 110,000 is taken from Rp 1 million. That would mean we are losing our money,” he added.

The same goes with transfer services provided by fintech companies. The amount of money transferred to other accounts would be largely intact, and the tax would only be imposed on transfer fees.

Read also: OJK to tighten P2P lending regulations

On P2P lending services, the government will impose income tax based on the gross interest obtained by the lender, which is the same policy used on capital gains in the stock market.

P2P platforms registered with the Financial Services Authority (OJK) have the obligation to collect the income tax and submit it to the government. For unregistered platforms, the borrowers will be subject to the payment obligation.

The regulation stipulates a 15 percent rate for domestic lenders, whether individuals or institutions, and a 20 percent rate for foreign lenders. Local lenders are required to report their P2P income taxes in their annual tax returns.

Indonesian Fintech Association (Aftech) managing director Mercy Simorangkir did not respond to requests for comments.