Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOJK to tighten P2P lending regulations

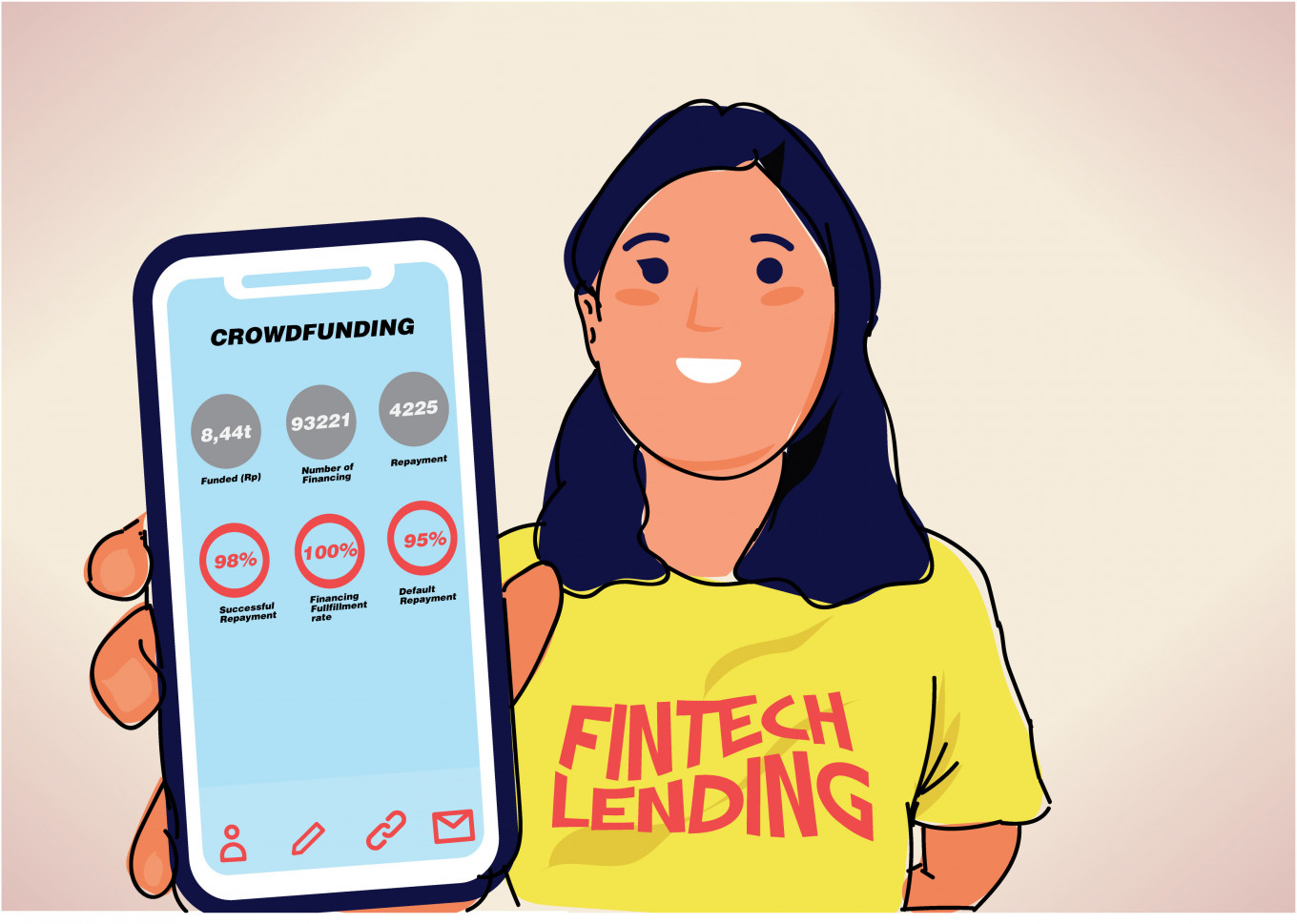

The Financial Services Authority (OJK) plans stricter rules for peer-to-peer (P2P) lenders.

Change text size

Gift Premium Articles

to Anyone

T

he Financial Services Authority (OJK) has announced a planned revision of rules for online peer-to-peer (P2P) lending that will tighten company establishment requirements.

OJK nonbank financial industry (IKNB) head Bambang W. Budiawan said the new rules would revise OJK Regulation (POJK) No. 77/2016 on online lending in key areas like capital requirements, registration and permits.

“We realize that the existing regulation is incomplete. [P2P lending] was an infant industry that needed to be regulated, but along the way we have noticed [regulatory] loopholes, and that is why we need to amend the regulation,” he said during an online press briefing on Wednesday.

Bambang went on to say that the authority had formulated new capital requirements for establishing a P2P lending company, but he declined to disclose the amount.

The prevailing regulation states that a fintech company must have at least Rp 1 billion (US$70,290) in capital when it registers its business with the OJK, and this needs to have risen to Rp 2.5 billion by the time it applies for a business license.

However, the OJK plans to remove the fintech registration step and wants companies to immediately apply for a P2P lending permit. Additionally, the agency would require a 3-year lock-up period for a fintech firm’s capital and equity to ensure the business’ sustainability.

“We want to make sure that fintech can commit and have a long-term business, so they don’t just quit within the first three years,” Bambang said. “But we do not want to rush this regulation, because we want it to last longer than the current one.”