Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsYoungsters set to take over Indonesian housing market: IPW

It is estimated that around 63.4 percent of potential Indonesian house buyers are millennials or members of Gen-Z.

Change text size

Gift Premium Articles

to Anyone

A

mid ongoing recovery in the domestic-property industry, younger generations are expected to take over the majority of the housing-market share; but reduced buying power means government assistance is needed to assist this segment.

In a virtual presentation conducted on Aug. 26, housing consultancy-firm Indonesia Property Watch (IPW) estimated that more than 63.4 percent of potential house buyers are millennials or members of Generation-Z (Gen-Z).

Statistics Indonesia’s (BPS) latest census shows that millennials and Gen-Z comprise 25.87 percent and 27.94 percent of the total citizen population, respectively.

BPS categorizes millennials as those born between 1981 to 1996 -- Gen-Z, between 1997 to 2012.

“Developers should take note that, although the middle- and upper-income-bracket market will still exist, the ‘fat market’ will shift to the middle-income bracket [...] because most of the supply has not yet adapted to the demand,” IPW CEO Ali Tranghanda said.

Read also: Govt extends VAT cut on new homes but reduces amount

As a result, the type of houses that will thrive in the market will be within the middle range of Rp 300 million (US$20,189) to Rp 500 million, a range considered affordable and to offer good quality, Ali continued.

As younger generations are more tech savvy and social-media conscious, most consider houses costing less than Rp 300 million not worth buying due to the lack of features and aesthetic designs.

“This segment demands a house design that can implement the latest technologies,” Ali continued.

However, most potential buyers in the housing market are facing significant difficulties in financing the purchase of these houses as their buying power is debilitated due to increasing consumer prices, which impact their savings for mortgages.

Data from IPW show that more than 50 percent of millennials still need funding from their parents to buy houses, and the report shows that a minimum Rp 8.5 million per month income is needed to start a house-buy scheme.

As a result, the contribution of younger generations in house sales in the first semester of 2022 (H1) was still minimal, while current housing-market sales were still supported by the mid- and upper-income-bracket segment of houses that ranges from Rp 500 million to Rp 2 billion, he said.

Data from Bank Indonesia (BI) show that sales of large-sized houses in the second quarter (Q2) were up by 29.86 percent year-on-year (yoy), followed by small-sized and medium-sized houses with 14.44 percent yoy and 12.25 percent yoy growth rates, respectively.

Read also: Property market hit by inflation, global interest rates

The situation is getting more tense. Ali estimates that the window is closing for the housing-market recovery boost, as the remaining months of 2022 are those crucial for housing-market expansion.

Starting from 2023, he continued, the housing market could face a significant slowdown as the “year of politics” is in full swing, which could affect financing policies and investors' appetites.

“After the 2024 general election ends, the housing market will begin to stabilize,” Ali predicted.

Although the government has already given housing incentives to low-income-bracket participants (MBR), Ali called for the government to expand incentives to include the aspiring-middle-income bracket, which includes the ever-so-productive millennials and Gen-Z.

He argued that the government-burdened value-added tax (PPN DTP), which was set to end on Sept. 30, should also be extended to accommodate the closing window.

BI data reveal that 74.49 percent of housing financing for consumers in the second quarter of this year still relies on mortgages, although growth in the total value of mortgages slowed by 7.07 percent yoy.

“Even though the incentives may not be as big as [those for] MBR, incentives for this segment are needed,” Ali added.

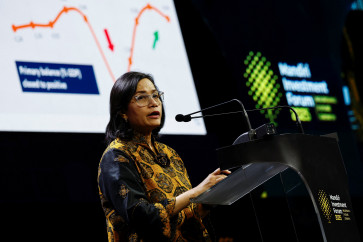

Previously, Finance Minister Sri Mulyani Indrawati had said that millennials were facing a challenging time in which to purchase a house, since the huge increase in housing prices was not accompanied by a proportionate increase in salary.

The central-bank data reveal that medium-sized house prices increased by 2.37 percent yoy in Q2, followed by small-sized and large-sized house prices which increased by 1.55 percent yoy and 1.23 percent yoy, respectively.

In that regard, Sri Mulyani continued, the government would use its budget to support MBR “under the principle of fairness”, as people not categorized as MBR were deemed to have sufficient purchasing power to afford their own house.

Government programs that assist MBR include the Housing Financing Liquidity Facility (FLPP), interest-rate subsidies for loan installments (SSB) and savings-based housing finance assistance (BP2BT).

“The focus for the use of the state budget, under the principle of fairness, is to help the lowest-income households to get a house,” the minister said on July 6.