Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsInvestors bullish on coal stocks despite harsh market

Change text size

Gift Premium Articles

to Anyone

I

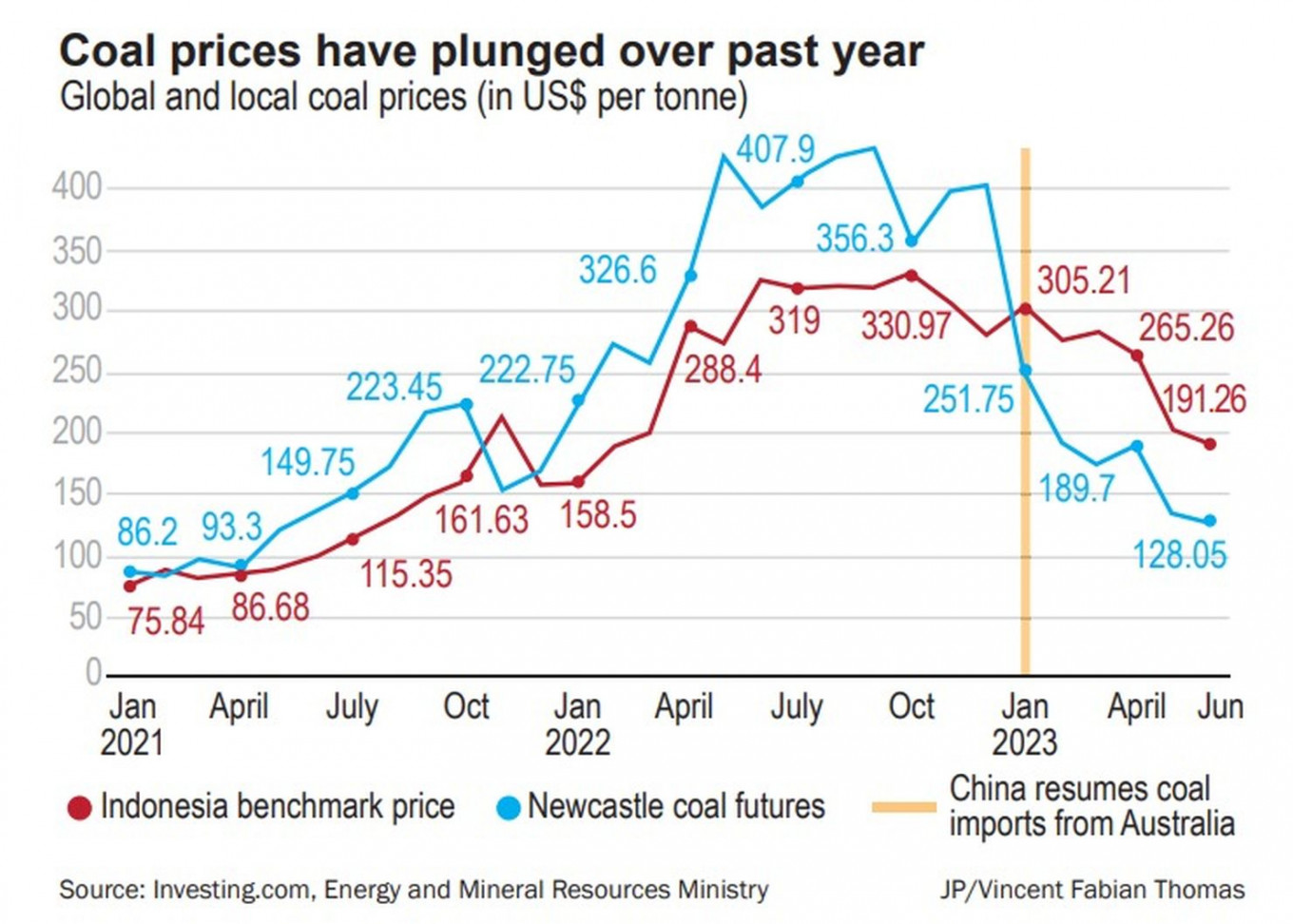

ndonesian coal stocks are expected to enjoy an uptick despite a forecast of further declines in coal prices in the face of a subdued economic recovery in China and muted industrial activity in manufacturing and construction, analysts say.

Felix Darmawan, an equity research analyst at Panin Sekuritas, said the outlook for Indonesia’s coal industry would depend on global coal prices.

“Prospects for Indonesian coal shares will be more bullish in the short to medium term, as an expected increase in demand for coal serves as an opportunity for larger export volumes,” he told The Jakarta Post on Wednesday, adding, however, that the bullish mood was “seasonal”.

High interest rates resulting in a global economic slowdown were one of the factors weakening the IDX Composite index over the first half of this year.

Indonesia’s energy sector, mostly supported by the subsectors of coal, oil and gas, was badly impacted by the economic downturn. The sector booked the worst performance and was down almost 20 percent year-to-date (ytd) on Thursday, Indonesia Stock Exchange (IDX) data show.

Publicly listed coalmining firms Adaro Minerals, Indo Tambangraya Megah, Indika Energy and Bumi Resources have seen their respective share prices drop 38.7 percent, 34.4 percent, 22.5 percent and 22.6 percent ytd.

“The end of the La Nina [weather] cycle should allow an increase in electricity production in countries that are still dependent on coal, setting a positive sentiment for global coal prices,” Felix said. But prices would also be subject to sudden shifts on the demand side, he added, caused by several factors, including a slowdown in Europe’s coal consumption due to recovering gas trading volumes.

Seaborne thermal coal prices in Asia have dipped to the lowest in two years as weakening demand in Europe and falling liquefied natural gas (LNG) prices offset strong demand in the top-importing region.

The prices of the main grades of thermal coal from top exporters Indonesia and Australia extended falls last week, but relief may be in sight, as the spot price of LNG gained, breaking a run of weekly declines stretching back to mid-December, Reuters reported.

Read also: Australian coal earnings expected to plummet

Meanwhile, Australia on Monday predicted its coal exports would halve in value over the next two years, as prices fall and consumers look to alternative sources of energy. Canberra forecast shipments of thermal coal, used in electricity production, would be worth US$20 billion, down from $43 billion this year.

Ahmad Zuhdi Dwi Kusuma, an industry and area analyst at state-owned Bank Mandiri, said Indonesia need not worry, as most of the coal Indonesia exported differed from Australian shipments in terms of properties.

“It will be reflected in Indonesia’s coal market, but the negative effect will not be palpable,” he said on Tuesday. He went on to say, however, that Indonesia’s benchmark coal price (HBA) would be mainly affected by future global demand.

“If Australia is optimistic that it can export higher coal volumes in the next two years, it means demand will still be high in that timeframe. This may [push] the HBA to a relatively high price,” he said, referring to a new report by Australia’s Department of Industry, Science and Resources, which forecasts a rise in Australian coal exports by volume for at least the next three years, spurred by growing demand for the fossil fuel in India and Southeast Asia.

Shipments of both thermal and metallurgical coal, which are used for power generation and steelmaking, respectively, are expected to rise steadily by volume until at least 2025, the latest quarterly energy and resources report released on Monday shows.

Chinese imports of Australian coal have also begun to increase after an informal ban was lifted earlier this year, the report said.

Read also: Drop in coal price to ease nickel production cost this year, Merdeka Copper says

Indonesian coal with an energy content of 4,200 kilocalories per kilogram (kcal/kg), as assessed by commodity price reporting agency Argus, dropped to $52.40 per tonne in the seven days to June 16.

This was the lowest since April 2021, and the grade, which is popular in both top importers China and India, has now slid 57 percent from the high of $120.86 reached in March 2022 in the wake of global supply fears after the Russian invasion of Ukraine.

Australian coal with an energy content of 5,500 kcal/kg, another grade mainly bought by China and India, fell to $84.17 per tonne in mid-June, down 70 percent from its record high of $280.20 in March last year, and the lowest since July 2021.

High-grade Australian thermal coal, which is mainly bought by Japan, South Korea and Taiwan, fell to $118 per tonne on June 19, according to price assessors Global Coal, about a quarter of its record high.