Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

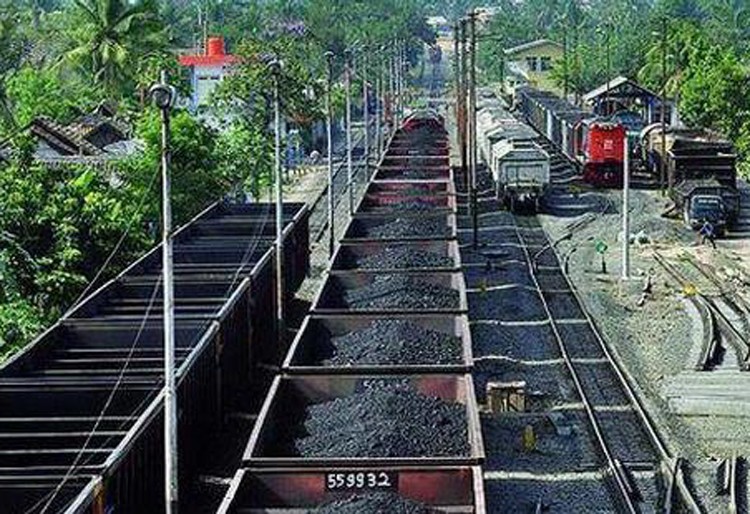

View all search resultsCoal miner Toba Bara to issue US$250 million notes

Change text size

Gift Premium Articles

to Anyone

P

ublicly listed coal miner PT Toba Bara Sejahtra has announced plans to issue medium-term notes (MTN) worth US$250 million in order to refinance its debts and further expand its businesses.

The notes, which will be listed in the Singapore Exchange (SGX), will mature in five years with a maximum interest rate of 10 percent per year.

Toba Bara will seek approval from its shareholders during an extraordinary shareholders meeting in Jakarta on Jan. 31, 2018.

“Proceeds from the notes will be used to restructure the company’s debts from [state lender] Bank Mandiri,” Toba Bara said in a prospectus published on the Indonesia Stock Exchange (IDX) website on Friday.

“The notes issuance will also increase the company’s ability to expand its businesses, including through investment in its own electricity projects, as well as in other mining companies and power plant projects.”

As of September, Toba Bara’s total liabilities stood at $135.5 million, up 22.5 percent annually. The liabilities included loans worth $38.17 million from Bank Mandiri.

The company mined 3.7 million tons of coal between January and September, or 61.6 to 74 percent of its full-year target of producing 5 to 6 million tons.

Toba Bara saw its revenues increase by 9.9 percent annually to $211.25 million, thanks to a recent hike in global coal prices. Meanwhile, its net profit skyrocketed to $15.85 million from only $1.73 million in the same period last year. (bbn)