Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOpening up and reform

Change text size

Gift Premium Articles

to Anyone

T

he government’s plan to open more sectors to foreign investors by revising the 2016 Negative Investment List (DNI) is indeed a bold measure in the run-up to the presidential and legislative elections next April, since electoral campaigns tend to raise the ugly head of inordinately strong nationalistic sentiment.

Even now, the camp of Prabowo Subianto, the contender in the presidential election, has highlighted inequality in income and asset ownership, and ensuing debate usually leads to the bashing of foreign investors (companies) and Indonesian businesspeople of Chinese descent.

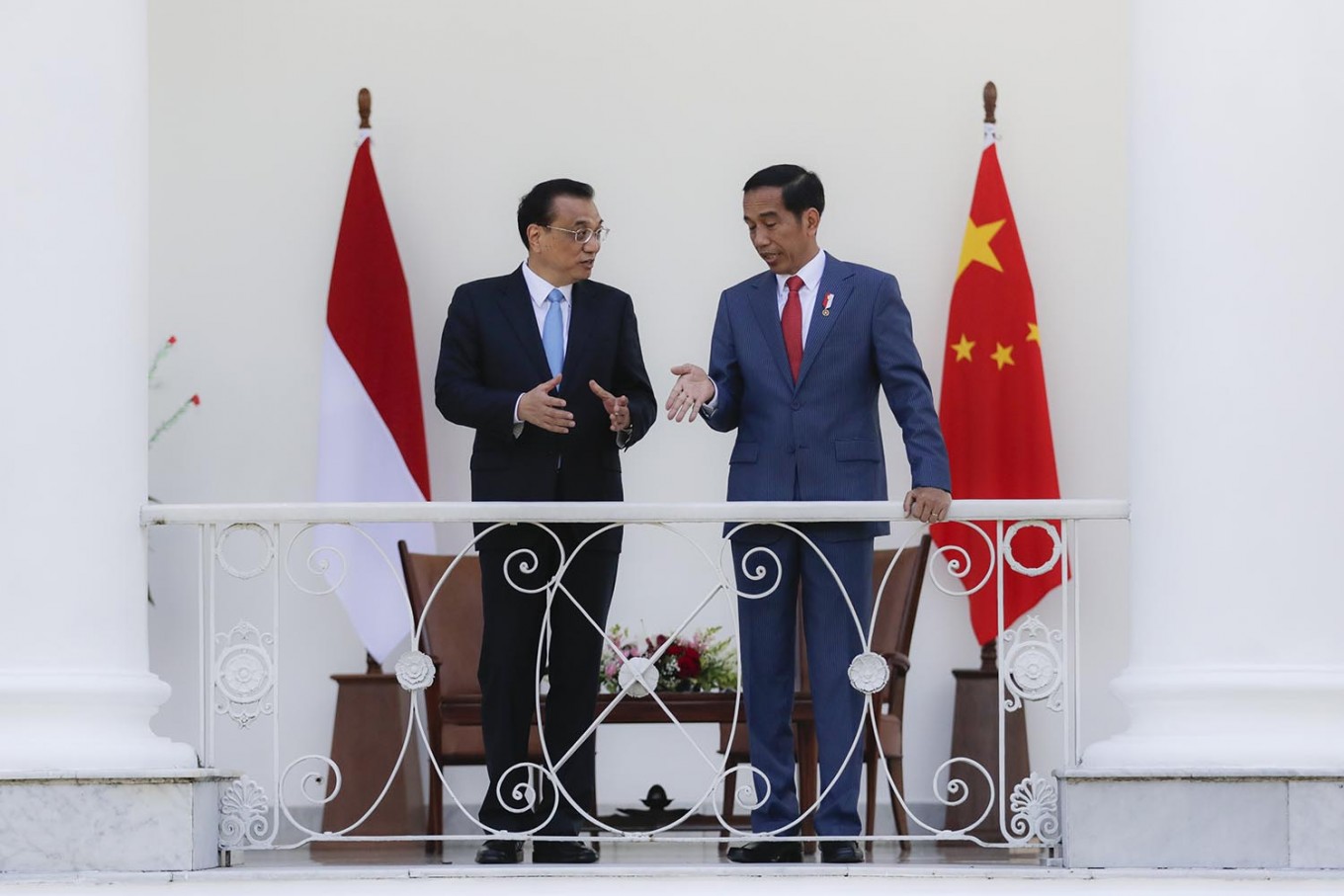

However, we still challenge the incumbent administration of President Joko “Jokowi” Widodo to make a tough move for the long-term good of the nation in a bid to woo more foreign direct investment (FDI). We need more foreign investment in several sectors, notably in higher learning institutions, transportation and logistics services and various segments of higher added value manufacturing industries, such as rubber processing, to expand our export capacity.

It is simply a coincidence that China observes this year the 40th anniversary of its reform and opening-up policy, which within 30 years has transformed the country into the world’s second-largest economic powerhouse.

The strongest driver of China’s rapid growth was its bold decision in 1978 to open up its economy through special economic zones, which attracted a huge wave of FDI because the rules and regulations in these zones became more flexible and liberal than the rest of the mainland.

Chinese experiences, which have been validated by many international researches, have shown that joint ventures with companies from advanced countries, under proper regulatory arrangements by the host government, have transferred technology, expertise and good corporate governance practices to indigenous firms. In fact, most Indonesian businesses have become high-growth companies by banking their capability in internalizing FDI spillovers — through both linkages and demonstration channels.

The benefits of FDI extend well beyond wooing needed capital. With proper government regulations, foreign firms can be guided to transfer to domestic businesses technical know-how, managerial and organizational skills and provide access to foreign markets.

World Bank studies also concluded that FDI improves labor conditions, setting global industry standards and delivering infrastructure to local communities. FDI can benefit domestic firms, mainly through linkages and demonstration channels: Linkages between foreign firms and local partners or suppliers can enhance the transmission of foreign firms’ technology, knowledge and requirements that may help domestic suppliers upgrade their technical and quality standards.

The demonstration effect, in which domestic firms imitate foreign technologies and managerial practices either through observation or by hiring workers trained by foreign companies, is another key channel that benefits companies in host countries. Just look at how Indonesian bankers who moved from foreign to local banks have contributed greatly to good governance in the banking industry.