Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsSafeguarding the economy through public-private engagement

The global fight against the invisible enemy of COVID-19 is ongoing. Most countries are still suffering from rapid increases in the number of cases, including Indonesia. Even worse, China, where the pandemic started, may still see a “second wave”.

Change text size

Gift Premium Articles

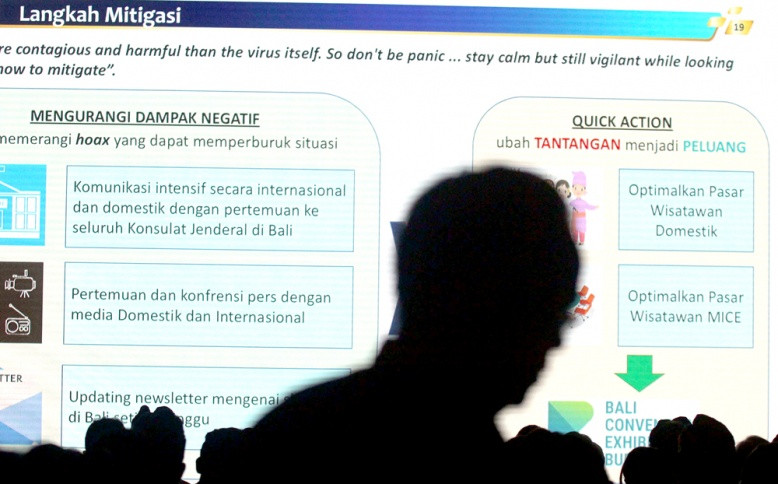

to Anyone

Contagious: The Bali representative office of Bank Indonesia uses a screen to explain measures the government has been taking to address the COVID-19 outbreak and its impacts on industry during the launch of the Bali Convention Exhibition Bureau on Feb. 13. The outbreak has battered China’s economy, resulting in a nearly 0.2 percent drop in economic growth in Indonesia. (JP/Zul Trio Anggono)

Contagious: The Bali representative office of Bank Indonesia uses a screen to explain measures the government has been taking to address the COVID-19 outbreak and its impacts on industry during the launch of the Bali Convention Exhibition Bureau on Feb. 13. The outbreak has battered China’s economy, resulting in a nearly 0.2 percent drop in economic growth in Indonesia. (JP/Zul Trio Anggono)

T

he global fight against the invisible enemy of COVID-19 is ongoing. Most countries are still suffering from rapid increases in the number of cases, including Indonesia. Even worse, China, where the pandemic started, may still see a “second wave”.

The health crisis and its economic impacts are becoming equally dangerous. Both have become surreal when most governments should operate uninterrupted amid the near shutdown of the economy. Nonetheless, while doctors and scientists are relentlessly seeking medicines for COVID-19 from laboratories, policymakers are beginning to show their statesmanship, even at higher levels, in the fight against the virus. In the economic and financial sectors, they are “throwing lifejackets” by actively announcing creative policies to prevent the economy from sinking deeper.

Bank Indonesia (BI) in its last board meeting maintained the seven-day reverse repo rate at 4.5 percent. However, the board also decided on other measures that signal an ongoing direction toward loosening monetary policy. As Indonesia’s monetary and macroprudential authority, BI combines its policy tools by lowering its reserve requirement (GWM), leaving the macroprudential intermediation ratio (RIM) unchanged and raising the ratio on the macroprudential liquidity buffer (PLM). The GWM was lowered by 200 basis points, whereas the PLM was raised by the same amount. Questions then arise about its meaning and how it will impact the economy.

The monetary-macroprudential mix assembles the strong public-private engagement in an economic setting, which could strengthen stability. The GWM reflects liquidity in the banking sector, whereas the RIM is an additional demand deposit measure and the PLM is intended entice banks to ensure better quality liquidity and financial management. BI directed around Rp 102 trillion (US$6.65 billion) in liquidity, which was originally held by banks, to buy around the same number of to-be-released Indonesian sovereign bonds (SBN).

BI did so by bypassing the increase of the RIM, which regularly follows a reduction of the GWM. The remaining 4.5 percent of the monetary policy rate is appropriate at the moment. This shows that the central bank also calculates the downward trend of the demand-side economy, which is reflected in a lower inflation rate in comparison to its historical record.

That might occur as a consequence of more stringent activity in the economy due to the virus. BI might still have a buffer to lower its policy rate, but the existence of “zero lower bound”, a condition in which the monetary policy rate is low enough to lose its affectivity, i.e., near to zero, should be greatly avoided.

The modulation steps undertook by BI amid the pandemic highlight banks’ role in developing the economy. BI is effectively guiding banks to receive more liquidity yet preserving them to still be prudent with their liquidity and financial management. In the meantime, BI grants access for banks to contribute more to the national effort to combating COVID-19 by requiring them to buy newly issued SBN.

Banks might face liquidity pressure from this pandemic situation. Notwithstanding, BI does not by any means overlook the liquidity shortage that banks might be concerned about. Banks at any time could “knock the door” to engage repo transactions with BI for any SBN they hold.

Just as Mohamed El-Erian, the former chair of the United States Global Development Council in Barack Obama’s administration, called the central bank “the only game in town”, it would never confront liquidity problems. Hence, BI is and will always be available for banks on that matter. This note is one of many sets of public guarantees provided for banks as the “private monies” generator.

Public-private relations are a not-so-modern pattern in the market economy. Banking could never be stable without an explicit guarantee from the sovereign. By the same token, the economy could grow indefinitely through the relationship between the sovereign and private sector.

Banks are licensed by the government to generate credits but need to “swallow” highly strict prudential regulations as their mandatory “payback”. Saule T. Omarova, professor of law at

Cornell University, states that finance is not primarily scarce and privately provided but it is extensible in the “public-private partnership” form.

What BI did is likely killing even three birds with one stone. On one hand, monetary policy is loosened, yet, on the other hand, the liquidity structure of the banking sector is strengthened. In addition, the policy supports ongoing fiscal stimulus plans. The government’s work on health care, social safety net programs for “blue-collar” and informal workers and incentives for affected businesses and industries could be well-supported by this monetary-macroprudential policy engineering.

Better yet, public-private relationships become more gallant because banks, as the representation of the private sector, are now involved in safeguarding the overall economy, just as authorities are always on standby for them. Three objectives are meant to be served here: easing of liquidity, stronger management on liquidity and finance and fiscal robustness.

The debate on whether modern monetary theory (MMT), which breakdowns monetary policy orthodoxy by allowing it to support the government’s deficit, is appropriate should be left aside for a while. The “joint venture” between fiscal and monetary policy contemplated in Article 16 (1) c of Regulation in Lieu of Law (Perppu) No. 1/2020 is now more than ready to be executed.

The market for SBN will be available through the “publicprivate engagement” established by the latest announced monetary-macroprudential policy mix. In turn, BI will enter the SBN primary market as a “last resort” when necessary. All effort is to support the economy to grow at 2.3 percent as projected or higher. It is now about how brilliant and dedicated minds kick in, one step at the time.

The economy could grow indefinitely through the relationship between the sovereign and private sector.

***

Staff member in the legal affairs department, Bank Indonesia. The views expressed are his own.