Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsA strong financial foundation for businesses to avoid layoffs, presented by Aspire

Change text size

Gift Premium Articles

to Anyone

T

here are a number of things needed for a business to develop in a sustainable manner, one of which is having a solid financial foundation.

When it comes to scaling a successful business, a lot of companies will choose to invest aggressively in sales and marketing to boost growth. In reality, one of the most crucial functions of a business is also the one that gets overlooked the most: managing your business finances.

To overcome this problem, Aspire seeks to provide all-in-one financial solutions for business owners and companies in automating and controlling their finances.

Through its solution, Aspire helps businesses and companies avoid overspending and report the current financial status for company leaders.

Thus, they not only save company time and resources, but also plan strategic decisions for sustainable company growth, including optimizing its business performance to achieve maximum profit.

Moreover, this step can also help companies avoid the option of terminating employees (layoffs). As we know, the recent layoff trend has hit companies in various parts of the world, including Indonesia.

Aside from macroeconomic situations, layoffs also often occur due to inaccuracies in business planning, mainly in a company's financial planning.

To prevent this, company leaders need to consider proper financial planning. This can be achieved in a number of ways, such as by leveraging a financial management platform that can monitor and track a company’s finances in real-time and transparently, such as the one offered by Aspire.

To provide integrated finance management services, Aspire comes with several supporting features.

Online finance management platform Aspire. (Dok. Aspire/.)

Firstly, a system approval feature to help disburse claims or bills automatically after the budget owner approves of it or if the claim falls under the term limits that have been set. This feature also helps allocate purchasing power to related employees or teams. Companies can set adjustable limits according to the needs of each division or project.

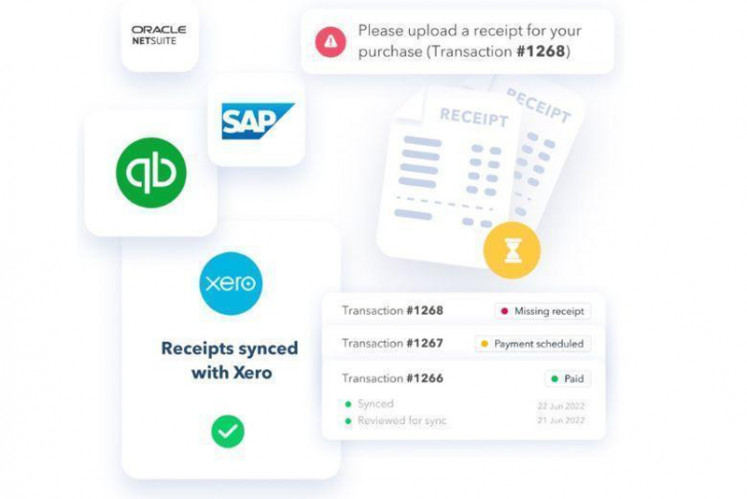

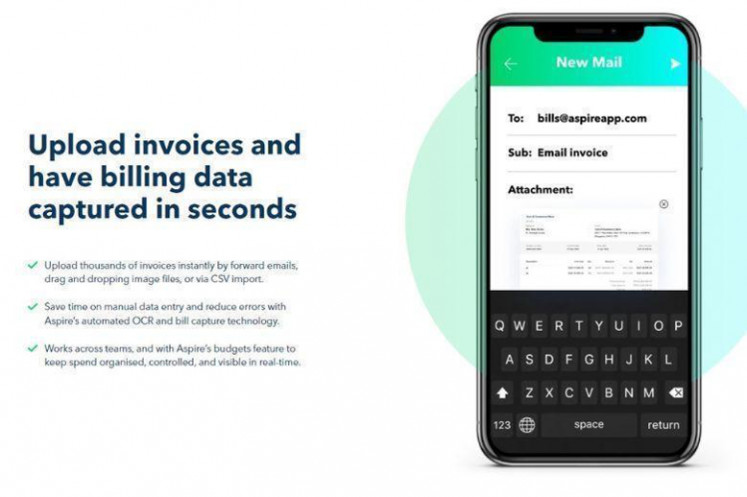

Secondly, payable management features to manage all your bills and invoices. This can be accessed through the Aspire dashboard and connected automatically to the company's bookkeeping software. Teams can automate payments according to due dates and approval statuses to maximize cash flow.

Thirdly, the receivables management feature that receives payments through virtual accounts. This feature is issued automatically for each invoice and connected directly to the company's bookkeeping software to provide up-to-date cash flow information.

Lastly, the multicurrency payment feature for local and international transactions. With this feature, business owners can save on exchange rates and simplify the process of international transfers.

Interestingly, all of these features can be managed through one dashboard, which makes Aspire superior to similar services, supported by a system that can keep up with the company’s stage of growth needs.

With these features, all expenses can be kept under control and recorded in real-time to monitor finances and budgets. Business owners can also adjust the budget at any time to avoid overspending or unnecessary expenses.

Automated systems for effectiveness

According to the McKinsey Finance 2030 report, by automating menial tasks, finance leaders can now spend 19% more time on value-added activities (versus transaction processing) compared with the previous decade. They can focus on being strategic advisors to the CEO and steering their company's future trajectory. Average finance cost/revenue has dropped by 25%.

In the first regard, you can save time by automating your reporting and data entry activity. Automating reduces human error and time-consuming manual processes, especially the time wasted in fixing issues stemming from previous mistakes. All this time is better invested in building your business.

Setting the right infrastructure for your business operation also helps to let business move agilely by delegating work, giving autonomy and execution capabilities directly to agents in charge to move faster without waiting for administrative formalities. Time effectiveness can also help reduce and balance company expenses up to 50 percent.

In essence, the digitalization and automation of mundane and manual processes means finance teams are able to adopt flatter and smaller structures, with roles being consolidated into fewer positions. This can help save money on resources. Moreover, when companies can plan their spending in advance, it also means that companies can look for better deals for their buck.

Access financial reports in real-time. (Dok. Aspire/.)The urgency of corporate online financial management

In recent years, the finance team's position has changed from a classic backoffice scorekeeping function to a more strategic partner in decision-making.

Co-founder and CEO of Aspire, Giovanni Casinelli said, “Most technology companies use more than five financial tools and platforms to manage their financial operations, making it very difficult to track and integrate with the company's tech stack at large.

“Each business has its own dynamic needs, so it is crucial that you find a technology provider that can address these unique challenges and help you scale at every stage of your growth.”

Giovanni found that a lot of small and medium enterprises (SMEs) in Indonesia were still not aware of the importance of budgeting. Their finance team primarily serves record keeping/bookkeeping functions rather than budgeting functions or offering strategic insight to the executive team, which is not ideal. These companies are prone to overspending, since they can only assess their company’s finances at the end of the month (instead of real-time).

Answering this problem, Giovanni seeks to provide an easy-to-use platform so companies can maximize their cash flow as well as manage their operations effectively.

According to Giovanni, Aspire service provides real-time insight allowing users to easily spot month-on-month trends, spending by department, category, vendor or expense types to make smarter and faster business decisions instantly.

"We want to answer this problem. With Aspire, business operations will be more effective while maintaining transparency in the company’s spending." said Giovanni.

Giovanni further said, Aspire equipped business owners to make better decisions through account insight and real-time performance analytics.

A display of one of the features of Aspire. (Dok. Aspire/.)“As we aim to reinvent business finances, we want to fill the gaps in the conventional financial system. Aspire’s mission is to be the true all-in-one partner for a new generation of entrepreneurs and business owners in Southeast Asia,” said Giovanni.

For this reason, he continued, Aspire was also carrying out several strategies to raise awareness of their product. One of which is by partnering with accounting firms to help SMEs in Indonesia set up a solid financial infrastructure.

Giovanni continued, “With a full range of services and product features, Aspire also works with Commanditaire Vennootschap [CV] and licensing companies to provide an all-in-one business financial platform for new companies.

"Through this partnership, we want to help companies manage budgets accurately and track expenses in real-time. Aspire improves efficiency while adding value to the suite of services offered by our partners."

Learn from Haus!, for example. With 1500 employees and 225 outlets scattered all over Indonesia, Haus! deploys automation and uses scalable finance stacks to help manage their ever-growing team-spending while maintaining control and visibilities upon the overall budget.

Haus! Chief Financial Officer (CFO) Yonathan Augustine said he used the Aspire platform so that marketing costs could be managed directly by the relevant team.

“Aspire has been very helpful in automating our expense management. It has also helped me to get hold of the company’s overall spending to make timely decisions and adjustments.” Yonathan said.

Besides Haus!, Aspire has helped other Indonesian companies, such as e-Fishery, Pintu, Pinhome, AyoConnect, RuangGuru, Mamikos and others to streamline their financial operation and improve workflow efficiency.

Future business solutions

In today’s difficult macroeconomic situation, Giovanni sees many Southeast Asian companies making the very difficult decision to hold layoffs as a cost-reduction strategy.

"The current moment is a very crucial time for the finance team to invest in the data/tools that will help make strategic financial decisions for businesses and profits without needing to lay off staff," explained Giovanni.

For this reason, Giovanni hopes that his platform can help startups and SMEs in Indonesia to keep growing sustainably by providing insights and financial tools needed to run a successful company.

With automation and careful financial planning, Giovanni believes Aspire can help companies in Indonesia to grow and succeed in their mission.

“This is in line with our vision and mission to serve growing businesses in Southeast Asia. We are filling a S$150 billion demand gap for better, faster and cheaper financial services for businesses in the region. Aspire is proud to contribute to the growth of the economy and local communities in Indonesia," Giovanni said.