Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsFLPP: Empowering housing access in 2024 budget

The government is persistently pushing for affordable and decent housing access for all Indonesians to positively impact society and the economy, particularly enhancing the overall welfare.

Change text size

Gift Premium Articles

to Anyone

T

he government is persistently pushing for affordable and decent housing access for all Indonesians to positively impact society and the economy, particularly enhancing the overall welfare. One of their efforts to support affordable homeownership, especially for low-income communities (MBR), is the Home Ownership Credit Facility Housing Liquidity Assistance Program (FLPP KPR). This program aims to provide affordable homeownership for low-income individuals, reflecting the government's commitment as stated in the 1945 Constitution, Article 28H Paragraph 1, affirming the right to a prosperous life, housing, a healthy environment, access to health services and decent living conditions.

Furthermore, access to adequate housing is not just crucial to fulfill the mandate of the 1945 Constitution but also plays a significant role in fostering a healthy and skilled human resource base, ultimately positively impacting economic development. However, providing access to suitable housing for the entire population, particularly in a country with the fourth-largest population globally, where 55.9 percent reside in urban areas, is not an easy task. Additionally, Indonesia's population is entering a demographic bonus phase, with the majority of its young population residing in urban areas, making access to suitable urban housing an urgent necessity to optimize this demographic bonus.

(Courtesy of Finance Ministry)Until 2023, the government allocated Rp 108.5 trillion from the state budget through revolving funds and State Capital Participation (PMN) for the FLPP KPR program, equivalent to 1.29 million housing units. As part of the Finance Ministry's Special Mission Vehicle, PT Sarana Multigriya Finansial (SMF) is committed to reducing the government's fiscal burden in the FLPP program by providing 25 percent financing support. SMF channels 25 percent of FLPP KPR funds from the state budget through partner banks to the public. Leveraging the received State Capital Participation, SMF issues debt securities. From the received PMN of Rp 7.8 trillion, SMF has disbursed FLPP KPR financing of Rp 17.25 trillion, equivalent to 481,188 housing units. In the first half of 2023, SMF disbursed support funds amounting to Rp 2.21 trillion, equivalent to 59,538 homes.

Indonesia has made significant progress in tackling housing backlog issues by implementing the FLPP policy. In the 2024 fiscal year, the government is allocating an additional investment of Rp 1.891 trillion to SMF for the MBR FLPP KPR program. This funding aims to encourage ownership of suitable and affordable housing for MBR while boosting economic income and job absorption in related sectors. As known, the housing sector is a strategic sector with a multiplier effect on other sectors.

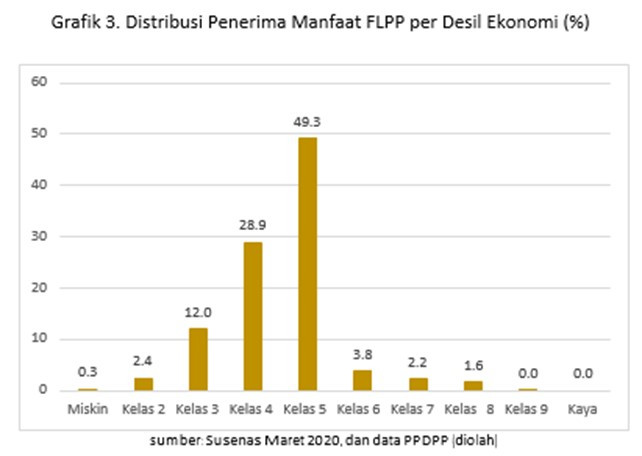

Graph 3 illustrates that the FLPP program's recipients are effectively meeting its main goal by assisting MBR in acquiring their initial homes. These beneficiaries typically belong to income brackets 1 through 8 or earn less than Rp 8 million, with the largest distribution found among those in classes 4 and 5.

The government has made multiple attempts to facilitate home ownership across the entire population through different programs, including policies and subsidized credit schemes like the FLPP, to alleviate the housing backlog using the state budget. The state budget has striven to assist diverse segments of the population, notably helping those with lower incomes access affordable housing. Ananta Wiyogo, as the CEO of SMF, highlights how this demonstrates the government's dedication to assisting all Indonesians, particularly those with low incomes, using substantial funds from the budget for the country's welfare.

Source: The Finance Ministry