Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAccelerating post-pandemic economic rebound through the PEN program

Change text size

Gift Premium Articles

to Anyone

The COVID-19 pandemic impacted all aspects of life globally in 2020, including the economic sector.

The emergence of lockdown, which became one of the most searched words during the period, marked limited access to human movement to prevent the spread of disease. Logistics mobilization was paralyzed, business and economic activities slumped, employees were laid off and economic growth went into the negative.

According to Statistics Indonesia (BPS), Indonesia recorded negative economic growth of 2.07 percent at the end of 2020. In Q2 2020, the economy contracted even more deeply, by 5.35 percent. The unemployment rate rose from 5.25 percent to 7.07 percent, while poverty climbed to 10.19 percent at the end of Q3 2020. State revenues were inevitably hit, with tax revenues experiencing negative growth of 38.64 percent in May 2020.

In five consecutive years from 2015 to 2019, Indonesia managed to maintain average economic growth of 5.03 percent. Under the leadership of President Joko “Jokowi” Widodo, the government responded quickly and accurately.

The first regulation in lieu of law (Perppu) issued in 2020 centered on efforts to maintain economic stability: Perppu No. 1/2020 concerning state financial policy and financial system stability for handling the COVID-19 pandemic and/or in the framework of facing threats that endanger the national economy and/or financial system stability was issued on March 31, 2020.

After obtaining approval from the House of Representatives, it became Law No. 2/2020. This legal umbrella was born quickly under a critical situation, considering that the COVID-19 pandemic entered Indonesia on March 2, 2020.

As an implementing regulation, Government Regulation (PP) No. 23/2020 concerning the implementation of the national economic recovery program in the framework of supporting state financial policy for handling the COVID-19 pandemic and/or facing threats that endanger the national economy and/or financial system stability and saving the national economy, later updated with PP No. 43/2020.

The National Economic Recovery Program (PEN) was the right move to accelerate the "healing" of the economic downturn. As the pandemic slowed down the economy, the government poured out a number of countercyclical policies by boosting spending to overcome the contraction from the economic shock.

The tolerance limit for the state budget deficit was relaxed, allowing it to be more than 3 percent of gross domestic product (GDP) for three years starting in 2020, returning to its original threshold in 2023.

In addition to spending on the health sector, such as providing vaccinations, the government through the Taxation Directorate General (DJP) also accommodates economic actors with various fiscal stimuli in the form of tax incentives.

These tax instruments include the Income Tax (PPh) Article 21, borne by the government (DTP) to help the economic capabilities of workers. PPh Article 21, which should be deducted by the employer, is implemented under the DTP scheme so that employees can enjoy their salaries in full. The realization of PPh Article 21 DTP facilities in 2020 reached Rp 1,710 billion, increasing to Rp 4,339 billion in 2021 and decreasing to Rp 2,109 billion in 2022 in parallel with the national economic recovery.

The Final PPh of 0.5 percent for the micro, small and medium enterprises (MSMEs) sector stimulus realization reached Rp 671 billion in 2020, increasing to Rp 801 billion in 2021 and then decreasing to Rp 178 billion in 2022.

MSMEs have also benefitted from the PEN program. (Source: Freepic)In addition, value-added tax (PPN) on the import or delivery of taxable goods or services (BKP/JKP) for handling COVID-19 was recorded at Rp 1,936 billion in 2020, increasing to Rp 4,460 billion in 2021 and decreasing to Rp 1,720 billion in 2022. In synergy with the Customs and Excise Directorate General (DJBC), the inspection of imported medical devices and vaccines has also been accelerated.

Other facilities were also utilized to guarantee the cash flow of taxpayers, including postponing tax payment obligations or accelerating preliminary PPN refunds. The schemes include exemption from Article 22 import income tax; the acceleration of preliminary VAT refunds; exemption from Article 22 income tax and Article 22 import income tax on the acquisition of goods and raw materials for handling COVID-19; exemption from Article 23 income tax on the provision of services for handling COVID-19; and reduction of Article 25 income tax installments.

Real results

Thanks to the formulation of appropriate, careful and integrity-based financial management policies, including stimulus from tax instruments, the Indonesian economy has rebounded from the pandemic. Economic growth was vibrant at 3.70 percent in 2021, 5.31 percent in 2022 and 5.05 percent in 2023. According to Statistics Indonesia (BPS), year-on-year economic growth was at 4.92 percent in the first half of 2024.

The tax revenue target for three consecutive years has also been met. In 2021, the Directorate General of Taxes recorded Rp 1,231.87 trillion in tax revenue, reflecting 100.19 percent of the revenue target. This was followed by Rp 1,716.8 trillion in 2022, or 115.6 percent of the target, and Rp 1,869.2 trillion in 2023, or 102.8 percent.

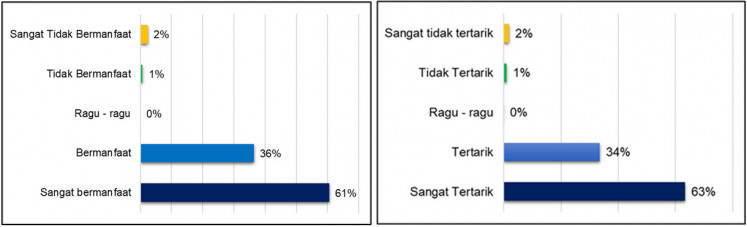

Based on the PEN Survey Results Report, which polled 1,492 respondents in 2020, most respondents considered the tax stimulus from the PEN program useful. As many as 36 percent of respondents considered PEN useful, while 61 percent considered PEN very useful.

In addition, respondents were interested in reusing the tax stimulus from the PEN program. Around 34 percent of respondents said they were interested in reusing the tax stimulus, and 63 percent of respondents said they were very interested in reusing the tax stimulus.

Graph 1: Average percentage level

Graph 2: Average percentage level of tax stimulus benefit interest in reusing tax stimulus

Report on the Results of the 2020 PEN SurveySource: Finance Ministry