Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIndonesia looking to convert more debt to rupiah

Change text size

Gift Premium Articles

to Anyone

I

ndonesia is looking to strengthen local currency usage in partnership with multilateral development banks (MDBs) amid global economic challenges and to support sustainable development.

Deputy Finance Minister Thomas Djiwandono said one of the key tools for debt management was debt conversion, which supports the development of local currency markets as foreign debt is converted to local currency.

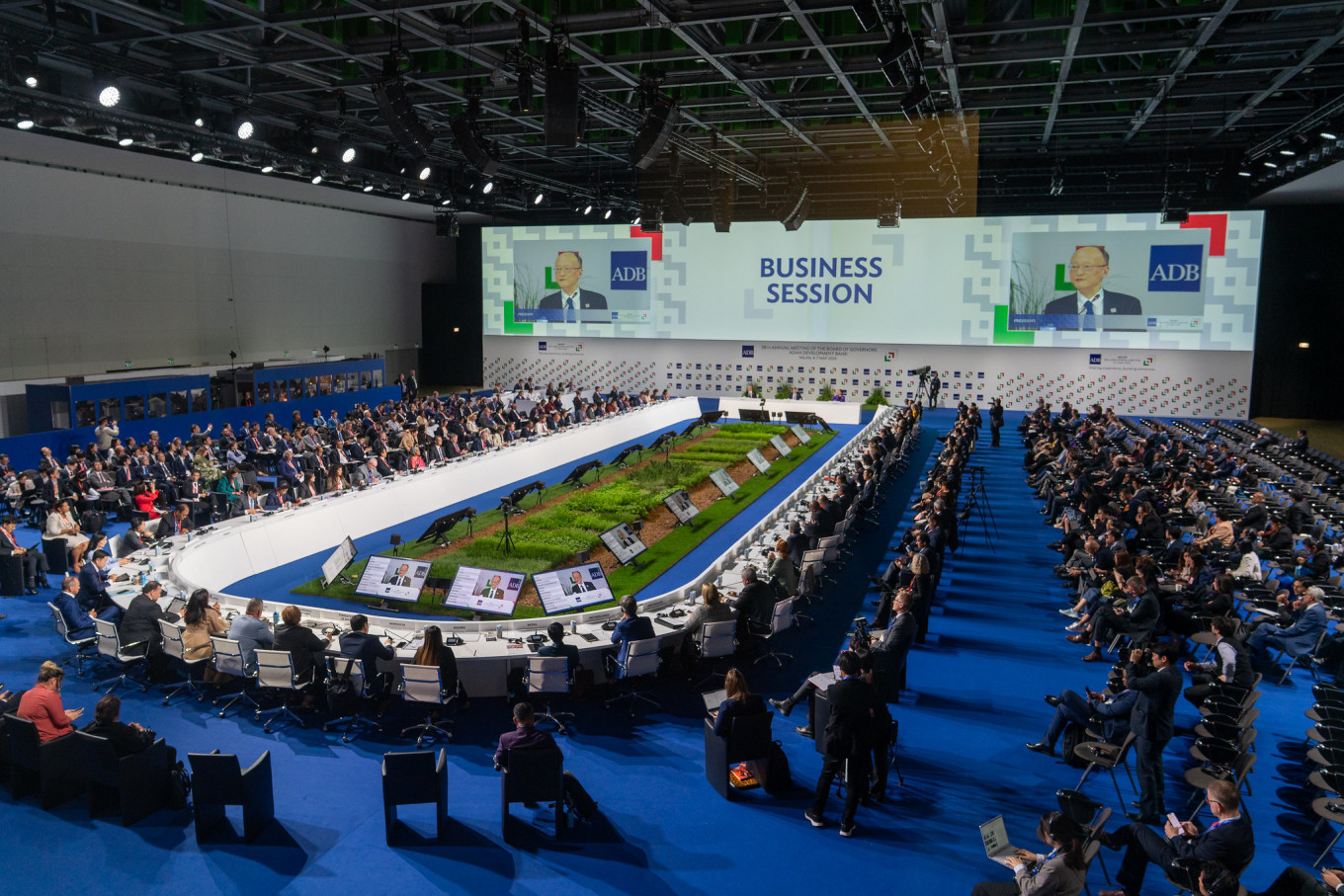

“More importantly, with debt conversion, we can lower our financing costs and minimize fiscal uncertainty, which in turn provides greater fiscal space to address other pressing needs,” he said during a seminar at the 58th ADB Annual Meeting in Milan, Italy, on Monday.

“Looking ahead, Indonesia would like to explore further opportunities in our partnerships with MDBs for any instruments and mechanisms that could contribute to our local currency.”

Indonesia has used MDB debt conversion mechanisms since 2019 in partnership with the World Bank and ADB.

Many of these conversions involved shifting from floating to fixed interest rates, resulting in loan interest payments reduced to close to 0 percent and, where appropriate, converting the foreign currency into local currency, thus reducing Indonesia's foreign exchange liabilities, Thomas said.

He went on to explain that, until 2025, Indonesia and the ADB had completed eight transactions covering 53 individual loans with a total converted amount equivalent to Rp 189 trillion (US$11.5 billion).