Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAsian shares fall as US unleashes fresh tariffs, jobs data up next

Change text size

Gift Premium Articles

to Anyone

A

sian shares fell on Friday after the US slapped dozens of trading partners with steep tariffs, while investors anxiously await US jobs data that could make or break the case for a Fed rate cut next month.

Late on Thursday, President Donald Trump signed an executive order imposing tariffs ranging from 10 percent to 41 percent on US imports from dozens of countries and foreign locations. Rates were set at 25 percent for India's US-bound exports, 20 percent for Taiwan's, 19 percent for Thailand's and 15 percent for South Korea's.

He also increased duties on Canadian goods to 35 percent from 25 percent for all products not covered by the US-Mexico-Canada trade agreement, but gave Mexico a 90-day reprieve from higher tariffs to negotiate a broader trade deal.

Taiwan's President Lai Ching-te said the rate is "temporary" and is expected to be reduced further once a deal is reached.

"At this point, the reaction in markets has been modest, and I think part of the reason for that is the recent trade deals with the EU, Japan, and South Korea have certainly helped to cushion the impact," said Tony Sycamore, analyst at IG.

"The market now, I think, has probably taken the view that these trade tariff levels can be renegotiated, can be walked lower over the course of time."

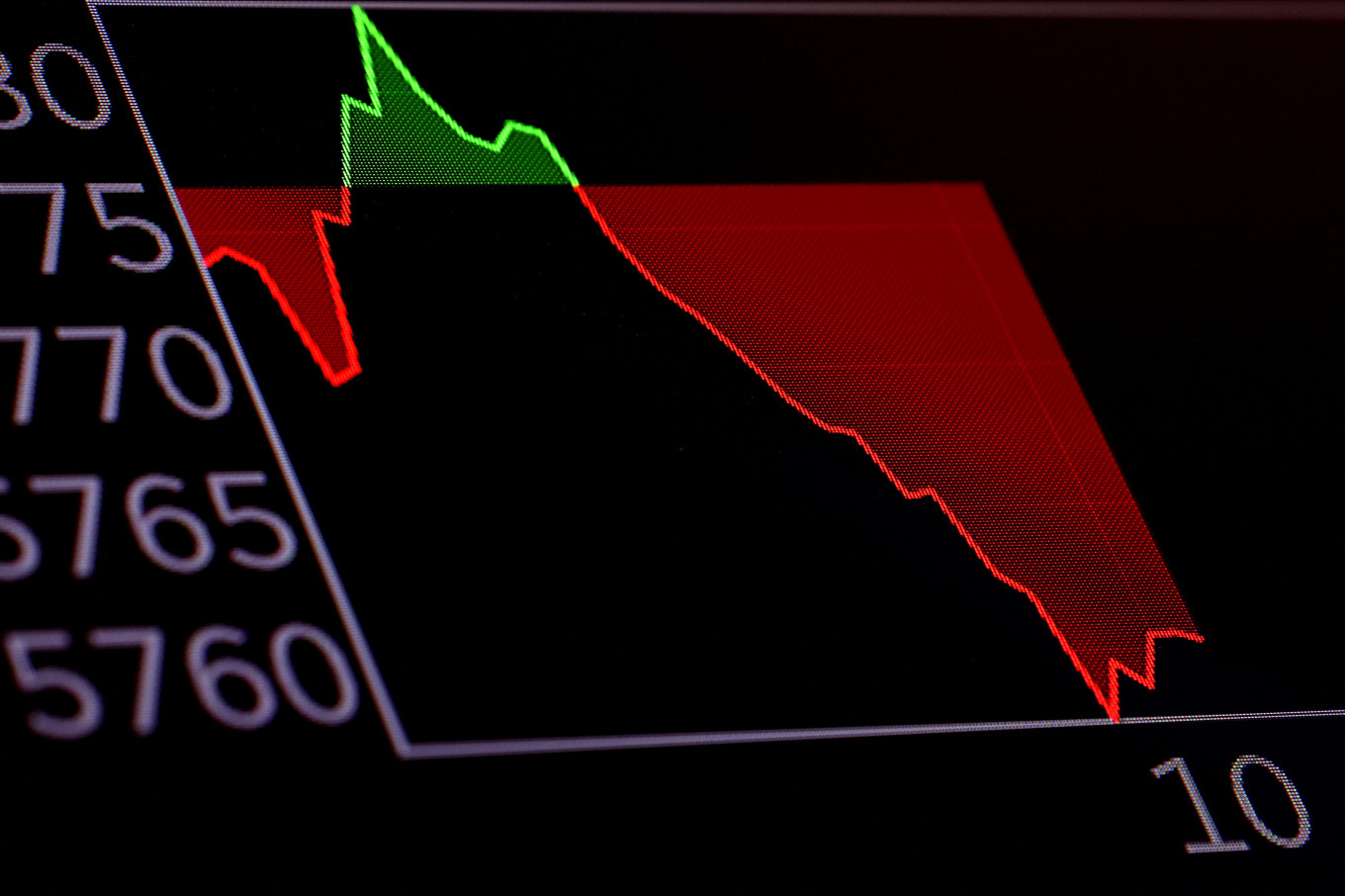

MSCI's broadest index of Asia-Pacific shares outside Japan fell 0.7 percent, bringing the total loss this week to 1.8 percent. South Korea's KOSPI plunged 3 percent while Taiwanese shares fell 0.9 percent.

Japan's Nikkei dropped 0.4 percent. Chinese blue chips were flat and Hong Kong's Hang Seng index eked out a small gain of 0.2 percent.

EUROSTOXX 50 futures slipped 0.2 percent. Both Nasdaq futures and S&P 500 futures eased 0.2 percent after earnings from Amazon failed to live up to lofty expectations, sending its shares tumbling 6.6 percent after hours.

Apple, meanwhile, forecast revenue well above analysts' estimates, following strong June-quarter results supported by customers buying iPhones early to avoid tariffs. Its shares were up 2.4 percent after hours.

Overnight, Wall Street failed to hold onto an earlier rally. Data showed inflation picked up in June, with new tariffs pushing prices higher and stoking expectations that price pressures could intensify, while weekly jobless claims signaled the labor market remained on a stable footing.

Fed funds futures imply just a 39 percent chance of a rate cut in September, compared with 65 percent before the Federal Reserve held rates steady on Wednesday, according to the CME's FedWatch.

Much now will depend on the US jobs data due later in the day and any upside surprise could price out the chance for a cut next month. Forecasts are centered on a rise of 110,000 in July, while the jobless rate likely ticked up to 4.2 percent from 4.1 percent.

The greenback has found support from fading prospects of imminent US rate cuts, with the dollar index up 2.5 percent this week against its peers to 100.1, the highest level in two months. That is its biggest weekly rise since late 2022.

The Canadian dollar was little impacted by the tariff news, having already fallen about 1 percent this week to a 10-week low.

The yen was the biggest loser overnight, with the dollar up 0.8 percent to 150.7 yen, the highest since late March. The Bank of Japan held interest rates steady on Thursday and revised up its near-term inflation expectation but Governor Kazuo Ueda sounded a little dovish.

Treasuries were largely steady on Friday. Benchmark 10-year US Treasury yields ticked up 1 basis point to 4.374 percent, after slipping 2 bps overnight.

In commodity markets, oil prices were steady after falling 1 percent overnight. US crude rose 0.1 percent to $69.36 per barrel, while Brent was at $71.84 per barrel, up 0.2 percent.

Spot gold prices were off a fraction at $3,286 an ounce.