Joint operation of Natuna block proposed

Following years of delays in the development of a number of gas projects around the Natuna Islands, an exploration committee is planning to propose a joint development involving a number of blocks in the area as part of moves to make costly projects more feasible

Change text size

Gift Premium Articles

to Anyone

F

ollowing years of delays in the development of a number of gas projects around the Natuna Islands, an exploration committee is planning to propose a joint development involving a number of blocks in the area as part of moves to make costly projects more feasible.

Andang Bachtiar, the head of an ad-hoc national exploration committee established in 2015, said the team was currently working on the plan for five blocks in the environs of the archipelago.

'We will propose a joint POD [plan of development] for five blocks. Under the plan, each party will be responsible for the development of certain facilities, but management will be shared,' Andang said.

According to Andang, the five blocks include East Natuna block ' previously known as Natuna D-Alpha ', Tuna block and South Natuna Sea Block B.

East Natuna block has total proven reserves of 46 trillion cubic feet (tcf), making it the largest gas reserve in Asia. Unfortunately, the gas field has a high CO2 level of around 71 percent, necessitating advanced technology and huge investment to develop the block. As reported earlier, the block needs between US$20 billion and $40 billion in investment. State-owned Pertamina, US-based ExxonMobil, France's Total SA and Thailand's PTT Exploration and Production (PTT EP) are among oil and gas firms reportedly interested in the block.

Development of East Natuna is estimated to be feasible only if oil prices exceed $100 per barrel. Currently, the global glut has pushed the price to a level of $37 per barrel.

Meanwhile, Tuna block is operated by Premier Oil, which holds a 65 percent stake. The remaining 35 percent is held by the Mitsui Exploration Company.

On the other hand, South Natuna Sea Block B contractors are ConocoPhillips with 40 percent ownership, leaving Chevron and Inpex with 25 percent and 35 percent, respectively. According to a recent report, the contractors are seeking to release part of their stake to new partners.

According to Andang, all the planned blocks are located in remote areas, and there has been no discussion among operators.

'If we work together, I'm sure we can shift the political constellation as well as the constellation of oil and gas prices, because the reserves there are huge,' he said, adding that the plan had to be formulated as soon as possible, as implementation would take two or three years.

Meanwhile, Pertamina director for upstream affairs Syamsu Alam said earlier that the contractors had asked for a two-year extension to the period of principal of agreement (POA) of East Natuna block, which expired on Dec. 10.

The POA for East Natuna field, formerly known as the Natuna D-Alpha block, was seen as an important stage prior to the signing of a production-sharing contract (PSC). The POA was signed in 2011, the same year the PSC for East Natuna was expected to be concluded. However, no progress has been reported to date.

'Even if the extension is granted, it's unlikely the block will be producing by 2030,' Syamsu said.

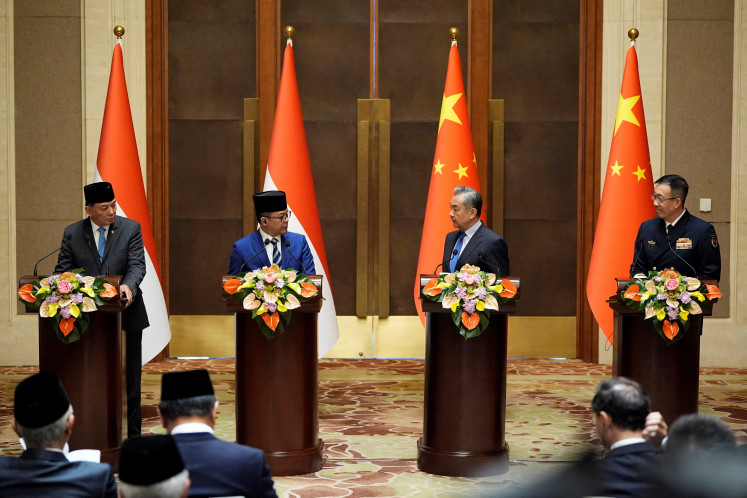

The Natuna Islands in the South China Sea are Indonesia's northernmost territory. While they lie far from the so-called nine-dash-line claimed to mark China's territory, recent tensions have driven the government to exert its stake over the area.