Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsSkeptics say tax amnesty now in dire need of ‘miracle’

Change text size

Gift Premium Articles

to Anyone

P

resident Joko “Jokowi” Widodo hoped that his flagship tax amnesty policy would be the dawn of a new day for the country’s economy, with billions of dollars of Indonesian funds stashed overseas being repatriated and the country’s notoriously low tax base widened.

The policy was launched with a bang, but looks like it might end in a whimper. Skeptical economists have started to question whether the amnesty is yielding the desired effects after sluggish results during the first few months and as the end of the low-penalty period approaches, after which interest in the amnesty is expected to wane.

The amount of money that had been collected from the amnesty was “very low” compared with the initial expectations, said Akhmad Akbar Susamto, an economist at the Jakarta-based Center of Reform on Economics (CORE).

“If there is no sudden miracle, the program is likely to be fruitless,” Akhmad said in a discussion in Jakarta on Tuesday.

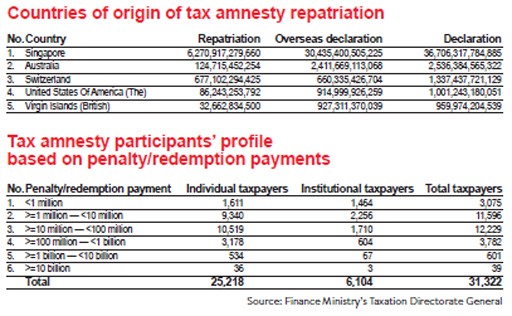

Tab:(Finance Ministry’s Taxation Directorate General/-)

Tab:(Finance Ministry’s Taxation Directorate General/-)

As of Wednesday evening, almost a third of the way into the program, each of the targets for repatriated assets, declared assets and penalty payments remained pitifully unmet. Repatriated assets only amount to Rp 13.9 trillion (US$1 billion), a mere 1.4 percent of the initial target; declared assets Rp 245 trillion, 6 percent; and penalty payments Rp 6.43 trillion,

3.9 percent.

Many, including Jokowi himself, expected most of the funds to be raised by September, after which penalty rates will be increased to 3 to 6 percent of declared assets until December and then 5 to 10 percent until the end of the program next March. Currently, penalty rates stand at 2 to 4 percent.

“People will join the amnesty if there is a serious punishment for not availing of it. In fact, the government is trying to convince people who have been avoiding their tax obligations for years to join the amnesty just through public meetings. That is far from enough,” Akhmad said, calling for a carrot-and-stick mechanism to encourage more participants.

Separately, Indonesian Institute of Sciences (LIPI) economist Latif Adam said the tax amnesty program ran a high risk of failure, given the “unrealistic” initial target of funds to be raised.

“The government has to prepare for the worst-case scenario, meaning there should be a plan B in case the amnesty does not hit the target,” he added, urging the government to consider increased borrowing to cover the lack of funds from the amnesty program.

Latif acknowledged that the government’s effort to widen its tax base for future tax collection was progressing, but he cast doubt on whether the amnesty was dominated by wealthy Indonesians, as initially targeted.

Government data show 1,591 brand new taxpayers have participated in the amnesty program so far amid the government’s drive to boost the number of individual taxpayers to 30 million people from 24 million last year. It also wants to boost the tax-to-GDP ratio to at least 16 percent, from 12 percent at present, one of the lowest in Southeast Asia.

More than half of the participants have paid penalty rates of between Rp 1 million and Rp 100 million, indicating the program has yet to net many big fish, with only 39 taxpayers out of 31,322 overall participants paying more than Rp 10 billion in penalties.

Many of the drawbacks of Jokowi’s amnesty now emerging had been predicted by the International Monetary Fund (IMF) and the Organisation for Economic Cooperation and Development (OECD).

IMF deputy director of fiscal affairs Michael Keen had said “it’s hard to think of good arguments for amnesties,” while Philip Kerfs, head of international cooperation in the OECD’s Center for Tax Policy and Administration, had warned that a tax amnesty would only favor noncompliant taxpayers.

The director for the state budget at the Finance Ministry, Kunta Wibawa, who spoke in the discussion, acknowledged that the first three months of the amnesty program were crucial for the government before deciding on other fiscal policies to manage the state budget, which was recently revised for the second time as a result of an expected tax revenue

shortfall.

He said the government would wait until the end of September, before deciding steps to ease the budget shortfall, including by widening the state budget deficit to nearer the 3-percent-of-GDP limit set

by law. (mos)

Prima Wirayani contributed to the story.