Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsLife insurance industry eyes steady growth in 2017

Change text size

Gift Premium Articles

to Anyone

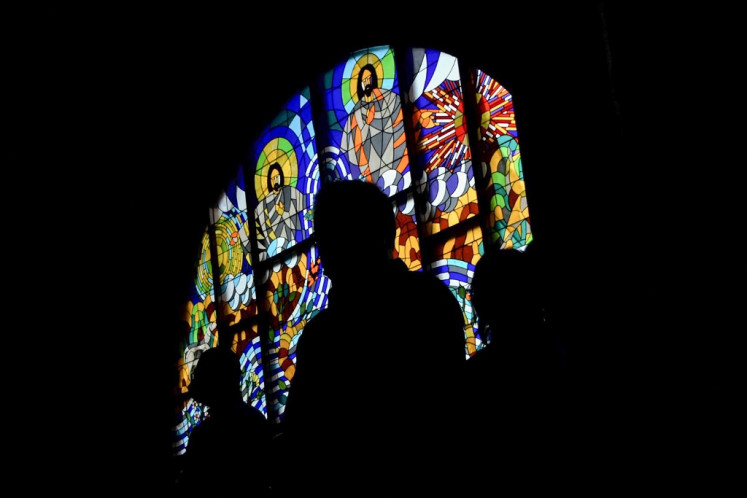

Good times: Indonesia Life Insurance Association (AAJI) chairman Hendrisman Rahim (center), communication and inter-institution division head Christine Setyabudhi (left) and communication head Nini Sumohandoyo converse after a press conference on Friday to share the performance of the industry in the third quarter of 2016. (JP/Winny Tang)

Good times: Indonesia Life Insurance Association (AAJI) chairman Hendrisman Rahim (center), communication and inter-institution division head Christine Setyabudhi (left) and communication head Nini Sumohandoyo converse after a press conference on Friday to share the performance of the industry in the third quarter of 2016. (JP/Winny Tang)

L

ife insurance firms expect to maintain double-digit revenue growth next year amid confidence about the country’s gradual economic recovery.

The Indonesian Life Insurance Association (AAJI) predicted on Friday that revenue would grow by at least 10 percent next year to a minimum of Rp 175.2 trillion (US$13 billion) from the projected Rp 159.28 trillion this year.

The association said the industry’s outlook was still positive, assuming the nation’s economy would grow by 5.1 percent next year.

“The government’s projection of 5.1 percent growth means the life insurance industry can grow by more than that,” AAJI chairman Hendrisman Rahim told a press conference on Friday.

Over the past 10 years, the industry has seen annual revenue growth of between 10 and 30 percent, according to the AAJI.

As of the third quarter of this year, life insurers’ investment portfolios were dominated by mutual funds, followed by stocks, government bonds and time deposits, AAJI executive communication and inter-institution division head Christine Setyabudhi said. (win/hwa)