Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBank Mandiri offers various investment options to keep repatriated funds

About Rp 8.5 trillion of the funds repatriated to Indonesia following the government’s nine-month tax amnesty in 2016-2017 were kept in Bank Mandiri

Change text size

Gift Premium Articles

to Anyone

S

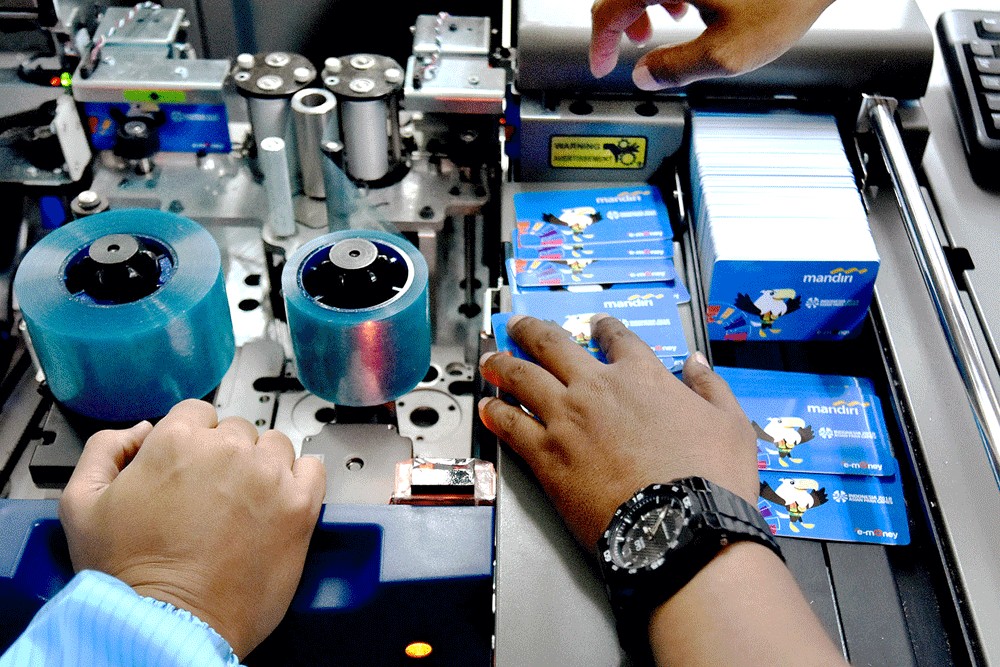

tate-owned Bank Mandiri is offering various investment products through its weal management division and securities and fund management subsidiaries to keep repatriated funds with holding periods ending later this year.

Mandiri business and networks director Hery Gunardi said the bank had developed various financial instruments, including through PT Mandiri Sekuritas and PT Mandiri Manajemen Investasi, to ensure the repatriated funds would not be moved to foreign countries.

“With these assorted products, we want to fulfill the needs of our [wealth management business] clients, whose funds are in Indonesia and abroad,” he said in a media briefing in Jakarta on Monday.

Hery said about Rp 8.5 trillion (US$597.63 million) of the funds flown back to Indonesia following the government’s nine-month tax amnesty in 2016-2017 were kept in Bank Mandiri. Some of the funds are placed in Bank Mandiri’s offshore products through its branch in Singapore, he said.

“It’s a challenge for us to make sure that after the holding period ends, the funds stay here [in Mandiri],” Hery said.

Following the tax amnesty, an estimated Rp 140 trillion in assets were repatriated to Indonesia. Taxpayers are required to hold their repatriated assets in the country for three years. This year will be the end of the assets’ holding period, raising concerns as to whether the assets would continue to remain in the country.

According to the Institute for Development Economics and Finance (Indef), the repatriated assets are just a small portion of some Rp 11 quadrillion of wealthy Indonesians’ total assets placed overseas.