Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsThings you need to know about government's sovereign wealth fund

The fund’s establishment would be regulated by the anticipated omnibus bill on job creation.

Change text size

Gift Premium Articles

to Anyone

I

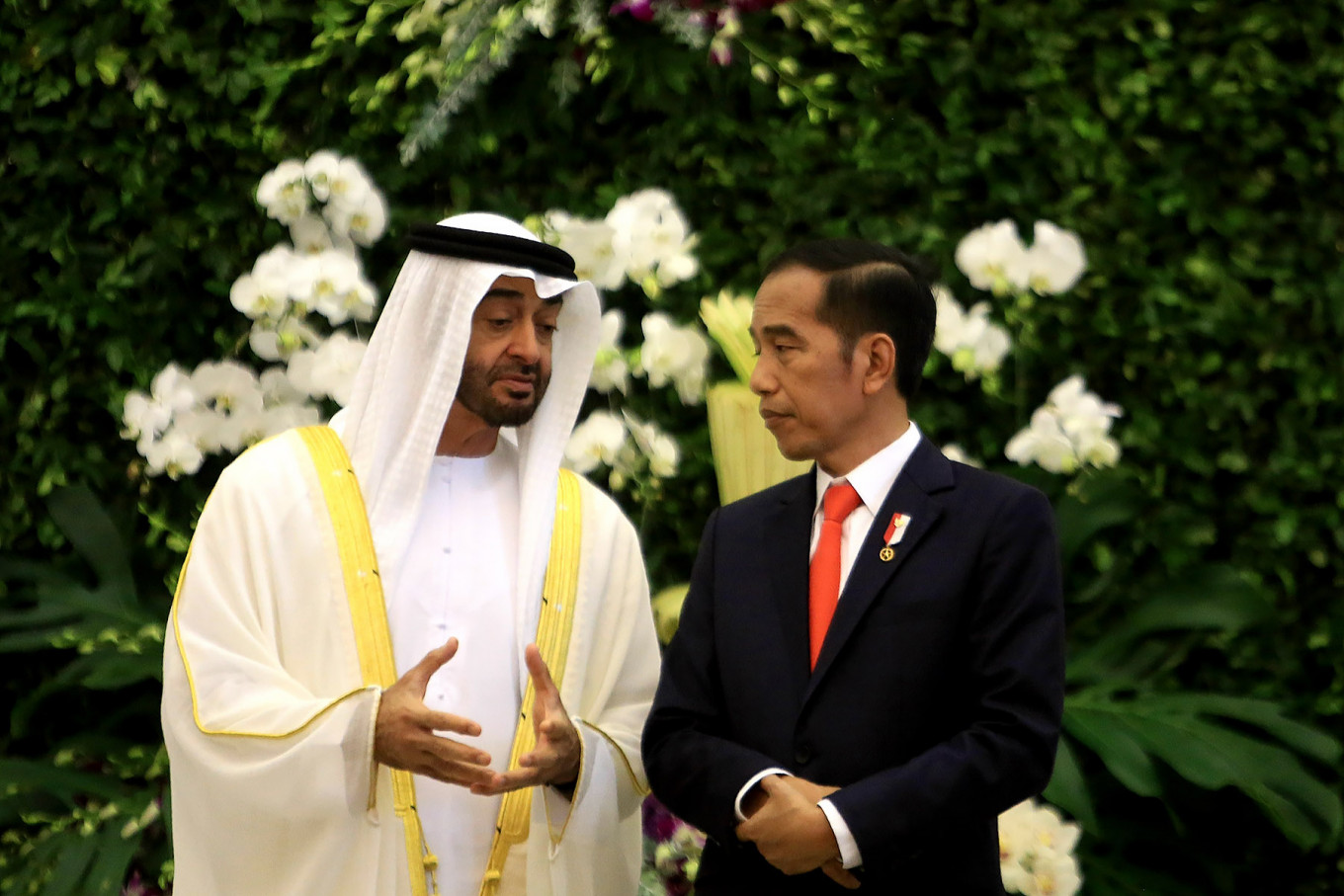

ndonesia is planning to establish a sovereign wealth fund to fund the country’s development projects following investment interest expressed by the United Arab Emirates (UAE) and the United States, among others.

The fund’s establishment is to be regulated by an anticipated omnibus bill on job creation, which has been drafted by the government and is expected to be submitted to the House of Representatives this week. The bill is seen as essential to support the government’s efforts to attract investments to the country to help fuel the sluggish economic growth.

In a statement on Jan. 13, Coordinating Maritime Affairs and Investment Minister Luhut Pandjaitan said the UAE, Japanese conglomerate SoftBank Group and the US’ International Development Finance Corporation (IDFC) were among the investors in the sovereign wealth fund. He said the possibility for other potential parties to join the fund was still open.

The UAE government has prepared US$6.8 billion to invest in Indonesia’s development projects through a sovereign wealth fund, while the IDFC has pledged to invest $5.5 billion in Indonesia. SoftBank Group, meanwhile, has offered up to $40 billion to invest in the development of the country’s new capital city.

President Joko “Jokowi” Widodo said previously that the planned sovereign wealth fund was expected to attract at least $20 billion of foreign inflows to finance the country’s infrastructure projects.

Read also: Government’s sovereign wealth fund plan questioned

However, some experts have questioned the fund’s establishment and management, saying the common practices are slightly different than what were set out in the government’s plan. Here are things you need to know about the sovereign wealth fund and its potential dark side: a moral hazard.

First of all, what is a sovereign wealth fund?

According to the US-based Sovereign Wealth Fund Institute, a sovereign wealth fund is a state-owned investment fund that commonly raises funds from balance of payment surpluses, official foreign currency operations, money from privatizations, governmental transfer payments, fiscal surpluses and revenue generated from natural resource exports.

A sovereign wealth fund invests in a range of assets, such as government bonds, equities and foreign direct investment.

Each sovereign fund has its own reason for being created and its own objectives including to fund social and economic development, diversify from nonrenewable commodity exports and increase savings for future generations, as well as stabilize a country’s budget and economy from excess volatility in revenues or exports, according to the institute.

What are things the government intends to do with a sovereign wealth fund?

A presentation shared by the Office of the Coordinating Economic Minister on the omnibus bill revealed that the fund’s establishment was aimed at managing and allocating a sum of funding and/or state assets. The fund’s assets would be in the form of state capital injection, assets/business development returns, state-owned enterprise assets, grants and other defined sources.

The sovereign wealth fund would be owned by the government and would be able to engage in direct or indirect investments and work with other parties, according to the presentation material.

In contrast to common practices, the government said it was in discussions to invite foreign investments into the planned sovereign wealth fund to help finance the country’s development projects, according to Luhut.

“This will have a multiplier effect,” said the minister during a recent press briefing. “If we have $15 billion [in a sovereign wealth fund], we have to look for projects that could generate up to $60 billion.”

President Joko “Jokowi” Widodo said the planned sovereign wealth fund was expected to attract at least $20 billion of foreign inflows to finance the country’s infrastructure projects.

Read also: 'Largest deal in Indonesia's history': UAE pledges to invest in deal worth $22.8b

However, the plan has raised questions as experts considered foreign investments should not be considered as the fund’s assets.

“The sovereign wealth plan is vague because a sovereign wealth fund is established by a country because it has excess money from a balance of payments surplus [among other things], like in the UAE,” Centre for Strategic and International Studies economic department head Yose Rizal Damuri said on Jan. 17.

What the government planned, he said, was that domestic funding and foreign investment would be collected under a sovereign wealth fund to be used in Indonesia.

“However, a sovereign wealth fund doesn’t work like that,” he added. “[The government’s plan] is probably to collect funding from other countries’ sovereign wealth funds.”

Would a sovereign wealth fund benefit a country’s economy?

There are several examples of a sovereign wealth fund enriching a country’s economy, including the world’s largest Norway Government Pension Fund Global.

The value of Norway’s sovereign wealth fund grew to a record of $1.09 trillion in October, boosted by rising global stocks and the strength of the euro and dollar, as reported by Reuters.

Built since 1996 to save petroleum revenues for future generations, the size of the fund has grown to almost three times Norway’s annual gross domestic product, far exceeding original projections.

“When the fund was set up, nobody thought it would pass $1.09 trillion. We were lucky to discover oil,” the fund’s chief executive, Yngve Slyngstad, said in a statement confirming the record, according to Reuters.

“The return on the investments in global financial markets has been so high that it can be compared to having discovered oil again,” he said.

Commonly known as the oil fund and managed by a unit of the central bank, it invests close to 70 percent of funds in global equities and some 28 percent in a portfolio of fixed-income assets, according to the same report.

Do sovereign wealth funds pose risks to a country’s economy?

Some sovereign wealth funds tend not to be as transparent as others, according to the Sovereign Wealth Fund Institute. “For example, one sovereign wealth fund may disclose their investment holdings on a periodic basis, while another fund keeps them private.”

Malaysia’s sovereign wealth fund, 1MDB, for instance, has been in a spotlight following alleged money laundering and financial fraud in which Malaysian and US investigators believe about $4.5 billion was misappropriated.

The case has implicated Wall Street investment bank Goldman Sachs officials and Malaysian businessman Low Taek Jho – commonly known as Jho Low – as well as former Malaysian prime minister Najib Razak.

Read also: Malaysian financier denies masterminding 1MDB graft scandal

Looted money was used by Jho to buy things from a super-yacht to art pieces as he remained a wanted man by Singaporean authorities and the US’ Department of Justice, according to Malaysia-based media outlet The Star.

Najib, meanwhile, faces 42 criminal charges in five separate trials related to the alleged theft of billions of dollars from 1MDB in at least six countries including the US, Singapore and Switzerland. He has pleaded not guilty, according to Reuters.

“The government must be able to supervise the fund management in a bid to avoid embezzlement such as in Jiwasraya or the 1MDB case,” Center of Reform on Economics Indonesia research director Piter Abdullah said.

Meanwhile, Yose pushed for “good governance based on international values” to avoid corruption and financial fraud in the country’s upcoming sovereign wealth fund.