Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIndonesia supports G20’s digital tax initiative approved during Riyadh meeting

G20 member countries have approved a tax system to collect tax from digital companies and prevent tax avoidance, but they need to further discuss the system’s technicalities

Change text size

Gift Premium Articles

to Anyone

Indonesia is supporting the initiative made by the Group of 20 (G20) major economies in Saudi Arabia recently to establish a new tax system to enable member countries to collect tax from global digital companies.

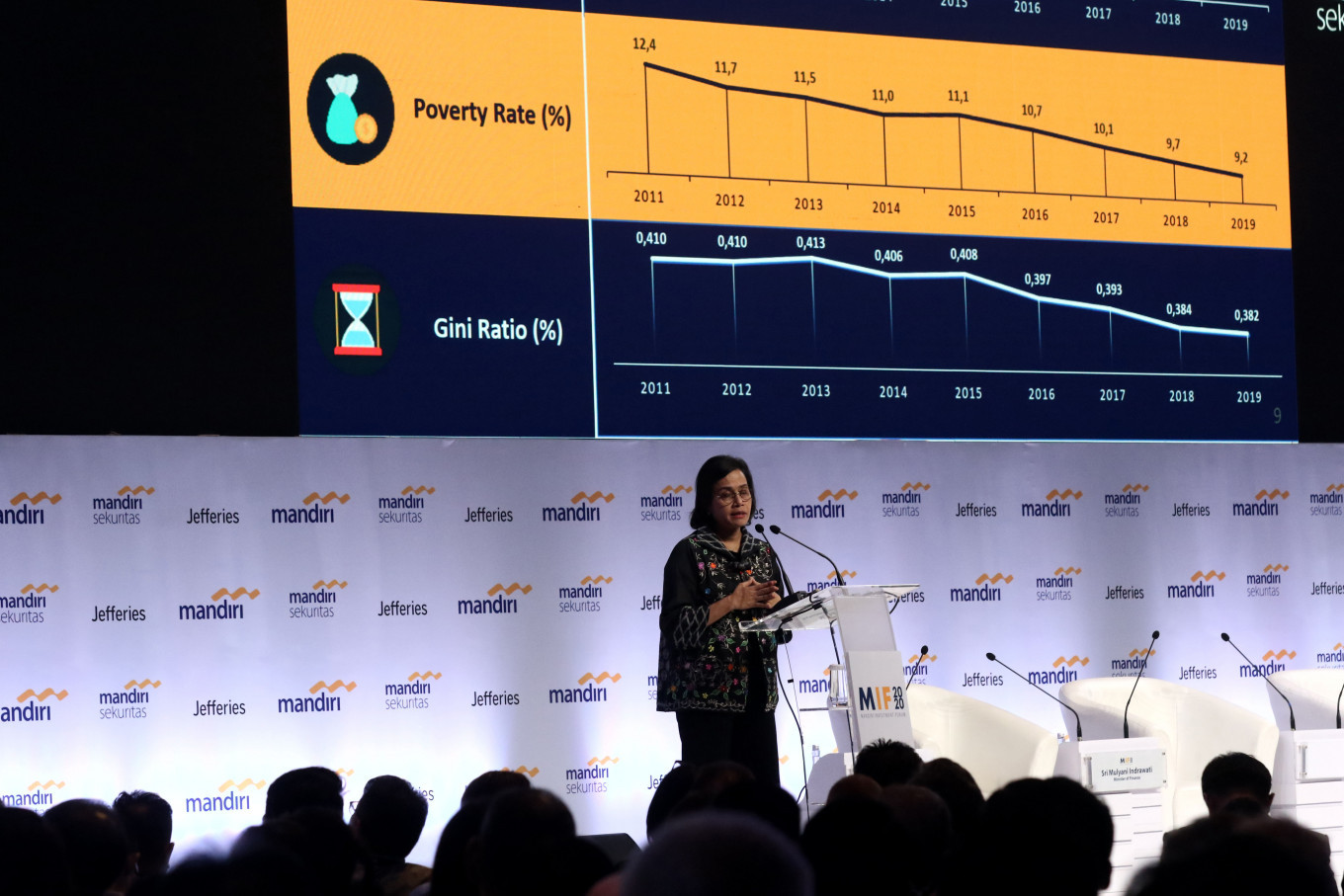

During the meeting of the finance ministers and central banks of the G20 member countries in the Saudi capital of Riyadh on Feb. 22-23, Indonesia’s Finance Minister Sri Mulyani supported the G20 countries’ approach but urged the forum to stress transparency and fairness, John Hutagaol, an international taxation director at the Finance Ministry said in Jakarta on Monday.

John said the G20 agreed to set up a tax system to collect tax from digital companies and prevent tax avoidance, but needed to further discuss the system’s technicalities.

The so-called “unified approach” model approved in the meeting aims to collect tax from companies that have limited or no physical presence in a country. The approach sets multiple thresholds that are based on a company’s turnover in a country, which would then define whether the company should pay taxes to the country where they run their business or where their products are purchased.

Based on the system, if a company’s turnover surpasses the determined global threshold, it should pay taxes to the country where it runs its business, John said. There would also be a threshold in each country that would determine whether that country has the right to receive tax payments from the company, he added.

Sri Mulyani also brought issues of tax hindrance into the spotlight during the Riyadh meeting and shared Indonesia’s progress in tracking its citizens’ assets abroad through the automatic exchange of information (AEoI) agreement with other countries.

“We have gained information on 1.6 million financial accounts owned by Indonesians in foreign countries worth 246.6 billion euro (US$274.2 billion) since AEoI began in 2018,” John said.