Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsGlimmer of hope: Indonesians optimistic, likely to spend more

More than half of Indonesian respondents say they are optimistic that the economy will rebound within two to three months, faring better than most countries across the globe.

Change text size

Gift Premium Articles

to Anyone

I

ndonesians are relatively more optimistic on the outlook of the economy and will spend more in the future as businesses are forced to adapt to changing consumer behavior to endure the economic effects of the pandemic, several surveys show.

More than half of Indonesian respondents say they are optimistic that the economy will rebound within two to three months, faring better than most countries around the world, according to a new McKinsey & Company survey on Indonesia consumer sentiment during the coronavirus crisis.

Another McKinsey article titled “A global view of how consumer behavior is changing amid COVID-19” states that optimism correlates with an increase in spending.

“Chinese consumers’ optimism results in a net increase in expected future spending, a situation also observed in Indonesia, Nigeria and India,” reads the report. “Most European consumers are less optimistic and, as a result, expect to spend less”.

Indonesia’s consumer-driven economy relies on household spending, which accounts for nearly 60 percent of the country’s gross domestic product (GDP).

The economy is expected to grow 2.3 percent this year, the lowest since 1999, or contract by 0.4 percent under the worst-case scenario as businesses and workers, consequently households, are paralyzed during the pandemic, government calculations project.

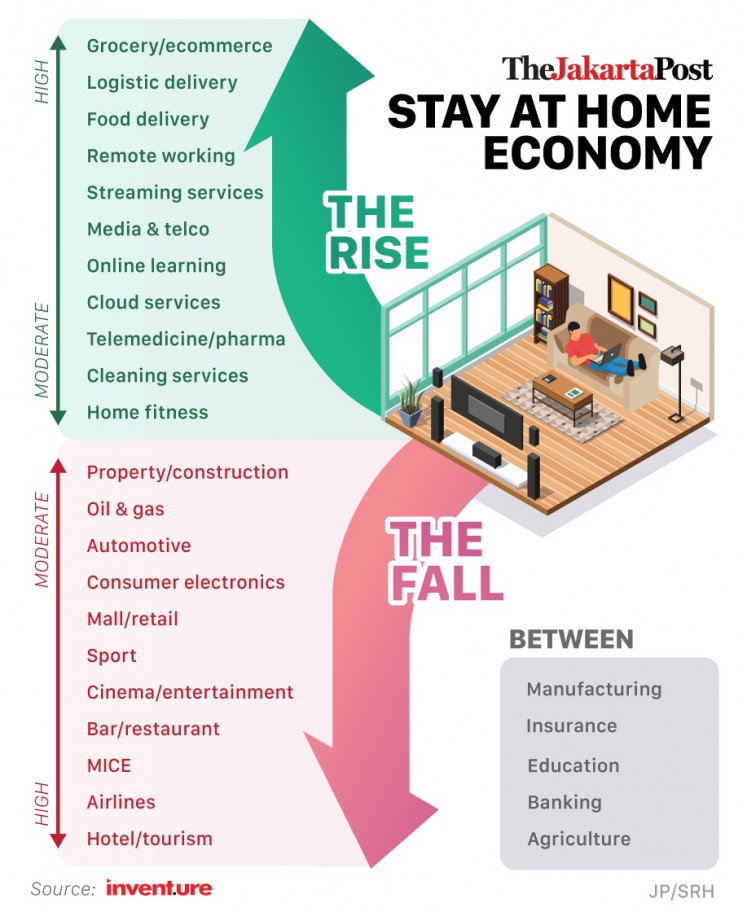

Business sectors that rise and fall in stay-at-home economy. (Inventure/"30 Consumer Behavior Shiftings")Another report from market research firm Kantar Indonesia points to manageable concerns over COVID-19 from the perspective of Indonesians. Based on a sample of 6,428 people on March 25, 68 percent of Indonesians were concerned but said they knew what to do, while 10 percent were very concerned and did not know what to do.

“We see that Indonesians are concerned but assured,” Kantar Indonesia wrote. “Indonesia and Malaysia are the only countries in the region that have maintained a net-positive sentiment in their social media chatter about COVID-19.”

While the reports point to consumer optimism in the future, spending will remain cautious and targeted with a big shift in consumer needs, requiring businesses to adapt to changing consumer behavior.

“Think of now as the new normal. We must take action,” said branding and marketing expert Yuswohady on April 13, during a webinar series hosted by Inventure Knowledge on COVID-19 and its impact on businesses. He urged businesses to be quick in adapting to the crisis, saying that “agility is key”.

Inventure released a briefing document titled “30 Consumer Behavior Shiftings” as a navigation guide for businesses to survive amid a spike in layoffs, poverty and bankruptcy that the government has forecast.

As the government tries to soften the economic shocks from the COVID-19 pandemic through tax breaks and cash transfers, businesses are urged to play their part in adapting to recent trends. Here are several major consumer behavior shifts that could present as business opportunities amid the pandemic, based on Inventure’s new report.

Digital channels, delivery services and subscription models matter

Regardless of the product or service, there are three common areas that companies can work on to build up their resilience amid the pandemic: strengthening delivery services, bolstering digital channels and considering a subscription model. The last one will work well when the first two have already been established.

“COVID-19 will become a catalyst to the development of the subscription business model,” concludes the Inventure report, explaining that the trend in routine online purchases will be accommodated well under the model as the consumer will attain cheaper prices while companies can be certain that there will be a steady flow of demand.

‘”Jamu” is the new espresso’

Aside from a turn to self-sufficiency, consumers are increasingly focused on health and well-being as a result of the pandemic. This has resulted in a spike in the consumption of vitamins, online fitness programs and online health consultations.

More than three out of four consumers in Australia, India, Indonesia, South Korea and Thailand that McKinsey & Company surveyed for their report — titled “Reimagining food retail in Asia after COVID-19” — say that they are “focusing on boosting immunity through more exercise and healthy living”.

As part of consumers’ pursuit of immunity boosts, many are turning to traditional remedies, according to a report from global market research firm Mintel titled “How COVID-19 is impacting food and drink markets in Southeast Asia”.

For Indonesian consumers, that traditional remedy is the traditional herbal drink, jamu.

“The COVID-19 pandemic is making jamu into a lifestyle. Jamu is the new espresso,” the Inventure report says, noting that a number of jamu producers have seen an increase in revenue of up to 50 percent. It predicts that the habit of drinking jamu will be “a new normal” and that jamu cafes will be more common in the future.

Read also: ‘Pay attention’, ‘transform’: Pandemic shifts business landscape, strategy

Emerging virtual social activities

In order to stay connected with friends and family members, many consumers are opting for “virsocial” (virtual social) activities, which means that they do activities in the comfort of their own homes but connected to their peers with the help of teleconferencing platforms.

Inventure’s report suggests that this behavior is driven by the desire to reduce the monotonous day-to-day life in quarantine. Businesses can tap into this growing market by replicating what DOOgether, an online platform for sports and activities, did in the midst of the pandemic, Inventure noted.

The platform launched two new features #dirumahaja (#stayathome) exercise by DOOgether and DOOlive, which enables consumers to follow live classes as well as numerous videos-on-demand in partnership with local wellness studios to guide consumers' daily exercises.

“DOOlive helps local studio partners, as well as the trainers teaching live classes, with income,” DOOgether chief executive officer Fauzan Gani said in a statement published on April 7, as quoted by kontan.co.id.

Read also: Three stages of emotion on COVID-19 journey: Where are you now?

‘Zoom-able’ workplace at home

“The work-from-home trend will give birth to a new industry that is the home office industry, which includes furniture, interior design, office devices and housing property designs that have workspaces,” the Inventure report reads.

Regions across Indonesia have implemented large-scale social restriction (PSBB) measures that include public area, school and house-of-worship closures, except for essential needs. President Joko “Jokowi” Widodo has also urged Indonesians to work, study and pray from home.

This has led to corporate meetings being facilitated by teleconferencing platforms such as Zoom and Google Hangouts. In relation to the recent mass adoption of the platforms, data from Google Trend show an increase in searches for home office equipment keywords, for example, “best computer monitor”, in early March.

Furniture store IKEA and electronics goods chain BestBuy have seen an increase in sales of office furniture as well, the Inventure report says.

Read also: Online groceries thrive as customers avoid supermarkets

Home-cooking makes a comeback

Consumers are starting to build on the habit of home cooking due to the implementation of social-distancing measures. Based on research by Moz, a software as a service (SaaS) company, among the most searched items on Google during the social-distancing period are family recipes and home baking.

“We’re seeing growing interest in at-home cooking, which presents challenges and opportunities for brands looking to engage with those preparing and enjoying tasty meals at home,” Mintel’s Asia Pacific food and drink analyst Tan Heng Hong said. The behavior is driven by more time being spent at home, he added.

Relevant business opportunities include instant seasoning, food preparation, “ready to serve” cooking such as frozen food, as well as running a cooking and recipes platform, as noted by the Inventure report.