Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsAssociation urges credit card holders to activate PIN before July

Change text size

Gift Premium Articles

to Anyone

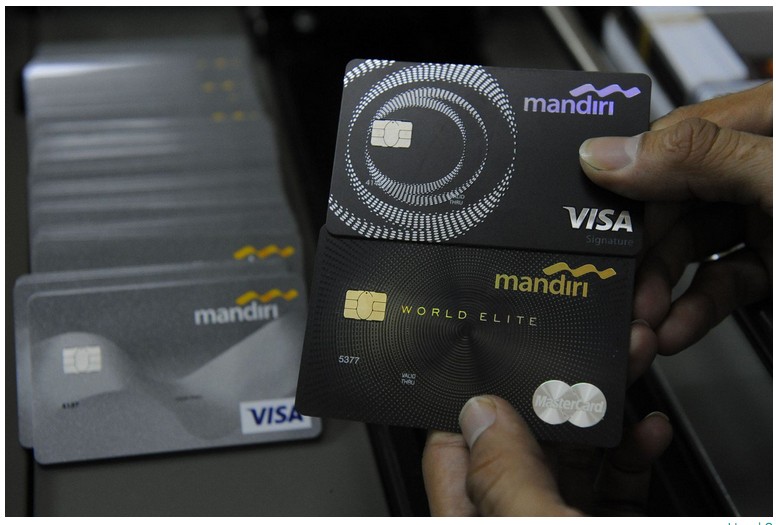

Plastic money: An employer supervises the printing process of Bank Mandiri credit cards at the state-owned lender's headquarters in Jakarta. Bank Indonesia reported that, as of October, there were 17.22 million credit card holders in Indonesia, 2.85 percent more than a year earlier. (Antara/Puspa Perwitasari)

Plastic money: An employer supervises the printing process of Bank Mandiri credit cards at the state-owned lender's headquarters in Jakarta. Bank Indonesia reported that, as of October, there were 17.22 million credit card holders in Indonesia, 2.85 percent more than a year earlier. (Antara/Puspa Perwitasari)

C

redit card holders should activate their six-digit personal identification number (PIN), which will be mandatory for transactions as of July 1, the Indonesian Credit Card Association (AKKI) has stated.

In accordance with Bank Indonesia regulation, starting from July 1, all credit card transactions will require six-digit PIN numbers as a form of authentication, while signature authentication will be disallowed. The only exception is for purchases below Rp 1 million (US$70.9) using contactless credit cards.

A survey by YouGov in June showed that one in four Indonesian credit card users had yet to activate their PIN, despite an overwhelming 81 percent stating they were aware of the regulation deadline.

“People know about the regulation, but they say they are too busy to activate their credit card PIN, while in fact it can be done in minutes,” AKKI chairman Steve Marta said in a press briefing on Tuesday.

Steve added that switching to PIN authentication was essential to increase the security of cashless transactions, especially during the COVID-19 pandemic which had prompted people to use more cashless payments to minimize the virus spread.

According to the survey, in the last three months, 75 percent of respondents have more often used digital payments, such as e-wallet OVO, followed by debit or credit cards.

“All transactions, including credit card usage, has gone down this year due to the pandemic. When transactions do happen, it is usually through online platforms instead of retail stores,” he said.

However, he said he was optimistic that credit card usage could still grow as people started to enter the transitional period when the government eases large-scale social restrictions (PSBB).

The PIN authentication requirement was initially planned for 2015 but was pushed back to 2020 as the banking industry faced difficulties in implementing the measure.

Meanwhile, Visa Worldwide Indonesia president director Riko Abdurrahman said the pandemic had accelerated consumers’ adoption of cashless payment methods globally.

According to the Kantar Covid-19 Barometer study in March, 62 percent of Indonesian consumers said they would continue to use credit cards and mobile e-wallets to pay for goods instead of cash, in line with the global trend.

“We are on the right trajectory in becoming a less-cash society. In fact, people are expecting Indonesia to become cashless in the next two to five years,” he told the press. “This is why it is essential for credit card holders to activate the PIN [payment method] and ensure a seamless payment experience.”

A recent survey by global fintech organization Rapyd showed that credits cards remained the most popular form of payment in Japan, Singapore and Taiwan, while e-wallets were the preferred choice in India, Indonesia, Malaysia and Thailand.

“While developed countries have been using cards for years and seem to be slower in adopting alternatives, consumers in emerging economies have leapfrogged the cards stage altogether and use mobile wallets or bank transfers,” the report stated.

The report suggests that only 4 percent of Indonesians have international credit cards and that debit cards are usually set up to disallow online purchases.