Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsThe inflationary pressures

If inflation spirals out of control, the growth of private consumption would weaken and unfortunately, inflation hits the fixed low-income group hardest.

Change text size

Gift Premium Articles

to Anyone

I

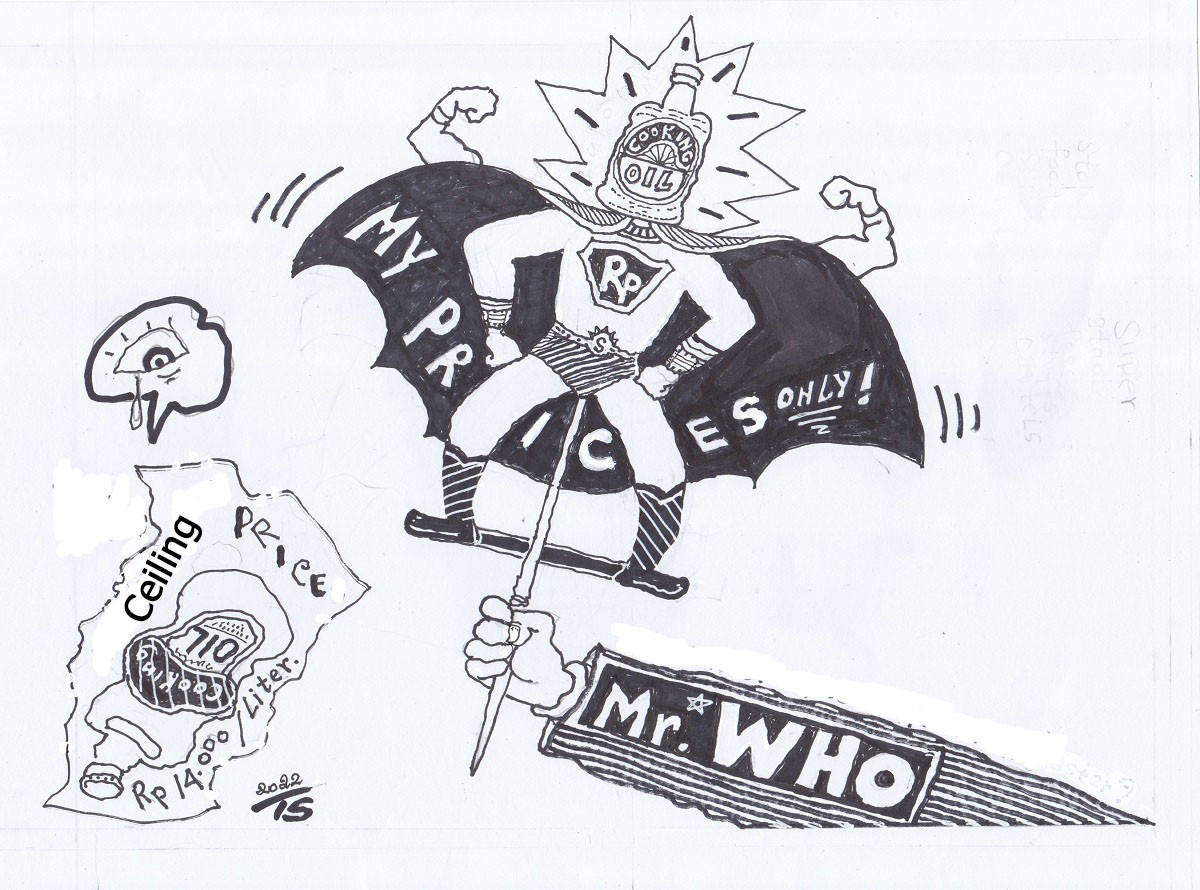

ndonesia’s consumer price index surged 3.5 percent year-on-year (yoy) in April, the highest since 2018, due to the combination of stronger demand in the post-pandemic economic recovery and hikes in the administered prices of food and energy. Several analysts estimated that skyrocketing cooking oil prices contributed significantly to the monthly food inflation.

Stronger inflationary pressures are also expected if the government goes ahead with its plan to raise the administered prices of Pertalite gasoline, liquefied petroleum gas and electricity for middle-income consumers.

The immediate question then, is will Bank Indonesia (BI) raise this month its benchmark interest rate which has been maintained at 3.5 percent since February 2021? The consensus among most analysts is that the central bank would most likely wait until the second semester before raising its policy rate. This is because core inflation in April was only 2.6 percent, meaning that the headline inflation was generated mostly by the rises in administered prices (supply side) of food and energy.

It is worthy of remembering though that Indonesia depends on imports for 60 percent of its fuel needs, 100 percent of wheat consumption and 60 percent of its soybeans and milk supply. It is therefore most important that the government resolves once and for all the cooking oil price mystery as the country is the world’s largest producer of palm oil, the source of almost 95 percent of the nation’s edible oil. If inflation spirals out of control, the growth of private consumption would weaken and unfortunately, inflation hits the fixed low-income group hardest.

In view of the lower economic growth on a quarterly basis in the first quarter, BI would most likely focus more on sustaining the recovery rather than on the surging inflation. That does not, however, mean that the government should simply sit back and relax, as uncertainty caused by the Ukraine crisis will continue to disrupt food and energy supplies.

True, the gross domestic product (GDP) grew by 5.01 percent yoy in the first quarter, but it fell 0.96 percent on a quarterly basis despite the persistent boom in prices of Indonesian major commodities such as coal and palm oil.

But the economy will continue to face headwinds, notably unfavorable external factors such as the uncertainty about the Ukraine crisis which has been causing disruption in the global supply chains of various commodities, notably food and energy. The energy and food crisis will certainly feed into our inflationary pressures.

The United States Federal Reserve last week lifted its benchmark interest rate by half a percentage point to a range of 0.75 to 1 percent, its biggest increase in 22 years. The aggressive move, though it has been expected for many months, could induce capital outflows from Indonesia, especially if inflation is unusually high. This in turn would adversely affect the rupiah exchange rate, making imports much costlier with massive repercussions for economic stability.

Another challenge is the urgent need for fiscal consolidation to return the legal ceiling fiscal deficit to below 3 percent in 2023 from an estimated 4.58 percent of GDP this year at a time when food and energy subsidies would likely increase significantly due to international price hikes.