Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsNo credit, no progress

According to a 2023 report by the World Bank’s International Finance Corporation, Indonesia’s “MSME financing gap is estimated to be US$234 billion”.

Change text size

Gift Premium Articles

to Anyone

M

icro, small and medium enterprises (MSMEs) play a bigger role in the overall economy in Indonesia than they do in any other ASEAN country, according to the International Monetary Fund (IMF), as they account for around 60 percent of GDP and 97 percent of nationwide employment.

Yet they received only 19 percent of bank loans issued in the country last year.

The implications of this can hardly be overstated. According to a 2023 report by the World Bank’s International Finance Corporation, Indonesia’s “MSME financing gap is estimated to be US$234 billion”.

Those figures speak for themselves, yet they fail to capture just how much business potential goes to waste and how much further along we could be in terms of economic and social development.

That is because of the tremendous multiplier effect bottom-up business activity generates, which extends beyond immediate economic output to things like human capital formation and strategic aspects, such as import substitution and supply chain resilience.

Indonesia is missing out on much of that because of business activity that is not happening as a result of a lack of funding.

Aware of the large number of people who make a living through small businesses, the government speaks incessantly about how it supports the sector.

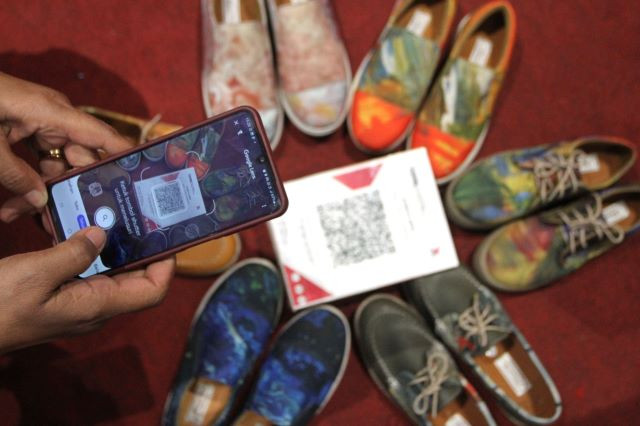

Ministries, the central bank and the Financial Services Authority (OJK) never tire of holding MSME workshops up and down the country on many topics, with particular fervor when it comes to financial literacy and digital inclusion.

Tech giants like GoTo and Grab are nudged to work with small business owners to drag them into the 21st century.

Furthermore, the government promises to protect MSMEs from foreign competition, such as by cracking down on imports of products allegedly dumped onto the local market.

Whether that is helpful is anyone’s guess. Competition is a driving force of betterment, a necessity for achieving excellence.

Rather than protect MSMEs by holding foreign competitors at bay, the government should ensure that local companies have what it takes to withstand the competition and even prevail.

The most important resource here is funding, because that can help entrepreneurs tackle any other challenge, be it a lack of human resources or know-how, failure to meet quality standards or insufficient scale to accept large orders.

However, there has been no improvement in credit disbursement. While MSMEs accounted for 19 percent of overall bank lending last year, it was 20 percent a decade earlier.

Of course, not every problem is solved by throwing money at it, but in the business world, no problem is solved without money. The wide MSME financing gap, according to the International Monetary Fund, has contributed to Indonesia’s low productivity and competitiveness.

Hard-pressed to get funds from banks, many entrepreneurs are looking elsewhere for credit, making them easy prey for loan sharks or even less reputable financiers. There are also peer-to-peer lenders vetted by the OJK, but they charge exorbitant interest rates to make up for the high risk or perceived risk of default.

To be clear, there is no straightforward answer to solving the issue of channeling affordable funds to MSMEs. Banks have every reason to be cautious about extending loans to businesspeople they know little about or who have no collateral to offer.

But without funding, few enterprises will emerge from the informal sector or reach the scale and level of professionalism needed to become more creditworthy. It all begins with money, or it does not begin at all.

Credit guarantees or subsidized loans, which the government is providing through the micro credit KUR program, are just a starting point in tackling the issue. Capacity-building through government-facilitated partnerships with big companies with the aim of strengthening vertical integration should be explored much more.

There are countless more avenues for this administration and the next to pursue. The government should leave no stone unturned to address this matter that lies at the very foundation of the national economy.