Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsThe dark side of Indonesia’s digital finance revolution

Digital finance has many proven benefits, but the rising trend in both online gambling and online lending have led many down the spiraling path into a vicious cycle of addiction and debt.

Change text size

Gift Premium Articles

to Anyone

T

he rise of digital finance in Indonesia has been nothing short of revolutionary. From bustling cities like Jakarta to remote villages, mobile phones and online financial tools have connected people to banking services that were once out of reach.

In a rapidly digitalizing society, these innovations have facilitated a cashless economy, significantly boosting economic transactions, particularly during the COVID-19 pandemic, when physical interaction was limited.

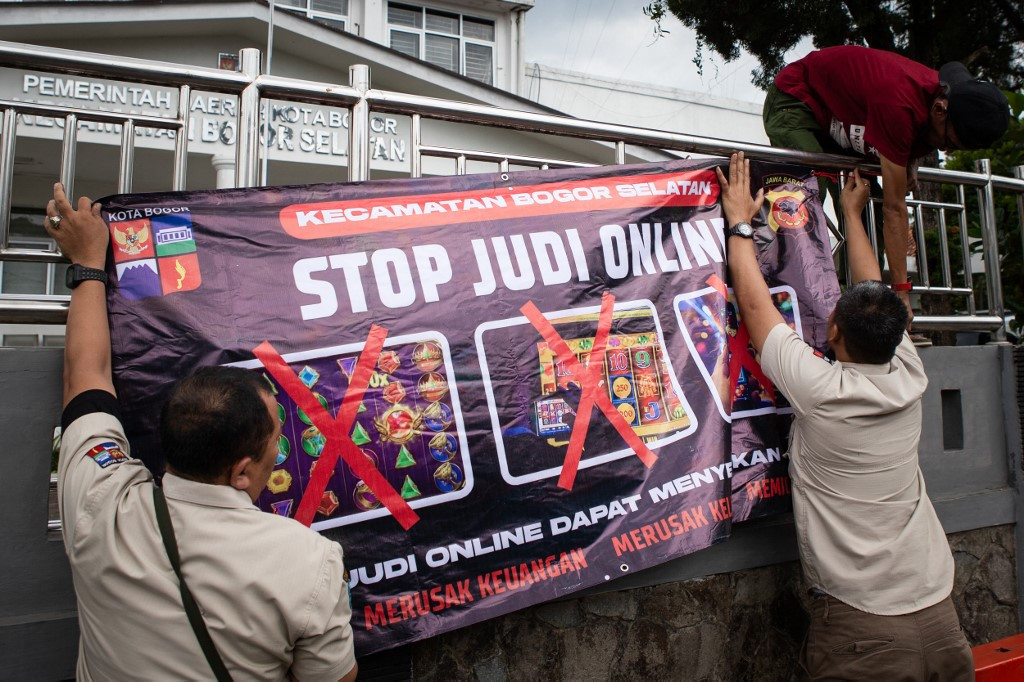

Yet as the saying goes, every rose has its thorn. While the bright side of digital finance has driven financial inclusion and economic growth, its dark side has given rise to financial vices, most notably online gambling and the proliferation of predatory online loans, locally known as pinjol.

I recall a moment at Palmerah Station in Central Jakarta, waiting for my on-demand motorcycle taxi to arrive. Nearby, I noticed a driver absorbed with his phone, not in his ride-hailing app but in a slot machine game on an online gambling platform.

For many Indonesians, this scene has become disturbingly familiar. It highlights a troubling trend: What was once a hidden activity has now become a visible and accessible part of everyday life.

Amid these challenges, it’s important to acknowledge the efforts of law enforcement, including the recent arrest of several officials at the Communications and Digital Ministry on suspicion of protecting online gambling networks. This crackdown offers a glimmer of hope, although it is tempered by the grim reality that those tasked with guarding against online gambling have instead enriched themselves from its profits.

The arrests highlight a deep-rooted problem within the country’s regulatory bodies, underscoring an urgent need for accountability to protect public trust and ensure that officials serve the public interest, rather than exploit the people.