Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

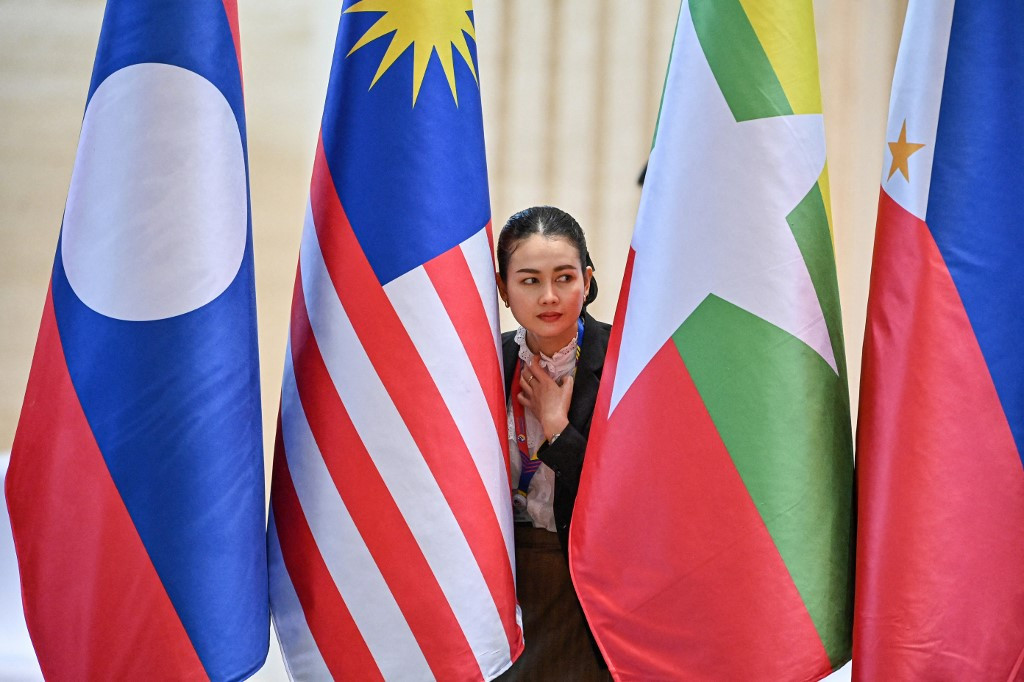

View all search resultsASEAN in the global economy: A half-century journey

As Southeast Asia gains prominence in the global economic landscape, recent developments underscore its growing influence.

Change text size

Gift Premium Articles

to Anyone

A

s Southeast Asia gains prominence in the global economic landscape, recent developments underscore its growing influence. By August 2024, Indonesia and Thailand expressed interest in joining the Organisation for Economic Co-operation and Development (OECD). Two months later, ASEAN members Malaysia, Indonesia, Thailand and Vietnam became partner countries of BRICS. These moves raise crucial questions about ASEAN’s economic evolution, its current role in the global economy and its future trajectory.

The transformation of ASEAN since its formation in 1967 has been remarkable. From a modest combined economy valued at US$24 billion, ASEAN has emerged as the world’s fourth-largest economic bloc by 2024, with an estimated gross domestic product of US$4.13 trillion, trailing only the United States ($28 trillion), China ($18.5 trillion) and Germany ( $4.5 trillion).

This rise reflects broader shifts in global economic governance. The dominance of developed nations, particularly the G7, began to wane in the early 1970s as emerging economies gained prominence. These rising powers have steadily increased their share across four key metrics: output, trade, value-added manufacturing and foreign direct investment (FDI). Among these emergent forces are China, India, South Korea and the nations of Southeast Asia.

ASEAN has methodically established itself as an indispensable partner for the world’s major economies. By 2023, it accounted for 8 percent of global trade, 5 percent of global value-added manufacturing and attracted 17 percent of global FDI. The bloc has become China’s primary trading partner, Japan’s second largest, South Korea’s third largest and the fourth largest partner for the United States.

This economic transformation stems not from developed countries' growth rates but from the rapid rise of emerging economies like China, India and South Korea. Development has been driven by structural transformation in industries, technology and human capital, alongside improved infrastructure and institutions that reduce transaction costs. Governments in these economies have successfully converted 'latent' advantages into strengths, capitalizing on latecomer advantages in industrialization and technology.

However, ASEAN faces two significant structural challenges. First, despite domestic consumption driving 55 percent of ASEAN’s economy and the region’s trade-to-GDP ratio growing from 61 percent in 2000 to 87 percent in 2023, the bloc remains heavily dependent on natural resources. The region’s value-added manufacturing to GDP ratio has declined since 2000, averaging just 20 percent in 2023. Moreover, 30 percent of ASEAN’s exports remain resource-intensive, with the remainder primarily in labor-intensive sectors. Only Singapore, Malaysia and Vietnam have successfully transitioned their exports to higher value-added exports.

Second, ASEAN grapples with a persistent "missing middle" in its medium-sized enterprise landscape. Between 97.2 percent and 99.9 percent of the region's approximately 70 million firms are micro and small enterprises (MSMEs), a pattern that has remained largely unchanged since 2010. While these enterprises contribute significantly to employment (85 percent), GDP (44.8 percent) and exports (18 percent), the scarcity of medium businesses hampers innovation, productivity and middle-class job creation. The ADB’s 2021 regional micro, small and medium enterprise (MSME) surveys show that the proportion of employment by MSMEs has declined over the past decade in five of the region's largest countries, even as the number of MSMEs has increased. This trend underscores the low productivity of MSMEs.