Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsWill planned merger revive Indonesia’s sharia banking?

Given this premise, the merger is expected to revive the performance of the sharia banking segment, which has been performing poorly relative to its conventional counterpart over the past two decades.

Change text size

Gift Premium Articles

to Anyone

T

hree state-owned sharia banks in Indonesia, PT Bank BRI Syariah Tbk, PT Bank BNI Syariah, and PT Bank Syariah Mandiri, recently signed a Conditional Merger Agreement to create a US$14.5 billion entity. The merger is expected to be completed by February 2021 and will account for just under half of Indonesia’s sharia banking industry and become the seventh-biggest bank in the country.

The merger is in line with the vision of the country’s Financial Services Authority (OJK) to consolidate the country’s banking sector and to promote sharia banks. In the recent years, the OJK has been trying to reduce the number of banks in the country, such as the integration of HSBC’s Indonesian unit with Bank Ekonomi Raharja and the merger between SMBC and Bank Tabungan Pensiunan Nasional.

The consolidation of the banking sector, including the merger of these sharia banks, is expected to improve efficiency through economies of scale and promote fair competition through the elimination of segmentation in the banking sector.

Given this premise, the merger is expected to revive the performance of the sharia banking segment, which has been performing poorly relative to its conventional counterpart over the past two decades.

The attempt to promote sharia banking in Indonesia dates back to 2002, when Bank Indonesia, which was the banking authority at the time, initiated the Blueprint of Islamic Banking in Indonesia. This ambitious initiative aimed at making the sharia banking industry the leading Islamic bank in Southeast Asia by 2010. This grand strategy also aimed at spurring double-digit assets growth in the sector and making it account for 10 percent of the total banking sector’s assets by 2010. The enactment of Law No. 21/2008 in July 2008 also provided legal justification to promote the development of sharia banking in the country.

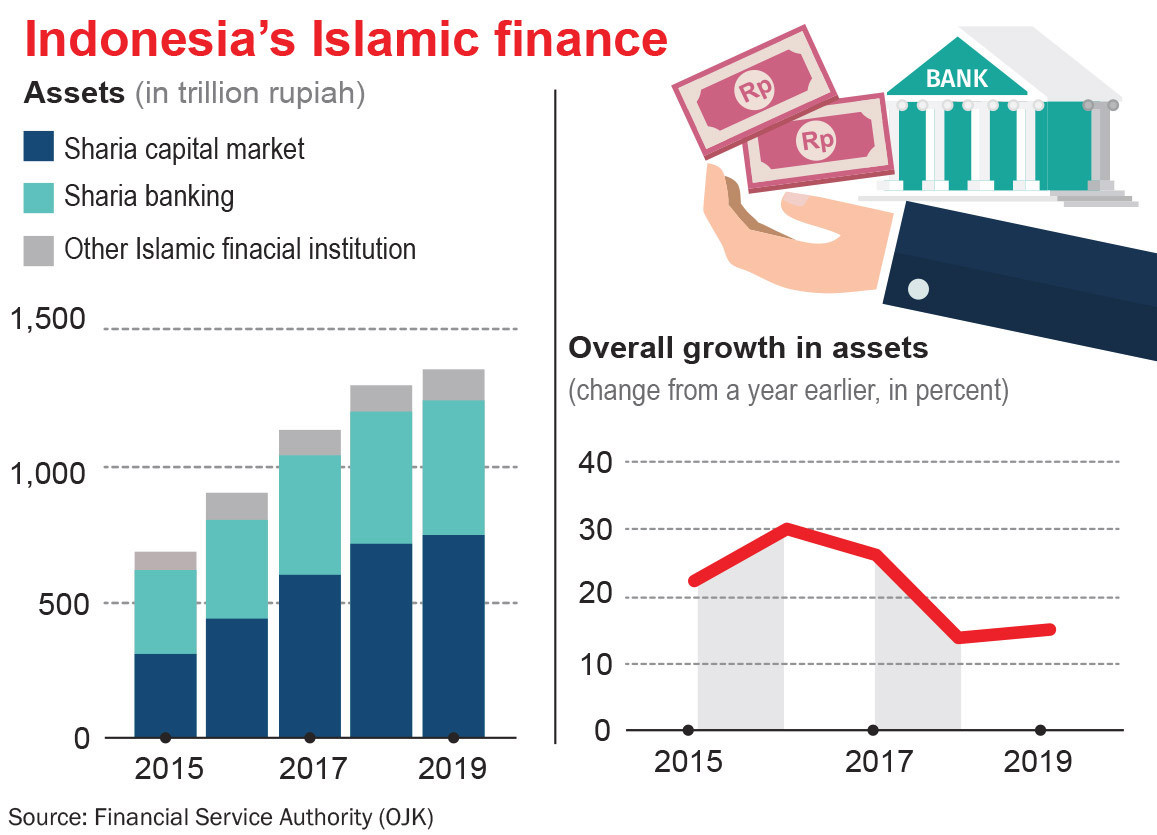

Fast-forward two decades later, however, sharia banks have not met many of these expectations. According to the latest statistics released by the OJK in July, sharia banks’ total assets were still below 10 percent of the banking sector’s total assets. This figure is much lower than Malaysia’s of above 20 percent.

In terms of performance, sharia banks also perform relatively poorly. Their capital adequacy ratio (CAR) stood at 20.9 percent in July (conventional banks at 23 percent), return on assets (ROA) at 1.4 percent (conventional banks 1.9 percent) and nonperforming financing (NPF) ratio at 3.3 percent (conventional banks 3.2 percent).

These statistics show that sharia banks perform worse in all fronts relative to their conventional counterparts, reflecting a structural problem plaguing the sector. The profitability of sharia banks, which already suffer from low efficiency (sharia banks’ operating efficiency is also below that of conventional banks), is eroded further by high nonperforming assets, thanks to poor risk management that forces banks to generate more provisions. Low profitability leads to lower capital increment that eventually hampers the increase in capital adequacy ratio.

In the recent months, the performance of sharia banks has been relatively better, as reflected by higher credit growth and the slowly declining nonperforming financing ratio. But this short-term improvement does not guarantee long-term growth. The merger may become one of the possible solutions to solving the structural issue plaguing Indonesian sharia banks. However, the merger alone is still not sufficient. Through the merger, the abovementioned banks may actually increase their efficiency and competitiveness but may not improve the overall performance of the sharia banking industry.

Regulators still have to promote risk culture in the industry. The enforcement of Basel III-equivalent rules will definitely help, particularly with regard to improving market, credit and operational risks.

Internally, sharia banks also need to introduce integrated risk management, credit risk specialization, better data reporting and IT integration to improve their efficiency and risk management. After that, sharia banks finally need to create innovative products that can meet the recently growing demand for and interests in sharia products, which will eventually give them competitive advantages to compete with conventional banks.

Sharia banking is not beyond help. As a matter of fact, it has great potential to be unleashed, which can help the development and deepening of the financial system in Indonesia. Growing income, which leads to higher savings, is one of them. More importantly, however, the rising awareness of sharia financing can give sharia banks a niche market and competitive advantage.

I believe that the merger, if accompanied with better company risk culture and more conducive Islamic finance regulations, will be able to fully unleash this potential.

***

The writer is a doctoral researcher at the University of Birmingham, United Kingdom. The views expressed are his own.