Climate transitional finance taxonomy: Lessons from GFMA

It not only laid out the undisputed nature of the science behind man-made climate change but also revealed that we had underestimated the pace and scale of that change.

Change text size

Gift Premium Articles

to Anyone

T

he accelerating impact of climate change was illustrated in stark terms in the recent Sixth Assessment Report by the Intergovernmental Panel on Climate Change (IPCC). It not only laid out the undisputed nature of the science behind man-made climate change but also revealed that we had underestimated the pace and scale of that change. These findings highlight the need for substantial shifts in financial market structures and taxonomies to rapidly scale climate investments and achieve low-carbon targets.

The Global Guiding Principles for Developing Climate Finance Taxonomies report by Boston Consulting Group (BCG) in partnership with the Global Financial Markets Association (GFMA) aims to present actionable principles to unlock green investment pathways.

There needs to be a substantial shift in market structures for climate finance if we are to mitigate the worst impact of climate change and meet the required US$3 to 5 trillion total annual investment required to both decarbonize the global economy and invest in adaptation and resilience to a changed world.

Accelerating shifts in financial systems

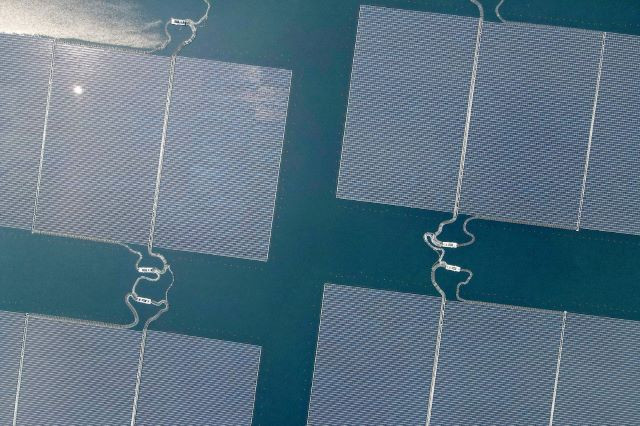

There is a need to refocus our efforts to expand transition finance, including “green” equity targeted at supporting low-emissions projects. The financial markets will play a fundamental role in driving this transition, with equity contributing 35 percent of the funding needed to meet the Paris Agreement’s stated 2 degree Celsius maximum, alongside 44 percent from loans and 21 percent from bonds.

Our shared climate crisis has been a growing focal point of major geopolitical events, such as the G20 and G7 in recent years, and will take center stage at the 2021 UN Climate Change Conference (COP26) in October.

The BCG-GFMA report highlights the need to encourage a fundamental transformation in financial markets, with growth required at an unprecedented scale, speed and geographic scope to meet the investment needs of our transition to a low-carbon economy. This is essential if we are to mitigate the worst impacts of climate change while unlocking benefits to economic growth and ensuring the viability of communities around the world.

Meeting these goals will require commitment by all market participants and will necessitate the development of consistent, comparable and reliable taxonomies that encourage positive climate investment and enable rapid mobilization of climate finance.

This shared consensus will be critical if we are to prevent cases of so-called “green washing”, with equity finance growing to play an increasingly important role in nurturing businesses along a green transition pathway.

In order to address the critical need for effective global climate finance taxonomies, the report defines five crucial global principles to steer the transition.

First, climate finance taxonomies should be broadened beyond the use of proceed structures (e.g. green bonds) to capture entity-level activities and all eligible sources of capital. Second, climate finance taxonomies should be objective in nature, supported by clearly defined metrics and thresholds aligned with the Paris Agreement and science-based targets. Third, these taxonomies should have a consistent set of principles and definitions but provide flexibility for regional and temporal variation to align with differences in transition pathways. Fourth, climate finance metrics should be defined and applied to sectors using science-based targets, balancing ease of use with transparency and robustness to both assess climate impact and support third-party verification. Fifth, climate finance taxonomies should be based on a governance process that is robust, inclusive and transparent and has the flexibility for continued evolution.

Defining the right strategies for Asia and ASEAN

Developing effective climate finance taxonomies will require regional and sector-specific, science-based transition (SBT) strategies that clearly outline the expected pathway, interim targets and ultimate destination.

Asia will be a pivotal region in ensuring an effective transition, accounting for around half of the world’s current annual carbon emissions. Of the US$100 trillion to $150 trillion climate-aligned financing required, $66 trillion needs to be invested in Asia alone. Defining the right taxonomy within this economically diverse region will require a localized approach.

The need for a nuanced local approach is also clear in ASEAN. Nevertheless, a global consensus on these five key imperatives, alongside an SBT approach to define local thresholds and inform transition efforts with evidence, will be a unifying feature underpinning efforts.

Collaboration, coordination, consistency and interoperability will be vital in Asia. Collaboration and coordination efforts within the region will require the development of taxonomies that account for both internationally agreed upon climate goals as well as a diverse range of ASEAN climate targets.

ASEAN’s financial sector is strategically positioned to accelerate changes in environmental action. The top 20 Indonesian, Singaporean and Malaysian banks alone accounted for 37 percent of total global lending to the region’s Financial Reporting Council (FRC) sector between 2011 and 2018.

Many regional banks have made clear commitments to sustainable finance and investing. There is a strong push for defining internal frameworks to incorporate climate transition risks in critical lending and monitoring activities. This is forcing a change to the internal risk taxonomy and risk inventory, allowing decision makers to understand where they are exposed to climate risk and link actions to appropriate mitigation.

Within Indonesia, scaling up climate finance is a priority, given the national commitments to renewable energy. However, investors face several challenges, not limited to enhancing cash flow understanding, decreasing the risk of projects by better valuation of provided collateral, matching tenures of lending against project timelines and creating alignment between various banks to allow for syndicated lending. This has further accentuated the need for better guiding principles on streamlining taxonomy.

Development banks will also play a major role in many Asian and ASEAN nations, motivating the mobilization of private sector capital through blended public and private solutions. These institutions will also play an important role in coordinating and developing effective sector- and region-specific taxonomies.

There is no silver bullet to deliver a unified and uniform global taxonomy that drives positive climate financing transitions. What we should recognize, however, are the common features and evidence-based measures that can be leveraged to drive this transformation.

--

Boston Consulting Group is the Consultancy Partner for the 2021 UN Climate Conference.

Dave Sivaprasad, Managing Director & Partner, SEA Leader for Climate & Sustainability, Boston Consulting Group Tushar Agarwal, Managing Director & Partner, Boston Consulting Group