Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOil price rise to impact plastic industry: Association

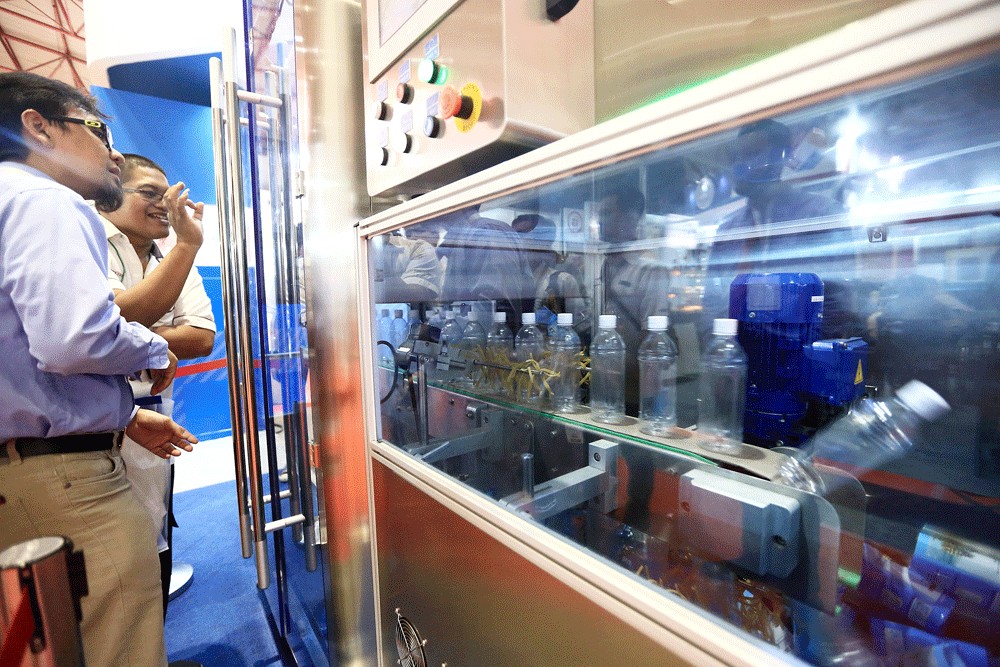

Plastic raw material prices have increased in the past few months as oil prices have spiked.

Change text size

Gift Premium Articles

to Anyone

I

ndonesian Olefin, Aromatic and Plastic Industry Association (Inaplas) secretary-general Fajar Budiono says the soaring global oil price is hurting domestic businesses through higher production costs.

“The [Ukraine] conflict has driven up oil prices, causing raw material prices to go up [sooner than usual],” he told The Jakarta Post on Friday, explaining that, “raw material prices usually start increasing in April after factories overhaul [their equipment], but instead, they have begun to hike now.”

Fajar predicted that the polymer price would increase by US$200 to $350 per ton from its current price of $1,450 per ton if world oil prices continued to stay above $100 per barrel. The polymer price stood at $1,250 per ton in January, Fajar said.

Polymer is one of the key raw materials for the manufacture of plastic, and raw materials account for approximately 80 percent of plastic production costs, according to Fajar, while the remaining 20 percent comes from utility costs, including electricity, and labor costs.

Read also: Pertamina ups LPG price, mulls raising gasoline price

In addition to the higher raw material costs, possible upward adjustment of fuel or electricity prices as a result of the rising fossil fuel prices could also increase production and distribution costs for processing industries like the plastic industry, Fajar said.

Fuel oil accounts for more than 60 percent of product distribution costs in the industry, while raw materials are the largest cost factor for production, followed by electricity.

Nevertheless, Fajar said he expected 4.5 to 5 percent growth in the domestic plastic industry this year as the food and beverage industry was recovering from the pandemic.

The plastic packaging industry is benefiting from delivery services, a market that has grown rapidly as consumers shop from home to reduce the risk of catching COVID-19. Booming food and beverage delivery services are making up for losses plastic packaging manufacturers have sustained as a result of reduced plastic bag usage in supermarkets.

Read also: Plastic industry gains from food deliveries, e-commerce, but long-term risks remain

“[Inaplas] is optimistic [that the domestic plastic industry] can achieve this, as long as production remains undisrupted,” he said.

As of 2017, Indonesia had 925 companies producing various plastic products, employing roughly 37,000 workers and producing approximately 4.68 million tons of plastic products combined, Industry Ministry data show.

Indonesian Chamber of Commerce and Industry (Kadin) deputy chairman for upstream and petrochemical industries Achmad Widjaja said what was happening at the global level was expected to affect the domestic market, given Indonesia’s dependence on imported plastic.

“If [the Russia-Ukraine war] continues until mid-year, the effect on goods prices would be significant,” Achmad said on Monday, as reported by CNBC Indonesia.

Oil price benchmarks have risen drastically lately as a result of severe sanctions imposed on Russia, a key exporter, sowing confusion and panic among global crude oil traders, shipping firms and importers.

Brent climbed 9.9 percent to $129.78 a barrel on Sunday, while US West Texas Intermediate (WTI) crude was up 9.4 percent to $126.51. Both are at more than seven-year highs.

The increase in oil prices would also impact other sectors, including transportation, which relied on nonsubsidized fuel, Energy and Mineral Resources Ministry spokesman Agung Pribadi said in a statement on Feb. 26.

Elevated oil prices are also expected to result in significant earnings losses for state-owned oil and gas company Pertamina’s downstream segment due to the public-service obligation to distribute fuel at government-designated prices, according to international rating agency S&P Global Ratings.

Downstream losses at the company are forecast to exceed $4 billion and offset any gradual gains from Pertamina’s upstream exploration and production operations amid higher oil prices, the agency estimates.