Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsOpportunities in new cost-difference provisions for JKN participants

Despite the opportunities, there are several challenges that arise.

Change text size

Gift Premium Articles

to Anyone

T

he government has issued a new regulation regarding the provision of cost difference for participants of the National Health Insurance (JKN) program. The regulation is contained in article 48 of the Health Minister Regulation (Permenkes) No. 3 of 2023, which was promulgated on Jan. 9.

This regulation was welcomed by various healthcare industry players, especially private insurance companies and hospitals as healthcare facility providers. The provision of cost-sharing through the new Coordination of Benefit (CoB) scheme will provide greater opportunities for supplementary healthcare insurance providers (private insurance) to play a greater role in providing access to public health services.

For hospitals, the new CoB scheme allows them to obtain better payment and profitability compared with the previous scheme due to the restriction of class increases and a cap on the Indonesia Case-Based Groups (INA CBG) rate. Meanwhile, JKN participants, especially the middle and upper segments (class 2 and 1 membership), can better utilize the JKN program according to their needs for better facilities and convenience.

However, despite these opportunities, there are several challenges that arise, such as a lack of technical regulation for the implementation, the possible need to adjust the terms of insurance policies, which currently vary according to the product, and if they are to cover the difference in costs for JKN participants and so on.

The CoB scheme allows users to combine the JKN with out-of-pocket (self-pay) payments or payments from employers and/or private insurance companies to access better medical services than the initial entitlement obtained according to the class of membership in JKN.

There are several changes in the provisions of the cost difference in the latest CoB scheme according to Permenkes No. 3 of 2023 compared with the previous scheme in Permenkes No. 51 of 2018.

First, the new regulation allows upgrades of more than one tier class above a JKN user’s membership class entitlement. Formerly, users were only allowed to upgrade one tier class above their membership class entitlement. In the case of JKN participants upgrading from class 2 to a class above class 1 (more than one tier class), the difference in costs paid is the difference in INA-CBG rates between class 1 and class 2 plus a maximum of 75 percent of the INA-CBG rate for class 1.

Second, it prohibits all class 3 JKN members to use the CoB scheme. Under the old CoB scheme, JKN class 3 participants could still upgrade their class for inpatient care.

Third, in case that the difference in cost is paid by the employer or additional health insurance, the provisions for the difference in costs shall be paid in accordance with the agreement/negotiation between the employer or additional health insurance provider and the hospital. Previously, the difference paid by the employer or private insurance used the same scheme as self-pay CoB.

Fourth, for information disclosure, hospitals are required to issue bills for the services of JKN participants who were upgraded class in the form of one bill that is not separate, while previous CoB practices still allowed for split bills.

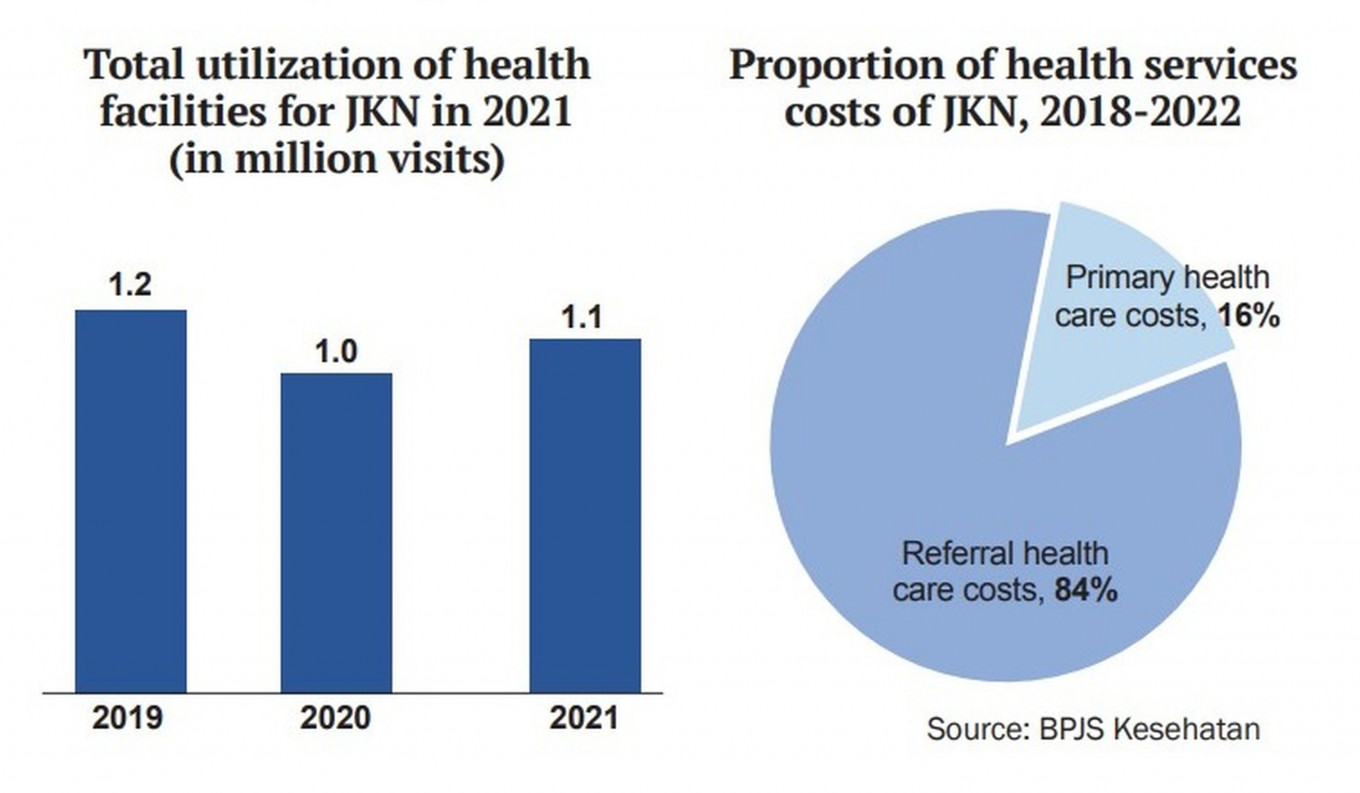

We see that the new CoB scheme can increase the involvement and role of the private sector (employers and private insurance firms) in creating a more comprehensive and better healthcare ecosystem. The new CoB scheme also provides greater opportunities for the private sector to take advantage of the JKN program’s huge potential "share of the pie" while also contributing to public health financing. Thus, this will also have a positive impact on the sustainability of the JKN program and BPJS Kesehatan's finances.

In addition, it is expected to abolish the opinion that BPJS Kesehatan is only for the low-class community, so it is hoped that service discrimination for JKN patients will no longer occur.

However, we realize there are a number of challenges in the implementation of this policy. This is because there is not yet available a technical regulation derived from Permenkes No. 3 of 2023 that regulates the CoB mechanism and cost difference in clear detail. Health Minister Regulation No. 51 of 2018 on the imposition of urun biaya (collective payment) and cost differences in the JKN program, insofar as it regulates provisions regarding cost differences, has been revoked and declared invalid.

Moreover, it is necessary to think about efforts so that private insurance companies are interested in participating in this new CoB scheme, for example by simplifying JKN patient procedures that have been considered complicated, such as referral procedures.

Some other pain points are related to the provision of varied health policies that regulate, among other aspects, waiting periods, pre-existing conditions, disclosure, exclusions, prorates, deductibles and so on. In this case, private insurance companies need to consider and adjust these things to cover the difference. Furthermore, operational processes, including the adequacy of detailed information contained in E-claims to be used for payment of insurance benefits is also a concern.

We think that there are several actions that are urgently required to support the implementation of the cost-difference provisions with the new CoB scheme.

First, familiarization of the new CoB policy to all related parties (JKN patients, private insurance companies and their customers, employers and hospitals) so that they have the same perception for its implementation.

Second, the government should immediately establish technical regulations derivative of Permenkes No. 3 of 2023 in detail by involving related parties that can predict and accommodate obstacles that may arise in practice, such as the potential constraints of different insurance policy terms as previously discussed and the need for the E-claim application to be applied properly for the cost-difference payment process.

Third, the potential for developing new insurance products (CoB JKN) with lower premiums because they are intended to cover the difference in costs. Last but not least, the government needs to attract the participation of employers and private insurance companies in financing the difference in costs of JKN participants with the new CoB scheme.

In sum, we hope that the new CoB scheme can be implemented properly soon and provide a win-win solution for all parties in the healthcare ecosystem, becoming a breakthrough for the development of healthcare services in Indonesia.

-- The writer is a senior industry analyst at Bank Mandiri.