Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsWith the banks’ growing role, is P2P still peer-to-peer?

Industry insiders say the increasing role of institutions marks a natural progression for peer-to-peer (P2P) lending, but analysts point to possible liquidity risks.

Change text size

Gift Premium Articles

to Anyone

O

ver the past two years, retail investors' position in peer-to-peer (P2P) lending platforms in Indonesia has been sidelined by that of banks. Some industry players argue that is the natural next step as fintech firms cannot solely depend on individual lenders after reaching a certain scale.

However, analysts have expressed concern that the trend could detract P2P lenders from their initial mission to actualize financial inclusion in the country.

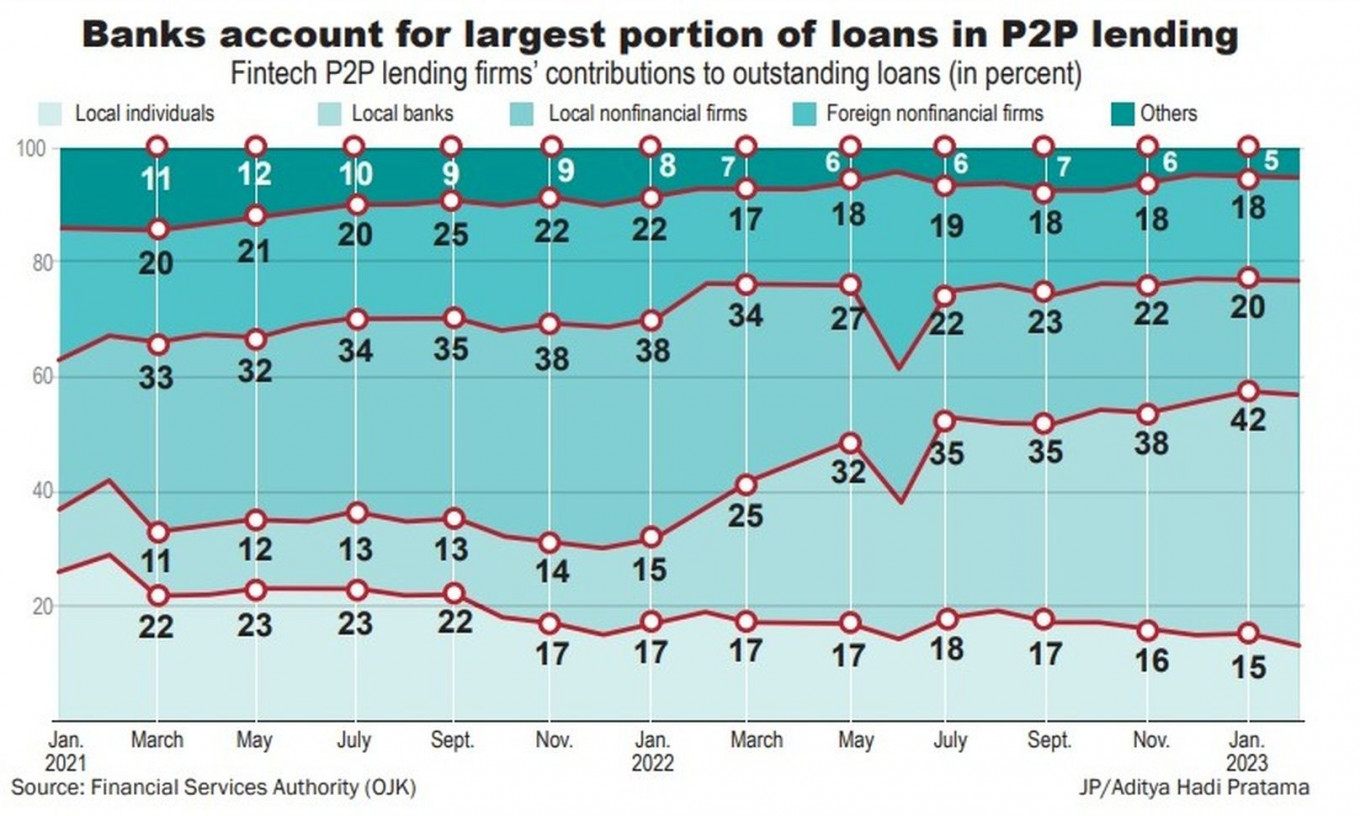

According to data from the Financial Services Authority (OJK), retail investors were still one of the biggest sources of funds for P2P lending platforms in January 2021, accounting for around 26 percent of total loans facilitated by P2P lenders in Indonesia, on par with local and foreign nonfinancial institutions.

As of February this year, however, the individual investors’ share of P2P lenders’ loans has diminished to 13 percent. Local banks, meanwhile, have become the top source of P2P loans as their contribution rose from less than 11 percent to almost 44 percent.

The contribution of other types of investors dropped from around 64 percent to 43 percent.

Bhima Yudhistira, director of Center of Economic and Law Studies (Celios), said there were several causes behind this trend, such as an “overflow” of third-party funds at banks and their efforts to channel loans to segments that are usually out of their reach or too costly to serve.

“On top of that, fintech players offer unbeatable interest. Yes, there is a risk of high non-performing loans (NPLs), but that can be offset by the huge interest," Bhima told The Jakarta Post on Tuesday.

Furthermore, the banks’ eagerness to collaborate with P2P lenders could also be a strategy to make headway with their own digitization efforts and to internalize fintech platforms’ services, Bhima added.

According to Nailul Huda, who heads the center of innovation and digital economy at the Institute for Development of Economics and Finance (Indef), the rise in interest rates in government-backed bonds may also play a part in this trend.

"With less risk, [individual] investors may opt for other investment instruments besides P2P lending [that offer competitive returns]," Nailul told the Post on Tuesday.

The trend raises questions about P2P platforms’ raison d'être.

Raising most of their funds from institutional investors rather than from individuals may violate P2P lenders’ initial mission for financial inclusion, Nailul opined.

Read also: Big banks sink teeth into P2P partnerships

The overall trend does not apply to each and every P2P lending platform in Indonesia.

Six-year-old crowdfunding platform Akseleran, for example, maintains that institutional investors only cover 45 percent of its outstanding loans, while the rest is dominated by retail investors. But the start-up admits that the contribution of non-retail investors has grown from only 10 percent in 2018.

"Most of [the institutional investors] are banks, as our cost of funds dropped to around 10 percent, making it difficult for multi-finance firms to become lenders," Akseleran cofounder and Group CEO Ivan Nikolas Tambunan said to the Post on Wednesday.

Ivan described the growing role of institutional investors, including banks, as a natural step in the evolution of P2P lending, arguing that the platforms could not solely rely on retail investors once they reached a certain scale.

"To facilitate [the issuance of] huge loans, we should partner with institutional lenders that can give us funds in wholesale," Ivan said.

According to Ivan, since the emergence of P2P lending firms in Indonesia, many players have been relying solely on institutional investors, especially those operating in the consumer loan segment. Meanwhile, players opening their services to individual lenders, such as Akseleran, were a minority.

"That's why the term "peer-to-peer" is not really accurate. I prefer to call it a marketplace lending platform," Ivan stated.

He also explained that institutional lenders, especially banks, could improve the quality of the industry, as they would expect fintech firms to demonstrate prudent risk management and credit assessment.

However, Ivan admitted that financial inclusion, the main purpose for the emergence of P2P lending, could only be achieved if retail investors still played a role in the industry.

"Financial inclusion is not only about giving loans to unbanked people, but also providing investment opportunities the general public had no access to before," Ivan said.

Retail contribution seen to drop further

According to Celios' Bhima, a huge contribution of banks to P2P lending could become a dependency risk for fintech firms. He suggested the platforms expand their sources of funds to a diversified range of lenders, especially smaller institutions.

He said he expected the contribution of retail investors to drop further but not end altogether.

Read also: Surge in P2P loan defaults could trigger 'natural selection': Analysts

Akseleran's Ivan also pointed out the importance of having a diversified range of funding sources, which is why he wants his platform to maintain the marketplace concept, including the existence of retail investors.

He added that the OJK had stipulated in Regulation No. 10/2022 that a single lender and its affiliates could not hold more than 25 percent of outstanding loans in any P2P platform, so as to prevent liquidity risks.

"Economic conditions have their ups and downs. In 2020, we saw many institutions worry and stop disbursing money for fintech firms. However, we are not really affected, as we still have our retail investors," Ivan explained, adding that he expected their share to remain unchanged this year.