Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsMedical tourism: Turning the tide for Indonesian patients

The economic value of this medical tourism is conservatively estimated at US$8-10 billion annually, for medical treatment alone.

Change text size

Gift Premium Articles

to Anyone

Indonesians are no stranger to traveling overseas to seek medical care. Every year, nearly 2 million Indonesian citizens travel overseas for medical purposes, with the vast majority visiting Southeast Asian neighbours, Singapore alone welcoming about 300,000.

The economic value of this medical tourism is conservatively estimated at US$8-10 billion annually, for medical treatment alone. For a country with $35 billion annual healthcare spend, this represents a colossal outflow. If allied services are added, including stay, travel, discretionary spending and loss of livelihood, the total costs are enormous. Turning the tide on this outflow will have major implications for Indonesia’s healthcare ecosystem.

The lure from neighboring healthcare destinations is gaining ground. Understanding the lucrative nature of medical tourism from Indonesia, Southeast Asian neighbors have been actively promoting their healthcare destinations to Indonesian citizens.

The government of Malaysia, under the aegis of MHTC (Malaysia Healthcare Travel Council) has been executing the Healthcare Travel Industry Blueprint with an aim to achieve $400 million healthcare travel revenue by 2025. It also recently mooted the Malaysia Flagship Medical Tourism Hospital Programme, with an aim to elevate the profile of select private hospitals in Malaysia on par with leading world-class medical destinations.

Thailand introduced new medical visa rules in January 2023, reducing the cost of application, allowing multiple entries per year, a maximum 90-day stay and allowing three accompanying family members. Singapore has been actively promoting its medical tourism industry under Singapore Medicine, a multi-agency government-industry partnership including Singapore Tourism Board, Economic Development Board (EDB) and Trade Ministry (MTI), led by the Health Ministry. Private hospitals in Singapore have also been partnering with hospitals in Indonesia to provide advanced care for patients when not available in their home country.

The winds of change are blowing

Recognizing the enormous opportunity cost of outbound medical tourism, Indonesia has begun taking steps to stem this outflow and redirect billions of dollars into the local healthcare sector.

The 41-hectare medical tourism Special Economic Zone (SEZ) in Sanur, Bali, aims at integrating the country's health and tourism sectors. The project involves the development of a new international hospital, the Bali International Hospital, in partnership with the Mayo Clinic, with a range of accommodation facilities consisting of premium resorts, hotels and care homes to accommodate up to 5,000 people. This SEZ is part of a strategy to recapture between 4 and 8 percent of Indonesian medical tourists seeking treatment abroad. Once fully functional it is expected to provide employment to nearly 40,000 workers.

Indonesia has also announced investments into 15 class A and class B hospitals in greater Jakarta; Bali; and Medan, Sumatra, as medical tourism pilots, as well as other investments across the four pillars of health-tourism development: medical, wellness, sports event-based health and MICE-based (meetings, incentives, conferences and exhibitions) scientific health tourism.

However, these plans are still at an early stage and a lot remains to be done.

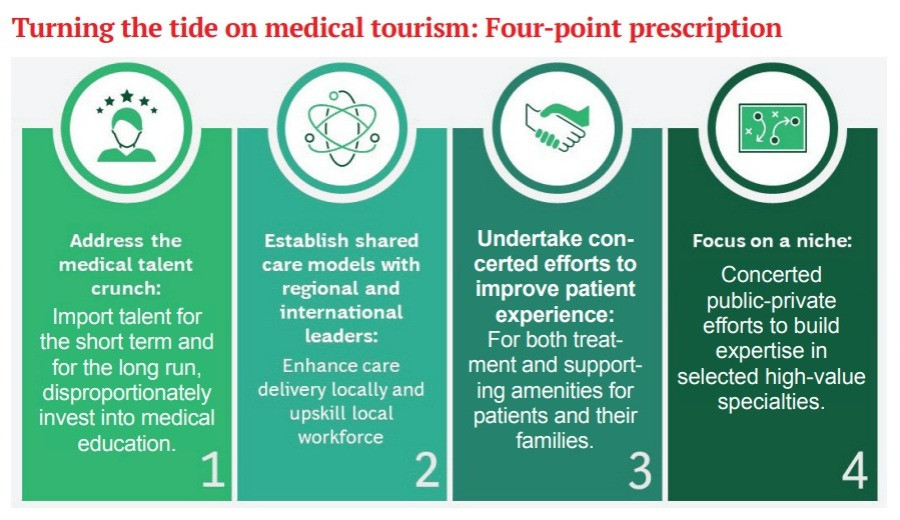

Turning the tide on medical tourism: Four-point prescription

First, address the medical talent crunch: At the heart of patient outflow from Indonesia is the lack of care quality, with limited availability and expertise of medical doctors. Addressing this challenge requires investment and patience, but it is imperative a start be made now.

In the short term, this would require importing medical talent. The recent legislative intent by government to permit foreign doctors to practice in Indonesia is a welcome step. In addition, establishing a Returning Expert Program (like in Malaysia) with appropriate incentives and academic accreditations, could also serve as a pathway for talented Indonesian “diaspora doctors” to return. Understandably, blanket, nation-wide implementation of “talent import” could be challenging, but a “sandbox” fashioned rollout for specific hospitals or SEZs could be a practical path.

In the long-term, Indonesia will need to disproportionately invest into medical education, by setting up educational institutions and programs and partnering with foreign medical institutions to train local doctors. India offers valuable lessons, where large investments into medical education, through a mix of private and public efforts, have boosted the supply of talent. Undeniably, the journey to quality of medical talent in India is still underway, but is expected to follow suit as the ecosystem matures.

Second, establish shared-care models with regional and international leaders: Being the fourth-most populous country in the world, many regional and international hospital networks view Indonesia as an attractive destination. This provides local hospitals with an opportunity to partner with world-class centers to deliver shared care to Indonesian patients. This “win-win” model would allow international hospital networks access to Indonesian patients, provide local hospitals the necessary knowledge and upskilling opportunities to deliver quality care and offer patients an opportunity to get treated in the comfort of their home country. This would require local hospitals to build mechanisms for international referral support including booking, accommodation, flights and medical communication, potentially through satellite clinics. It would also imply heavily utilizing digital technology to support remote diagnosis, patient monitoring, clinician-patient interaction and broader delivery of care.

Third, undertake concerted effort to improve patient experience: Retaining outbound tourists requires local hospitals to also provide supporting amenities tailored to the needs of international clients. Waiting time, lack of transparent communication, inferior quality of support services and rude behavior are familiar challenges repeated by locals, which do not require sophisticated medical knowledge to address. Strong hospital operations and inculcating customer-service mindset can help resolve these challenges.

It might also be valuable to learn from leading medical destinations, which operate separate, luxury international wings. Bangkok’s Bumrungrad International Hospital, for example, has a dedicated department to help organize treatment schedules and support family, and operates two serviced apartment blocks for family accommodation.

Fourth, focus on a niche: The variety of clinical specialties for which Indonesians travel abroad is vast. A concerted, joint effort by the government and private sector, focusing on select high value specialties could yield rapid efforts. This would require the government to launch dedicated training and education programs for specific specialties, partner with other governments to upskill specific talent and allow foreign talent to practice in a “sandbox” framework. Private sector, in turn, would need to invest into building relevant centers of excellence and ensuring at-par patient experience.

As Southeast Asia’s largest economy, Indonesia’s health care sector potential is enormous. With its demographic advantage and rising affluence, Indonesia is both a source of huge medical tourism value, and a sleeping giant of healthcare provision ready to rise.

Efforts to address the talent shortage, forge credible international partnerships, improve patient experience and build a niche in the right medical services could provide a platform for remarkable growth that supercharges the nation’s healthcare ecosystem.

***

Anurag Agrawal is a partner and associate director, while Yishu Pi is a consultant at Boston Consulting Group.