Improving financial literacy in Indonesia

Change text size

Gift Premium Articles

to Anyone

R

amadan is a time of spending for most Indonesians, and people usually hold back their spending in the months before to allocate more for Idul Fitri. Retailers, from luxury fashion brands in malls to street food stalls, take this opportunity to get more business by providing discounts.

This trend is also amplified by the fact that digital payment provides options to delay actual payments from customers’ wallets. One such service is PayLater, which has received consumer attention in the last two years.

Likewise, online stores and e-commerce see this as an opportunity to boost revenue. By collaborating with e-wallet providers or other fintech lending companies, they offer easier loan processes for the PayLater application with no interest, flexible payment instalments, discounts and cash back.

Fintech lending users continued to increase in March, reaching 14.34 million accounts, up 7.13 percent month-to-month (mtm). The registration and disbursement of loans are simple, with no collateral requirements and no income demonstration requirements, which is a main factor in gaining users.

The Financial Services Authority (OJK) recorded that fintech lending, or peer-to-peer (P2P) lending, operators registered as of March reached 102 providers with total assets of Rp 6.38 trillion, an increase of 41 percent year-on-year (yoy) when compared to the same period in 2022. In addition, fintech lending has collaborated with 1,057 other financial services institutions for loan channeling.

Total outstanding loans as of March were Rp 51.02 trillion, an increase of 1.9 percent mtm and 36.5 percent yoy. The default rate under 90 days (TWP90) for P2P lending companies, which is an indicator of nonperforming loans (NPL) in fintech lending has increased annually and monthly.

In March 2023, TWP90 was 2.81 percent, while in 2022 it was 2.32 percent.

Looking at more details on the distribution of borrowers, more than 60 percent of fintech loans were distributed to customers within the 19- to 34-year-old age bracket. From those accounts, 86 percent can be categorized as performing loans and 3 percent are included as nonperforming loans.

From this information, we can conclude that most of the demand for fintech loans comes from Gen Z and Millennials. However, we know that students or other young people have yet to have a steady income. On the other side, they are relatively more inclined to consume. This may result in having lower balances in their savings accounts, or even none at all.

The younger generation want to follow trends and to look stylish. To do so, and without draining their saving account or cashflow by unintended or unplanned spending, they apply for PayLater.

By delaying payment, they can still take part in unplanned events or buy new clothing without emptying their wallets immediately.

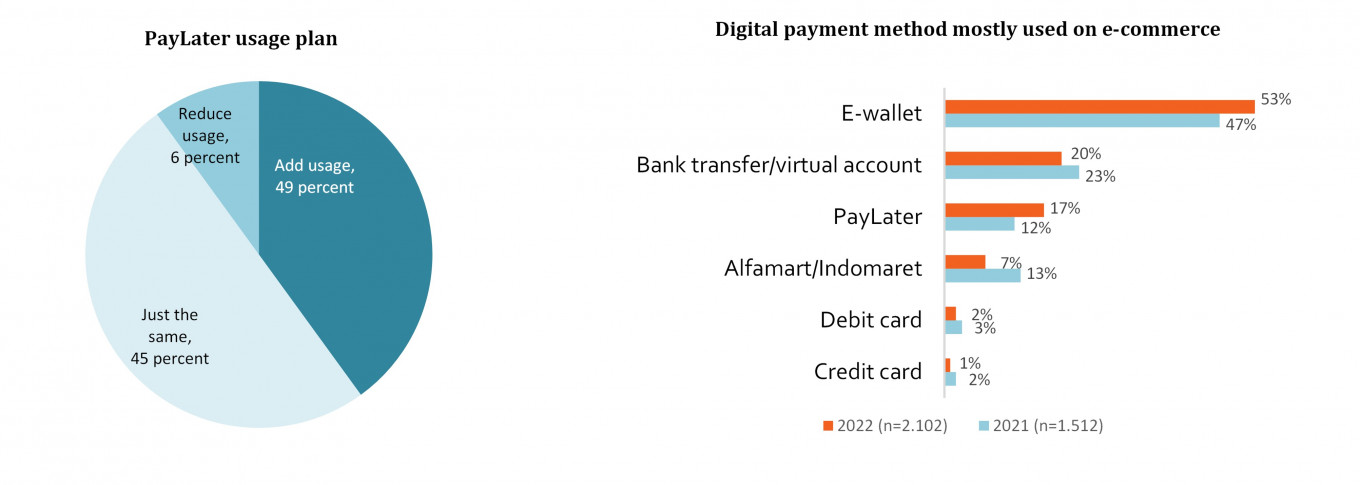

In a survey conducted by Kredivo and Katadata Insight in 2022, it can be seen that PayLater usage has increased in 2022 to 17 percent when compared to 2021, which was 12 percent. This is what provides a great opportunity for PayLater providers to offer alternative payment methods to consumers when making purchases online.

The PayLater feature offered by fintech players has been integrated into the e-commerce check-out process to facilitate the settlement of payment transactions, enabling consumers to make payment processes without the need to switch applications.

Still, in the same survey, it was said that 45 percent of respondents would still use PayLater as a payment alternative. The reasons most respondents still use PayLater are easy registration and payment flexibility.

Because the limit on PayLater is not as big as a credit card, a spending maximum can be set. However, we know that some PayLater users are actually people who are at high risk of default. This risk needs to be anticipated by setting up stricter screening criteria from the side of the lender and the loan recipient, according to the 2022 Kredivo e-commerce behavior report.

As a result of higher non-performing loans, the lender will enter into special surveillance because the TWP90 exceeds the minimum threshold. On the other side, the borrower will be blocked by Bank Indonesia (BI) from applying to other type of loans, such as car loans or mortgages.

No matter the nominal value of a loan, if you are late in paying, it will have a long-term impact.

It is a good idea to provide an age limit or a condition of parental approval if the borrower does not have a permanent job so that when they apply for a loan, they can be monitored.

This was done due to the low financial literacy of the borrowers, who are still very young, which has a long-term impact because they will be included in BI’s blacklist. Therefore, educating young people, especially Millennials and Gen Z, on how to improve their financial literacy is important.

***

The writer is an analyst at the Mandiri Institute.