Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBad loans, limited growth blight P2P lending business

P2P lending platforms want the OJK to massively increase the maximum ticket size for productive loans, which they hope will rekindle growth in the industry.

Change text size

Gift Premium Articles

to Anyone

I

ndonesia’s person-to-person (P2P) lending platforms have been struggling to make their business case in an industry that was brought under Financial Services Authority (OJK) supervision in 2016.

Some have posted alarming delinquency rates, defined as the ratio of loans that are at least 90 days past due (TWP90) to total loans and roughly equivalent to the nonperforming loan ratio in banking, and some are even facing legal threats from their lenders.

Those that have kept their bad loan ratios relatively low, on the other hand, have expanded to other financial sectors, such as digital banking and multifinance, to boost lending growth and hit profitability.

Earlier this week, P2P lending firm Akseleran announced the start of an initial public offering (IPO) process it hopes will raise Rp 359 billion. The company plans to use the fresh funds to acquire multifinance firm PT Pratama Interdana Finance.

"We’re doing it right now as we got the opportunity to acquire a multifinance company – simple as that. We have been looking for [an acquisition target] since last year, and we finally got a firm that is relatively clean," Akseleran CEO Ivan Nikolas Tambunan said at a press briefing on Monday.

That same day, the OJK said one more P2P lender would go public this year, but it declined to disclose the name of the firm or what the funds would be used for.

Akseleran's move reflects a trend of P2P players looking beyond their core business.

While Investree, Alami and Modalku have invested in conventional banks and turned them into digital lenders, KoinWorks has widened its business scope to focus on small and medium enterprises (SMEs).

"Internally, we have treated ourselves as a neo-banking player rather than a P2P lending firm, as P2P is a smaller part of our group," Modalku CEO Ronald Wijaya said in an interview with CNBC Indonesia on May 3.

Read also: P2P lending firm Akseleran aims to raise Rp 359b through IPO

According to Alvin Cahyadi, vice president of investment at local venture capital firm AC Ventures, P2P lending firms were expanding into other services largely to bring down their cost of funds (COF) so that they could eventually offer their borrowers lower interest rates.

"In general, P2P lending has a higher COF, as their borrowers are riskier than banks'. However, some of those borrowers have grown their businesses and are actually eligible for lower interest rates," Alvin told The Jakarta Post on Tuesday.

By providing banking services, for example, P2P lending firms could lower their COF by taking deposits from the general public, something that is prohibited by OJK rules if they operate as pure P2P lenders.

When asked whether the P2P lending model had become just a stepping stone for start-ups, Akseleran’s Ivan said that depended on a firm’s specific circumstances.

"For us, we just want to serve a bigger ticket size [loan amount per deal] and wider segment," Ivan explained, adding that current OJK regulations only allowed P2P players to disburse up to Rp 2 billion per loan.

In May, Ivan stated that industry players and the Indonesian Joint Funding Fintech Association (AFPI) had encouraged the regulator to increase the maximum ticket size for P2P loans to Rp 10 billion.

Bambang W. Budiawan, deputy commissioner for the supervision of financing institutions and other financial service providers at the OJK, said the agency was in the process of reviewing the regulation.

He noted that the current cap of Rp 2 billion was more than enough for consumptive loans.

“Meanwhile, is Rp 2 billion enough for a productive loan? I don't think so. Based on our observation, it could be between Rp 3 billion and Rp 5 billion, or even up to Rp 10 billion," Bambang said on May 16, as quoted by Bisnis.

However, the head of the OJK's department for the supervision of other financial service providers, Triyono, said on June 9 that no decision had been finalized on increasing the maximum loan value.

Read also: With the banks' growing role, is P2P still peer-to-peer?

Yorlin Ng, chief operating officer of venture outfit Momentum Works, said raising the loan ceiling would allow P2P players to expand their business to include less risky lenders.

"The challenge is that the larger ticket size can also be easily served by banks and other traditional credit institutions," Yorlin told the Post on Wednesday.

Another challenge for P2P lending firms, according to Yorlin, lies in the fact that they do not get much capital from investors, which was even the case for publicly-listed P2P lending platforms in China and the United States.

"Therefore, [venture-capital-funded] P2P lending players typically try to expand into other business models to increase their enterprise value," Yorlin said.

Grappling with bad loans

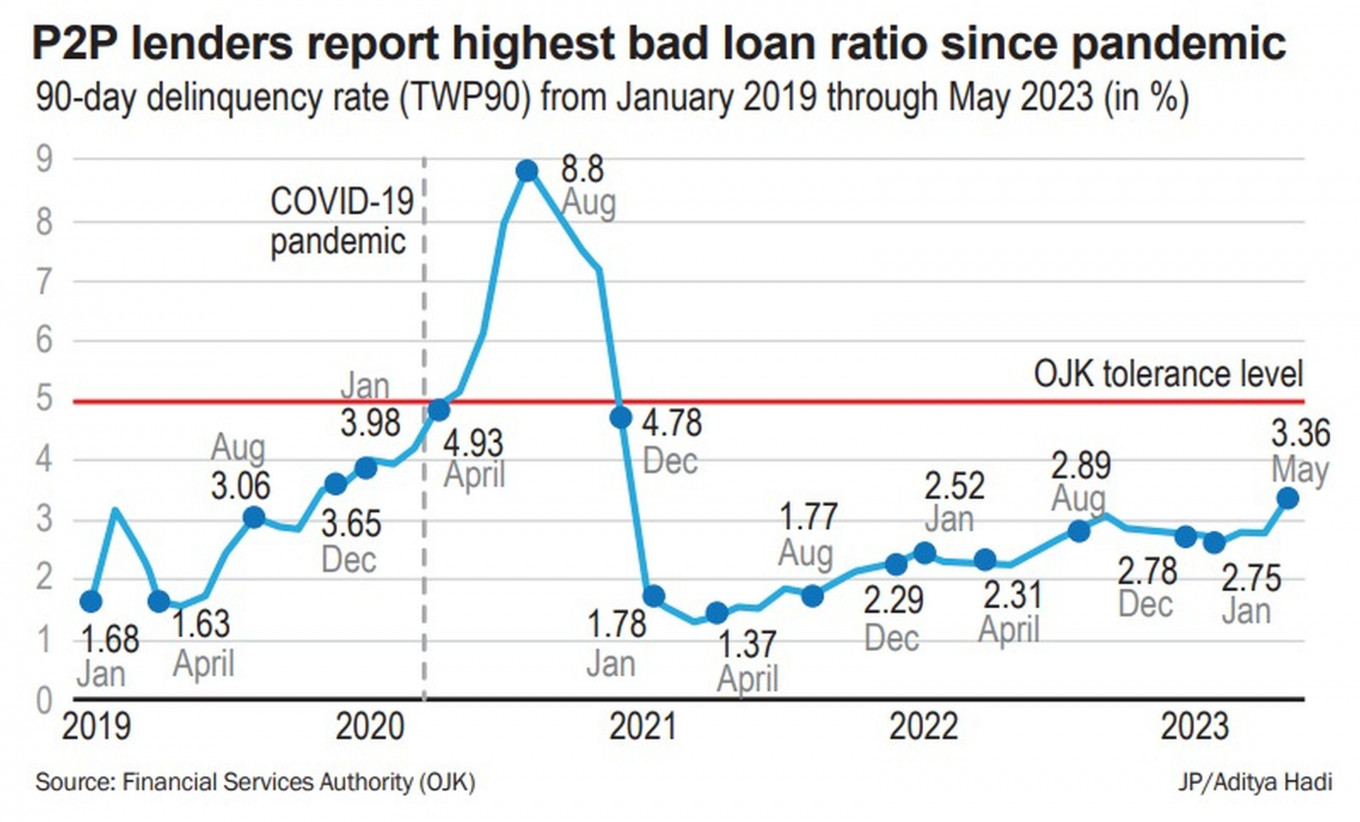

On Tuesday, the OJK announced that the TWP90 ratio in P2P lending hit 3.36 percent in May, which is the highest level since the COVID-19 outbreak.

According to the OJK, that number was "pretty good", as it was still below the tolerance level of 5 percent.

However, the metric varies widely between platforms. Some companies, such as Akseleran, Alami, Amartha and Investree, currently have TWP90 ratios below 5 percent, but others have exceeded that threshold, such as Modalku and KoinWorks, which posted 5.58 percent and 9 percent, respectively.

The bad loan ratios for Tanifund and Igrow hit 63 percent and 46 percent.

According to AC Ventures' Alvin, a rise in bad loans is normal amid uncertain macroeconomic conditions and happens in other financial sectors as well.

"However, P2P lending firms that have experience in risk management will be able to navigate the problem," he said.

Momentum Works' Yorlin said experience in other markets showed that credit scoring models in P2P lending differed a lot from banks. Thus, the path to profitability of those firms would depend on the talent and organizational capabilities of each company to do credit scoring and risk control in a scalable way.