Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsNew oil, gas incentives ‘one step forward, two steps back’

Change text size

Gift Premium Articles

to Anyone

O

il and gas players continue to butt heads with the government over the latter’s proposed incentives to boost exploration and production activities.

The Indonesian Petroleum Assocation (IPA) has expressed its disappointment over the proposed incentives, which will be included in an upcoming revision to the 2010 Government Regulation (PP) No. 79 on cost recovery and tax treatments for the upstream oil and gas industry.

Speaking to reporters on Friday, IPA executive director Marjolijn Wajong was reluctant to detail the association’s complaints but insisted that the incentives would not whet investors’ appetite for Indonesia’s struggling oil and gas sector.

“There are several changes that won’t lead us forward, but take us back. How do I say this? It takes us one step forward but two steps back,” she said following a meeting with officials from the Energy and Mineral Resources Ministry.

The planned incentives will exempt oil and gas companies from paying import value-added tax (VAT), import duties, domestic VAT and property tax, as well as waive similar taxes during the exploitation phase.

Non-tax incentives will include clearer rules on investment credit and domestic market obligation (DMO) holidays. A DMO is a requirement imposed on firms to allocate a certain amount of oil or gas production to meet domestic demand.

The government hopes that these incentives will improve the oil and gas sector by increasing the economic value of oil and gas projects — which are mainly measured by the internal rate of return — to 15.6 percent from the current value of 11.59 percent, making the upstream side more attractive.

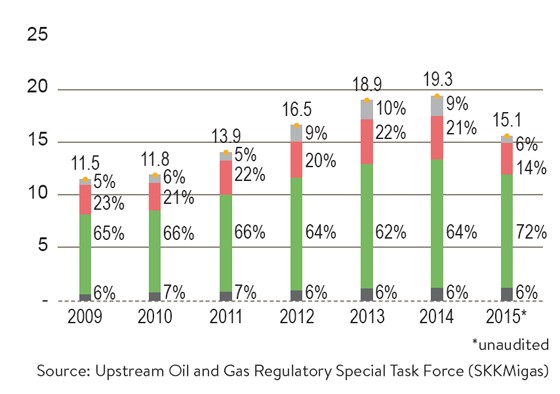

During the first half of the year, there were 113 active exploration sites, with only US$367 million invested in exploration activities out of a total investment of $5.7 billion in the oil and gas industry, according to data from the Upstream Oil and Gas Regulatory Special Task Force (SKKMigas).

The reluctance to commence exploration is mainly due to low global oil prices, which have risen slightly of late since first lurching to around $30 per barrel more than a year ago. This has also caused a lack of enthusiasm in investors to bid on the 14 conventional oil and gas exploration sites that the government has put up for auction this year.

The regulatory changes are also unlikely to encourage firms to significantly boost their current activities. ReforMiner Institute researcher Pri Agung Rakhmanto earlier said that firms would still have to pay indirect taxes and fees with the new revisions.

Separately, Energy and Mineral Resources Ministry secretary-general Teguh Pamudji said Friday the main point of contention between the government and business players revolved around which contracts the revised PP 79/2010 would apply to.

While the incentives will apply to new contracts devised in the revision, he noted that several existing contracts signed after 2001 still used the assume-and-discharge scheme instead of the cost recovery scheme — the reimbursement scheme for oil and gas production and exploration costs — introduced in 2010.

(-/-)

(-/-)

The assume-and-discharge scheme is favored by the IPA because it creates more business certainty by guaranteeing that investors will not have to pay any additional fees and taxes in the future during the long duration of their product-sharing contracts, many of which can last over 30 years.

“They are mainly questioning whether or not [those assume-and-discharge contracts] will continue using the same scheme,” Teguh said.

Meanwhile, SKKMigas deputy head Zikrullah said the effects of the revised regulation, including increasing oil and gas production, would only be felt in the next five to 10 years.

“For example, if there is an increase in investment in this year’s bidding then it will take six years for the exploration period to be completed. So, it could take five to 10 years,” he said.

_____________________________________

To receive comprehensive and earlier access to The Jakarta Post print edition, please subscribe to our epaper through iOS' iTunes, Android's Google Play, Blackberry World or Microsoft's Windows Store. Subscription includes free daily editions of The Nation, The Star Malaysia, the Philippine Daily Inquirer and Asia News.

For print subscription, please contact our call center at (+6221) 5360014 or subscription@thejakartapost.com