Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIndonesia grapples with inflation dilemma as subsidies cut

Change text size

Gift Premium Articles

to Anyone

International Monetary Fund (IMF) Managing Director Christine Lagarde, left, stands with Development Committee Chair Indonesia Finance Minister Sri Mulyani Indrawati, before the Development Committee plenary, at World Bank/IMF Spring Meetings at IMF headquarters in Washington, on April 22, 2017. (AP/Jose Luis Magana)

International Monetary Fund (IMF) Managing Director Christine Lagarde, left, stands with Development Committee Chair Indonesia Finance Minister Sri Mulyani Indrawati, before the Development Committee plenary, at World Bank/IMF Spring Meetings at IMF headquarters in Washington, on April 22, 2017. (AP/Jose Luis Magana)

What’s good for Indonesia’s fiscal chiefs is proving a headache for the central bank.

President Joko "Jokowi" Widodo’s push to phase out electricity subsidies that have drained the budget of billions of dollars is boosting prices in the economy and threatening the bank’s 3 percent to 5 percent inflation target.

For reform-minded Jokowi, getting rid of the subsidies and building fiscal space has been a focus of his two-year-old presidency. It’s won him support from international investors and credit-rating companies, but now presents a test for Bank Indonesia: how to manage the short-term pain for consumers without halting the nascent recovery in the economy.

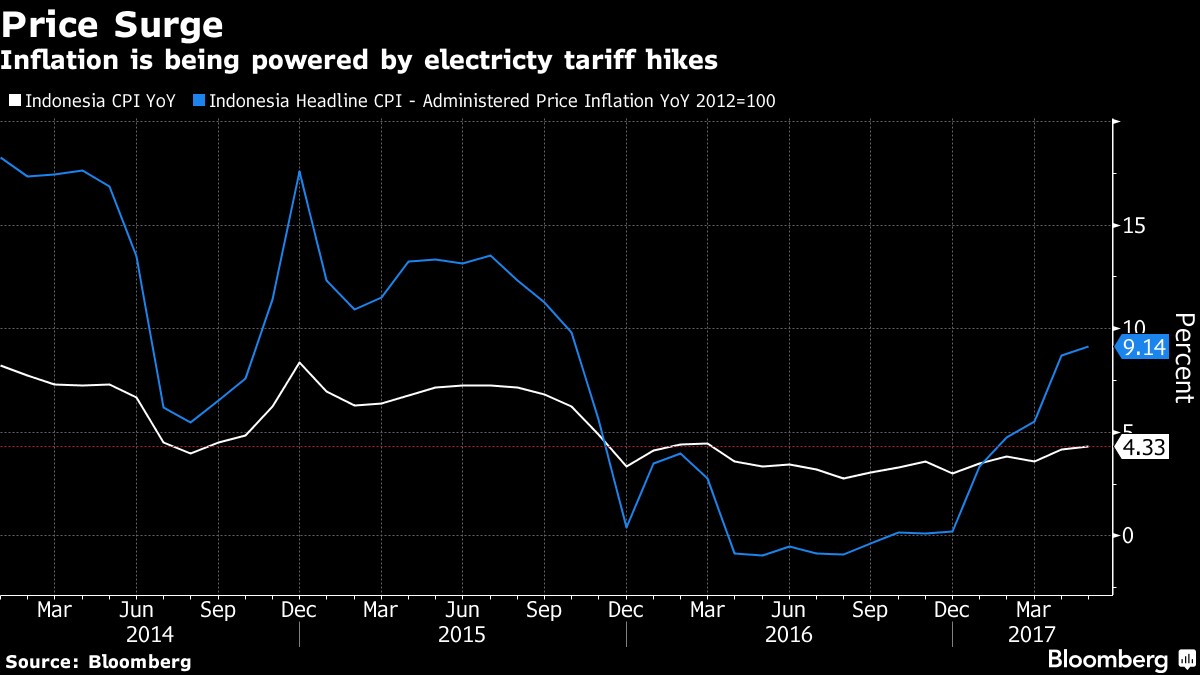

“Inflationary pressures have largely arisen from administered price hikes such as electricity tariff hikes,” said Weiwen Ng, an economist at Australia & New Zealand Banking Group Ltd. in Singapore. Higher power costs “are a necessary evil” and structural reform that the economy needs, he said.

Inflation is being powered by electricity tariff hikes(Bloomberg/File)

Inflation is being powered by electricity tariff hikes(Bloomberg/File)

The government raised electricity tariffs twice this year, and delayed a third hike initially planned for June because it would have coincided with Ramadhan, the Muslim fasting month when food prices generally spike. Inflation, which reached a 14-month high of 4.3 percent last month, could have broken through 5 percent if power costs were raised a third time, said ANZ’s Ng.

After reducing interest rates six times last year, Bank Indonesia has since kept its benchmark interest rate unchanged at 4.75 percent and will probably maintain that stance on Thursday, according to all 28 economists surveyed by Bloomberg. A separate survey shows most economists expect the rate will be higher in a year’s time.

The rate outlook is also being shaped by the Federal Reserve’s moves to tighten U.S. monetary policy, which may affect foreign inflows to emerging markets and currencies. Bank Indonesia’s rate decision on Thursday will follow several hours after the Fed is expected to raise borrowing costs.

The rupiah has gained 1.4 percent against the dollar this year and was trading at 13,287 as of 10 a.m. in Jakarta on Wednesday.

Subsidizing electricity costs have long been criticized for drawing resources away from other much-needed priorities, such as infrastructure projects. The Canada-based International Institute for Sustainable Development, which has produced regular reports on energy policy in Indonesia, estimated subsidies reached a peak of Rp 101.8 trillion ($7.7 billion) in 2014. The budget allocation for this year is Rp 45 trillion, it said.

“Fiscally, the subsidies are wasteful,” said Lucky Lontoh, a researcher on energy policy at the institute’s Global Subsidies Initiative in Jakarta. “They aren’t the best way to use Indonesia’s resources for the good of the people.”

The government is mandated to keep its budget deficit under 3 percent of gross domestic product, a line that is getting closer as tax revenue comes under pressure. Jokowi has ordered government ministries to review their spending plans this year to help keep the budget under control.

The deficit may widen to as much as 2.7 percent of GDP this year compared to an estimated 2.4 percent for 2016, Finance Minister Sri Mulyani Indrawati said last week. She said on Tuesday that the government remained “optimistic” about reaching its revenue target this year and was taking a cautious approach in case it misses that goal.

Gundy Cahyadi, an economist at DBS Group Holdings Ltd. in Singapore, said a gradual increase in electricity prices would help limit the impact on inflation.

“You do not want to give a one-time hike, which would only put a lot of stress on prices in the short term,” he said. “That could also be disruptive.”