Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsBTN targets fifth position this year

Change text size

Gift Premium Articles

to Anyone

A

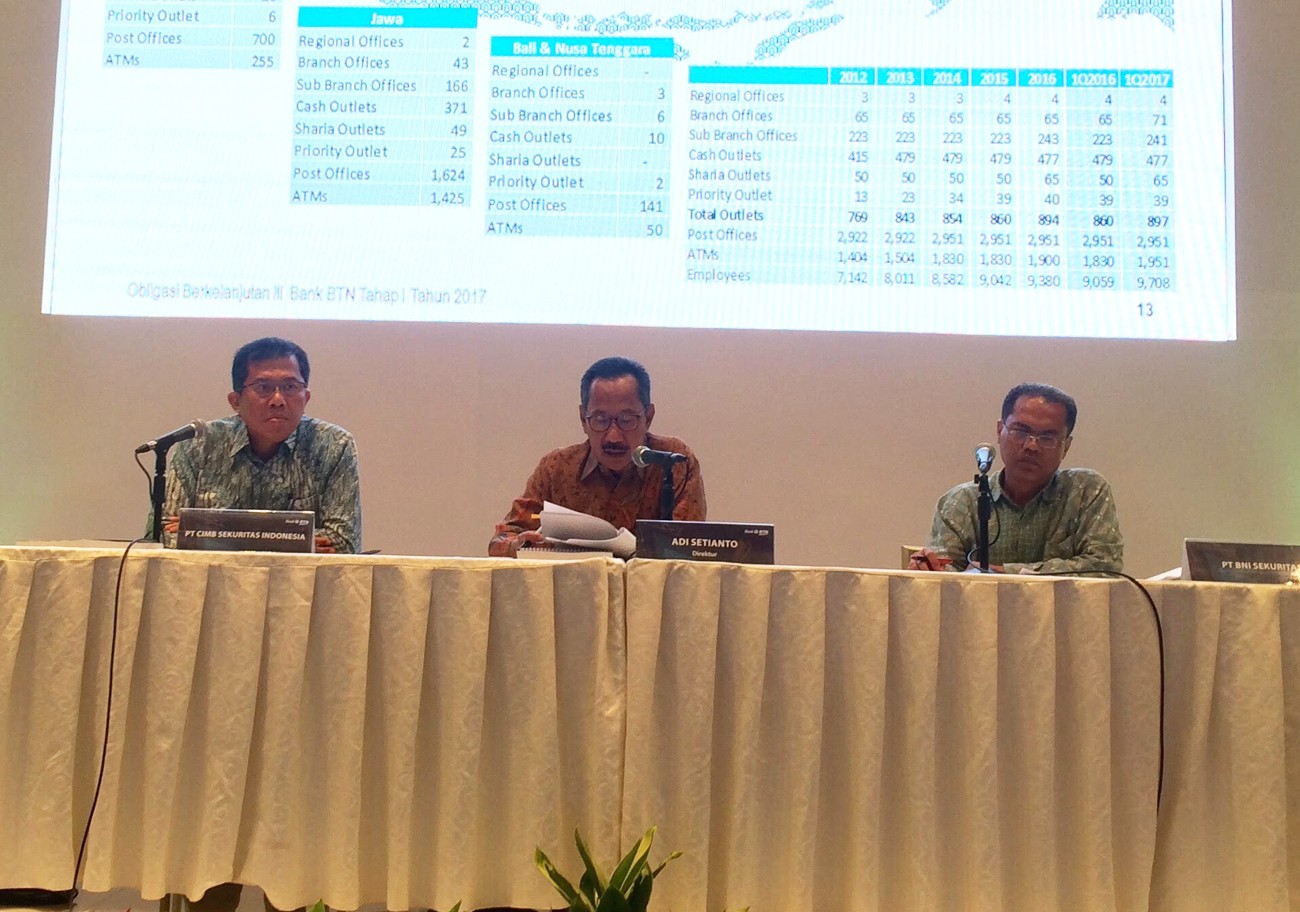

fter rising to the sixth place among the country’s largest banks, state-owned lender Bank Tabungan Negara (BTN) has set itself a target of another notch up to become the fifth-largest bank by year-end.

At the end of last year, the fifth position was held by private lender Bank CIMB Niaga with total assets of Rp 236.95 trillion (US$17.83 billion), followed closely by BTN with assets of Rp 214.16 trillion.

As of April, BTN recorded loan growth of 18 percent year-on-year (yoy), bringing its lending portfolio to Rp 170.45 trillion. The growth rate was almost twice the national banking industry’s average of 9.3 percent.

BTN’s third-party funds increased 21.82 percent yoy to Rp 157.52 trillion. BTN president director Maryono said that with such growth, its assets could total about Rp253 trillion by the end of the year.

He added that the management would keep the bank’s annual credit growth rate at around 18 percent and that of third-party funds at around 23 percent. (dis/tas)