Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsYahoo has some good news and (of course) some bad news: Gadfy

The good news, by Yahoo standards, is the company’s business is slightly less terrible than it has been. Hooray?

Change text size

Gift Premium Articles

to Anyone

Do you want the good news or the bad news about Yahoo Inc.? Hint: The good news is that there actually is some good news.

The tech company that can do nothing right had plenty of bad news in its (maybe) last disclosure of quarterly earnings before Verizon Communications Inc. (maybe) buys the internet parts of Yahoo and leaves behind a Yahoo shell called Altaba with a messy pile of Alibaba shares and other highly valuable refuse.

The continuing bad news from Yahoo is the company doesn't believe it will complete the sale to Verizon in the first three months of this year, as it originally thought. Um, of course not. Yahoo and Verizon are in semi-open war over whether Yahoo was forthcoming about two sweeping cyberattacks on Yahoo users. Lawyers fighting over who should bear the risk from cyberattack hangovers and potential regulatory crackdowns naturally makes it tough to finalize a deal on schedule.

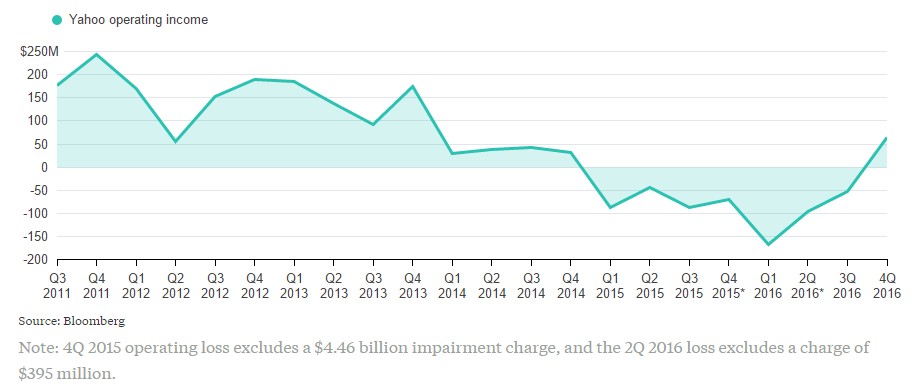

The good news, by Yahoo standards, is the company’s business is slightly less terrible than it has been. Hooray?

Yahoo posted a $64 million operating profit for the final quarter of 2016. That might not sound so grand for an internet company that only has to pay for pixels and engineers. But it was the first operating profit Yahoo posted in two years. The bad news: It amounted to an Amazon-like tiny operating profit margin of 4 percent.

Progress, by Yahoo's standards

Yahoo slashed its staff in the last year and managed to post an operating profit for the first time in two years.

Yahoo operating income(Bloomberg/File)

Yahoo operating income(Bloomberg/File)

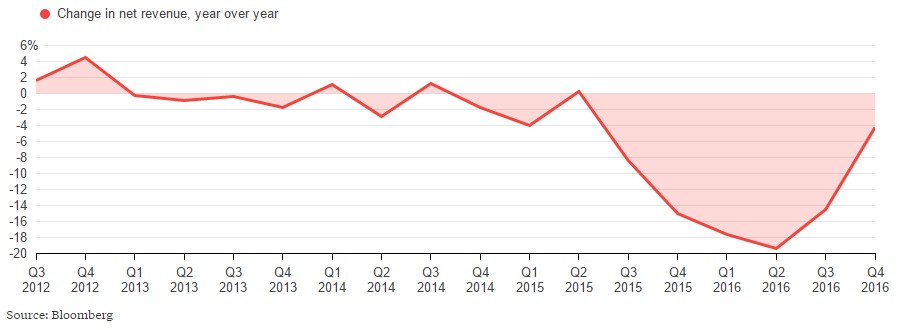

There are other dark linings to Yahoo’s happy cloud. The profit came largely because it has slashed staff and other costs -- something Verizon would have done anyway if and when the deal closes. Yahoo's revenue is still shrinking, although it is shrinking more slowly than before. Revenue, excluding commissions paid to advertising partners, declined 4 percent in the fourth quarter. That was the best revenue performance in 18 months.

Less terrible

Yahoo's revenue excluding commissions to partners dipped 4% in the fourth quarter, a slower decline than previous quarters.

Yahoo's revenue(Bloomberg/File)

Yahoo's revenue(Bloomberg/File)

All that means Yahoo's business has turned a corner, which would have been great if Yahoo had remained independent. The metrics that will matter to Verizon if it buys Yahoo -- the number and price of ads Yahoo is selling -- are not doing so hot. Yahoo's share of the U.S. digital ad market is expected to shrink to 2.7 percent this year from about 4.2 percent in 2015, according to eMarketer estimates. And the amount of time Americans spend surfing Yahoo's websites and apps is staying flat at best, comScore data show.

Oh. I guess that isn't such good news after all.

***

Shira Ovide is a Bloomberg Gadfly columnist covering technology. She previously was a reporter for the Wall Street Journal. This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

To contact the author of this story: Shira Ovide in New York at sovide@bloomberg.net

To contact the editor responsible for this story: Daniel Niemi at dniemi1@bloomberg.net