Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsIntegrate 'waqf,' sukuk and microfinance

One of the best practices of waqf land usage is Bencoolen Waqf in Singapore. As a Muslim minority country, Singapore has provided several specific legal frameworks for Muslims.

Change text size

Gift Premium Articles

to Anyone

I

n 2015, 193 countries, including Indonesia, adopted the United Nations’ Sustainable Development Goals (SDGs), which comprise 17 optimistic goals that aim to end poverty, hunger and inequality across the world by 2030.

Islamic finance, with its objectives to achieve socio-economic justice and reduce inequality, is in line with the global goals.

There are several tools in Islamic finance, namely waqf, sukuk and Islamic microfinance, which can be integrated into the agenda and result in achieving all 17 SDGs.

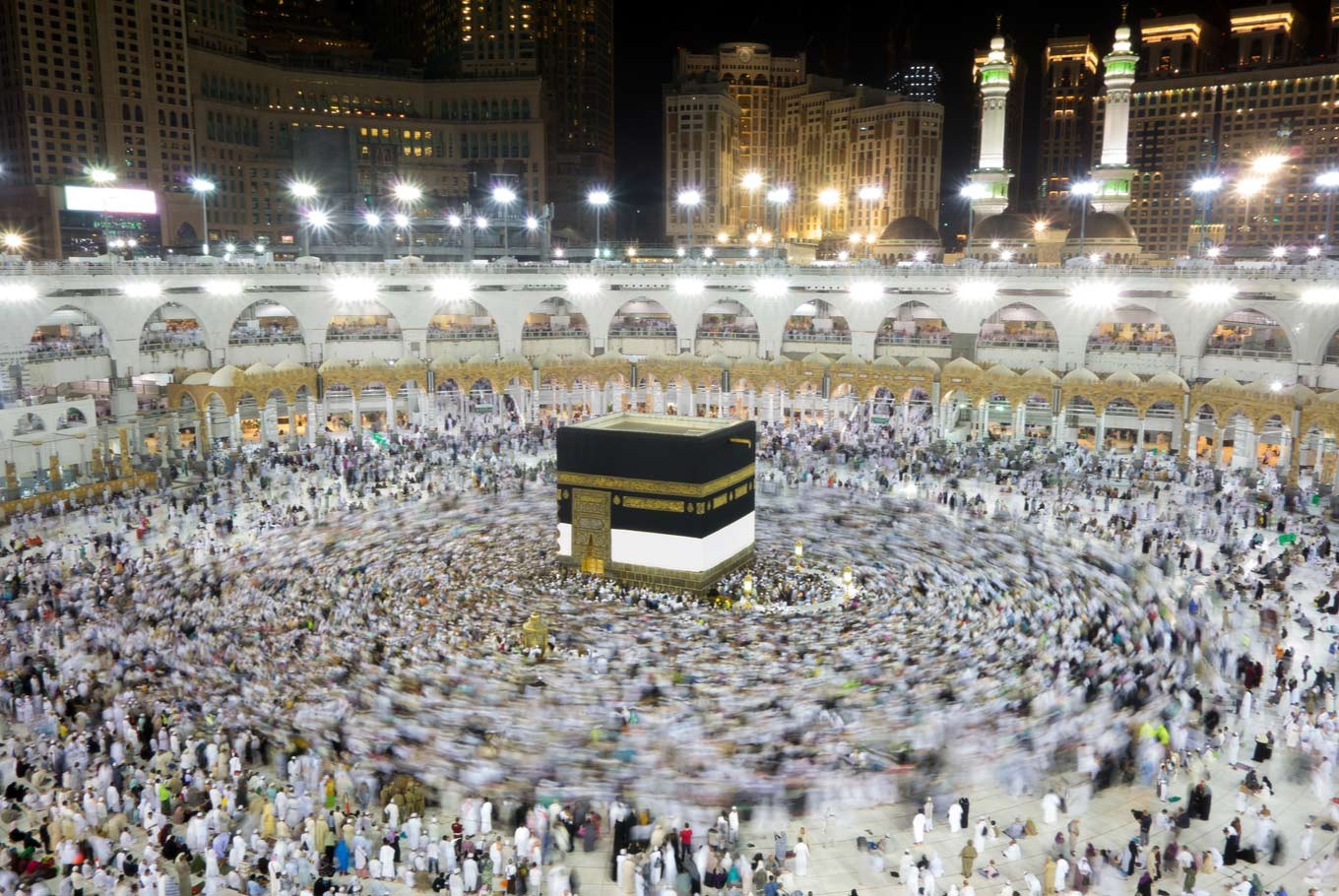

Waqf is an endowment made by a Muslim or an organization for charitable causes. There are two types of waqf: land and cash. About 45 percent of waqf land is used for mosques and schools. Even though it creates an impact through the improvement of religious places and educational reach, waqf land has an enormous opportunity to contribute to the socio-economic development of a country.

One of the best practices of waqf land usage is Bencoolen Waqf in Singapore. According to a 2010 census, Muslims comprise approximately 14.7 percent of the city state’s population aged 15 years or above.

As a Muslim minority country, Singapore has provided several specific legal frameworks for Muslims. The regulation and supervision of waqf properties are considered to be Muslim affairs, and are under the jurisdiction of the 1966 Administration of Muslim Law Act (AMLA).

According to Article 59 of the AMLA, all waqf properties in Singapore should be under the regulation and supervision of the Islamic Religious Council of Singapore (MUIS).