Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsPromise of digital financial services in Southeast Asia

The digital financial services industry holds big potential that could be unleashed if fundamental underlying challenges are addressed.

Change text size

Gift Premium Articles

to Anyone

W

ith a population of 570 million and a booming gross domestic product (GDP) expected to reach US$4.7 trillion by 2025, the six largest markets in Southeast Asia — Indonesia, Malaysia, the Philippines, Singapore, Thailand and Vietnam — represent one of the world’s fastest-growing regions. Within the region, the digital financial services industry holds big potential that could be unleashed if fundamental underlying challenges are addressed.

By 2025, we expect digital financial services to generate $38 billion in revenue, with Indonesia accounting for $8.6 billion of that sum. Based on research conducted by Bain & Company in collaboration with Google and Temasek, Indonesia’s digital financial services industry is likely to grow by 34 percent annually through 2025. Only Vietnam will see faster growth. However, the industry could become substantially larger, reaching $60 billion in revenue throughout the region, if certain conditions are met.

It is well known that Southeast Asia’s consumers have more limited access to financial services than their peers in developed markets. In Indonesia, nearly eight out of 10 adults are either “underbanked” — meaning they have no access to credit cards or have no long-term savings product, for example — or “unbanked,” without access to a basic bank account. In addition, millions of the region’s small and midsize enterprises (SMEs) face large funding gaps.

Now all eyes are on digital financial services — including payments, remittances, lending, investments and insurance — to overcome these and other challenges.

Four factors have stymied the growth of digital financial services in the region. First, consumers and merchants alike have been slow to abandon cash and make the move to digital. Another obstacle has been the lack of a reliable digitized identification system in most Southeast Asian markets. In addition, regulators have taken a cautious approach. A final issue: The region’s financial infrastructure remains largely underdeveloped, with an absence of robust credit bureaus, for example.

Despite these impediments, the market is poised to grow fast. High smartphone penetration and engagement will speed customer adoption of services like e-commerce and ride hailing, while paving the way for embedded financial services. Regulatory policies are also becoming more open.

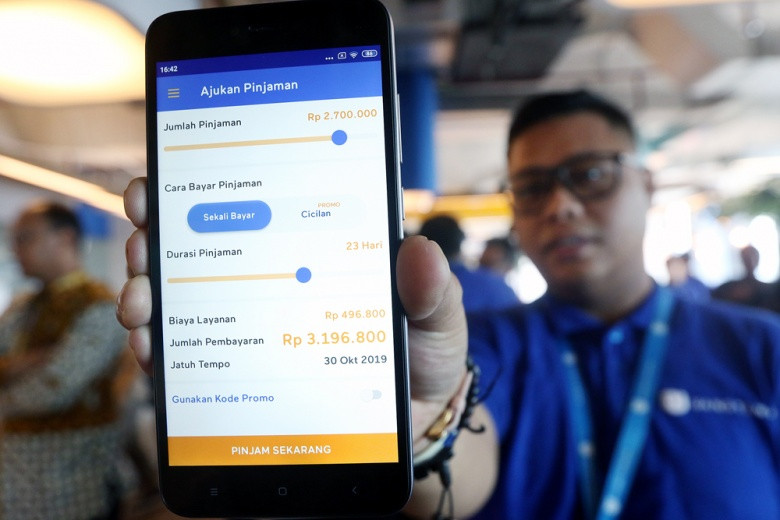

Among the five services we studied, digital payments and remittances are the most advanced, with payments expected to exceed $1 trillion in transaction value by 2025. The other services — lending, investments and insurance — are still emerging, but each should grow by more than 20 percent annually through 2025. At that point, lending will make up half of all digital financial services, led by innovations in consumer lending and SME working capital financing. We expect digital lending to achieve 61 percent annual growth in Indonesia through 2025.

Today the industry is a free-for-all among four major types of players, none of which has everything it will take to win. For example, established financial services players such as banks and insurance companies have broad financial services expertise, a large customer base, customer trust and access to low-cost funding.

But fintechs — the new generation of independent players with innovative business models—benefit from a more flexible cost structure and cleaner technology stacks, allowing them to provide competitive pricing and better user experiences. Established consumer players such as telcos, airlines and retail companies are expanding into financial services, bolstered by broad distribution networks and massive amounts of customer data, but they may lack the digital capabilities to leverage those assets.

Consumer technology platforms such as ride-hailing and gaming companies have a large online customer base for cross-selling of financial services and digital capabilities, and they offer an online-to-offline experience. We found that new entrants are gaining trust in Southeast Asia, especially in Indonesia and Vietnam.

As this field of competitors quickly expands, lines are blurring between different categories of players in the ecosystem, and partnerships are becoming more common. Disruption will more likely come from consumer technology platforms than from pure-play fintechs offering niche services.

We expect that more banks will partner with established consumer players or consumer tech platforms to expand their user base and build volume. Companies that are more nimble and technology-savvy will outpace competitors and gain share. DBS, for instance, has targeted the tech-savvy population in Indonesia, including both banked and under-banked consumers, through Digibank, which offers uncollateralized loans within certain limits, among other digital-only services.

Digital financial services’ development will play out differently in three distinct customer segments. The banked segment (representing 23 percent of Indonesia’s population) will remain a major focus for established players.

Under-banked consumers (26 percent of the population) will be served by new technology-enabled business models. This segment represents the true growth engine in digital financial services.

While all competitors can pursue this market, consumer technology platforms have some distinct advantages. They have leaner cost structures, no antiquated legacy technology systems, access to rich data sets and digital-native customer engagement.

We are seeing new business models in unsecured consumer lending and merchant lending emerge. For example, online marketplace Tokopedia provides consumer purchase financing in partnership with pure-play fintechs such as OVO, and has begun lending to its merchants in partnership with both established players and pure-play fintechs.

But digital financial services will not be a panacea for reaching the unbanked (51 percent of Indonesia’s population), although some fintechs have achieved early success. For example, with three million customers across rural Indonesia, Mapan (under the Gojek umbrella) offers a unique program in which participants take turns making interest-free loans from pooled money to buy white goods. Overall, however, pure-play fintechs and consumer tech platforms are not yet making a meaningful impact. Governments and telecom companies will need to play a key role in accelerating development of this segment.

In addition, SME merchants, such as independent restaurants and shops, are set to become an important digital financial services battleground. Digital advances are rapidly opening up new business models to serve a potentially huge market.

Our survey of more than 250 SME owners in Indonesia found that 76 percent already accept digital payments or are likely to accept them in the next three years. All four types of digital services players will fight it out for the vast SME market.

***

Aadarsh Baijal and Usman Akhtar are Bain & Company partners based in Singapore and Jakarta, respectively.