Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsWhat the future lending landscape will look like

Banks, in conducting lending activities, use the “five C’s” of credit in analyzing the creditworthiness of prospective borrowers. The five principles are character, capacity, capital, collateral and conditions.

Change text size

Gift Premium Articles

to Anyone

T

he rapid advancement of technology nowadays leads to wishful thinking about the future, in which lending activities by financial institutions will be easier to access, thereby achieving financial inclusion and bringing the benefits of economic growth to the community.

Banks, in conducting lending activities, use the “five C’s” of credit in analyzing the creditworthiness of prospective borrowers. This principle is trusted as a tool to implement prudential banking so that the assumption of banks as trusted institutions is maintained. The five principles are character, capacity, capital, collateral and conditions. Character evaluation is performed to determine whether the prospective borrower can be trusted to manage the funds loaned by the bank.

Capacity reveals the borrower’s ability to repay the loan. Capital provides the data for a bank to determine the condition of assets and wealth owned by the prospective borrower, which the bank will take into consideration to determine the feasibility of the size of loan granted. To mitigate the risk of default, a bank will conduct a collateral assessment to determine the assets owned by the prospective borrowers that can be taken by the bank in the event the debtor being unable to repay the loan. The last principle is conditions, an evaluation is conducted by analyzing the economic conditions at the time and in the future that will affect the business run by the debtor.

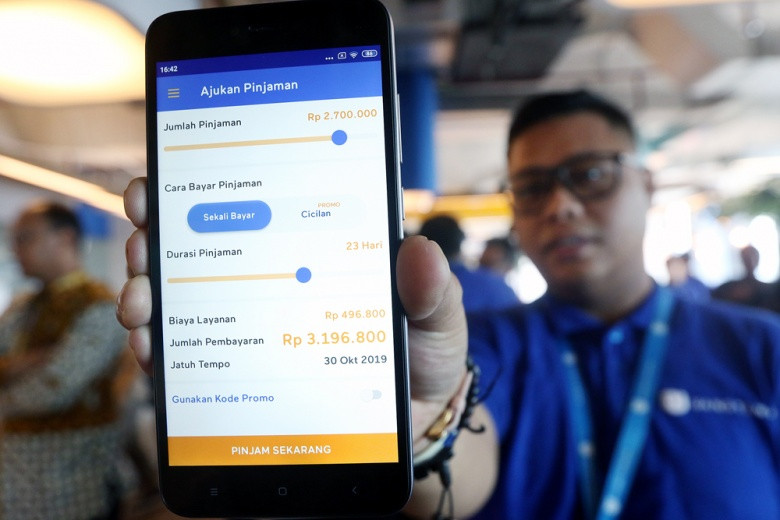

How then can technology help with the “five C” analysis, making it easier for banks or other financial institutions to decide a prospective borrower’s creditworthiness? The advancement of financial technology at this moment has made payment transactions for public service facilities easier because they are done online or electronically with various payment instruments such as internet and mobile banking.

Electricity, telephone, tax, internet and water bills can be easily and quickly resolved without the need to leave the house. The use of technology in payment transactions will have positive effects in the form of the availability of the community’s track record database in fulfilling their obligations to the public facilities that have been used. From this track record, it can reveal the character of a person and the responsibilities they have, including in terms of timeliness of payment.

Based on this, the assessment of the five C’s principles can be made and can also be strengthened with the track record of other transactions, such as credit card bills and loans that have been held. Meanwhile, the ability of a prospective borrower to repay (repayment capacity) can be illustrated from the business activities that have been conducted. The massive rise in noncash or digital transactions is expected to make a major contribution to the provision of public transaction data.

In “The Indonesia Payment System Blueprint 2025”, one of the five main areas of initiatives undertaken by Bank of Indonesia (BI) as the payment system authority is to develop a retail payment system that supports the digital financial economy. The Quick Response Indonesia Standard (QRIS), launched in August 2019, is one form of digitized retail payment by BI. The QR code standardization facilitates the digital integration of economic-finance nationally at the micro-level, so as to increase the use of QR codes in public transactions that were previously fragmented.