Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsWhen will the easy money support end?

Inflation continues to rise in many emerging markets because of higher fuel and food prices, and supply chain disruptions interacting with a stronger economic rebound.

Change text size

Gift Premium Articles

to Anyone

T

he current global financial trend has seen central banks hinting at pulling out of their easy money support in the face of mounting inflation pressures. Central banks in Brazil, Russia, Mexico, Chile and a vast number of East European emerging markets (EMs) have already raised policy rates and reduced asset purchasing programs sooner than anticipated, to rein in inflationary pressures to keep inflation expectations anchored.

Inflation continues to rise in many EMs because of higher fuel and food prices, and supply chain disruptions interacting with a stronger economic rebound.

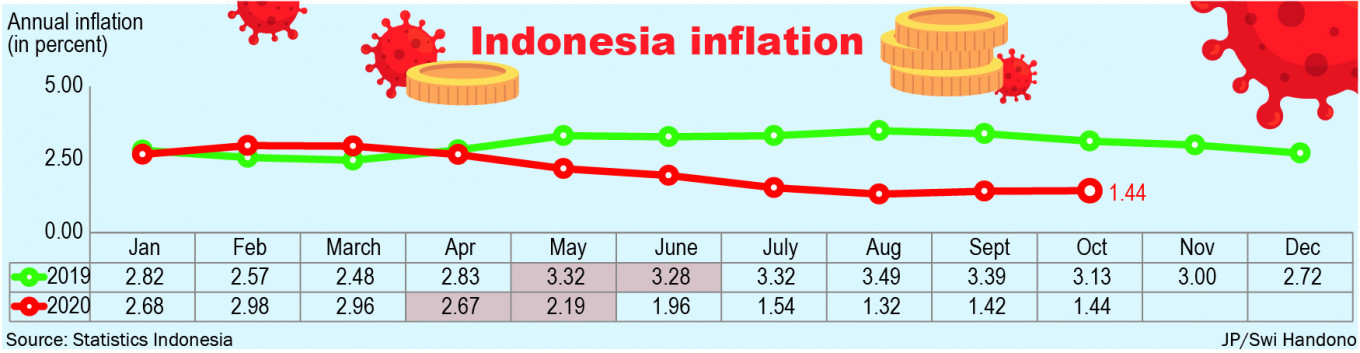

At the same time, manufacturers and exporters are facing headwinds from supply chain disruption and surging freight and maritime costs. The risk is rising that ironing out supply-side wrinkles may take longer than the first half of next year. Hitherto, we see no signs that the increase of inflation in Indonesia is becoming broad-based across the economy. In Indonesia’s annual Consumer Price Index (CPI), inflation only inched up to 1.60 percent in September, still considerably lower than the historical average. The prices increased mainly because of a faster rise in prices of housing, utilities and transport amid loosening restrictions in some regions in Indonesia.

But the impact of imported inflation due to global supply chain disruption cannot be ignored, as mechanical machinery, iron and steel, chemical product and plastic goods, metals and motor vehicles make up the largest part of Indonesian non-oil imports, which on a monthly basis reach an average of US$14 billion. The soaring world crude oil prices – of which Indonesia is a net importer – will also eventually impact, leading to increasing domestic transportation costs.

Inflation risks arising from global supply chain disruption are currently still balanced by weak household consumption, although there are signs of an economic activity upturn as represented in the trend of prompt indicators, such as retail sales, consumer expectations and the Purchasing Manager Index for manufacturers

In the short-term, a rapid recovery in household consumption is imminent, possibly attributable to the income effect in regions outside Java, which are benefiting from current soaring commodity prices of coal and crude palm oil. Following the reopening of the country, the recovery in household consumption will proceed even faster as people start spending their savings.

Owing to the lockdowns, households are sitting on large savings accumulated during the pandemic – as shown by deposits in the banking system that have amounted to Rp 7.12 quadrillion ($508.57 billion) as of August.