Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsTax policy direction of 2024 gears up to reach increased target

Change text size

Gift Premium Articles

to Anyone

T

he government has increased the targeted tax revenue of 2024 by 9.4 percent, totaling up to Rp 1,988.9 trillion. For context, the estimated realization of 2023 amounted to Rp 1,818.2 trillion.

"Tax revenues in 2024 are expected to grow higher compared with 2023 in line with economic growth and supported by various optimal tax policies," said Director of Tax Dissemination, Services, and Public Relations, Dwi Astuti.

However, as the New Year is fast approaching, obstacles remain. Efforts to achieve the tax target next year may be hindered by a series of problems which include increasingly heated geopolitical tensions. The unfinished war between Russia and Ukraine, followed by the war between Israel and Hamas. Tensions are also brewing between the United States and China, which will have an impact on global trade.

Another problem that must be paid attention to is climate change. The crises are visible in terms of drought, as it triggers the decline of long-term food security. Moreover, because of the decline of commodity prices, along with imports and Voluntary Disclosure Program (PPS) recently, the revenue performance slowed compared with last year.

Amid all the concerns, the government is striving to hit the target mark with implementation and continuation of the policies introduced recently.

Tax policy direction 2024

The general tax policy for 2024 is directed at supporting the economic transformation process amid various challenges. This is done through implementing activities related to Periodic Payment Supervision (PPM) and Material Compliance Supervision (PKM). Moreover, other policies are also being implemented to optimize revenue achievements in the coming year, including encouraging the level of compliance and integration of technology in the tax system, expanding the tax base through intensification and extensification, strengthening synergies through joint programs, utilizing data, and taking law enforcement actions.

The government is helping to maintain the effectiveness of the implementation of the Harmonization of Tax Regulations (HPP) Law to encourage an increase in tax ratios and tax incentives that are increasingly targeted and measurable to support the business climate and competitiveness, as well as economic transformation with high added value.

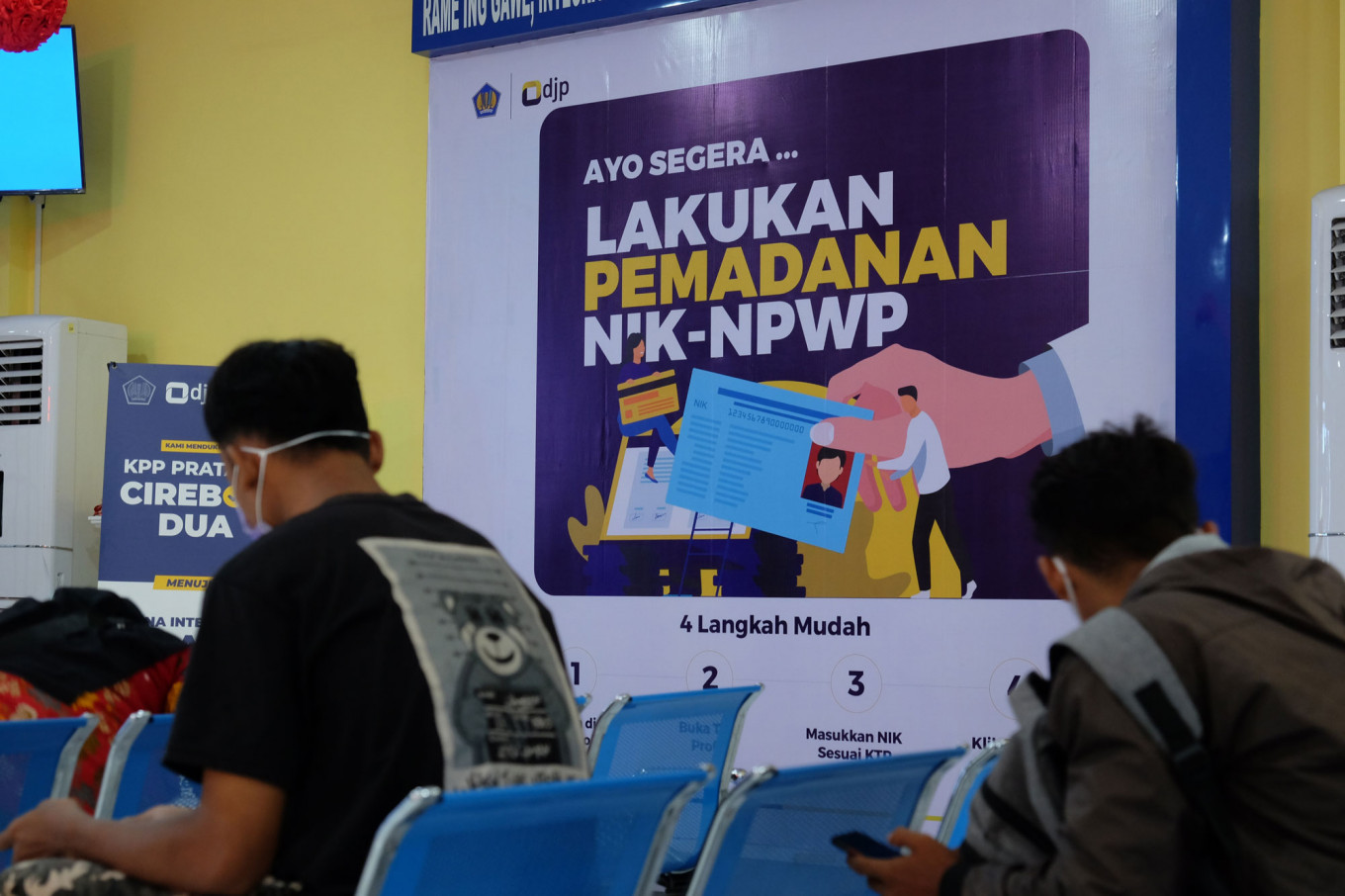

Dwi explained that in optimizing the expansion of the tax base as a follow-up to the HPP Law, the steps taken were a follow-up to the voluntary disclosure program and the implementation of the NIK as an NPWP.

The Directorate General of Taxes will strengthen tax extensification as well as targeted and regional-based supervision, such as the implementation of the preparation of the Tax Revenue Security Priority Target List (DSP4) and priority supervision of high wealth individual (HWI) taxpayers and group taxpayers, affiliated transactions and the digital economy.

In terms of law-enforcement activities, the Directorate General of Taxes will continue to uphold the principles of justice, by optimizing the disclosure of untruthful statements and the use of digital forensics activities. The Directorate General of Taxes is optimistic that it can overcome the challenges considering that the Core Tax Administration System (CTAS) will be implemented in mid-2024. Through the implementation, it is hoped that the information system and business processes of the Directorate General of Taxes can be more integrated and reliable, thereby making it a strong, credible and accountable state revenue institution.

Tax instrument as economic drivers

Since the recent implementation, taxes have become a fiscal policy instrument, both to support government programs and in emergency conditions. The same policy will be continued in the new year.

The fiscal policy instruments include Value Added Tax (VAT) not payable to small entrepreneurs (turnover of up to Rp 4.8 billion), VAT exempted on basic necessities, education and health services, Tax Holiday & Tax Allowance, 50 percent reduction in PPh rates for MSME corporate taxpayers (with a turnover of up to Rp 50 billion), 0.5 percent final PPh for taxpayers with certain business turnover in accordance with PP 55 2022, final PPh exemption for OP taxpayers with certain turnover in accordance with PP 55 2022 with turnover up to Rp 500 million, Free Trade Zone (exempt from VAT and PPnBM), Special Economic Zone (not subject to VAT and PPnBM), VAT not levied in Bonded Zones, VAT exemption on imports or deliveries of machinery and/or equipment, VAT not levied on certain means of transport , DTP VAT on houses, and DTP VAT on electric cars.

Signaling a better tomorrow

The tax revenue from January to September of this year showed good promise, attributed to the good performance of economic activities. The realization of the period reached Rp 1,387.78 trillion, which amounted to 80.78 percent of the target.

Supported by good economic performance, tax revenues from January to September 2023, grew positively to reach Rp 1,387.78 trillion. Non-Oil and Gas PPh contributes as much as Rp 771.75 trillion, followed by Rp 536.73 trillion attributed from VAT and Luxury Goods Sales Tax (PPnBM), PBB and other taxes amounting to Rp 24.99 trillion, and Oil and Gas PPh amounting to Rp 54.31 trillion. The four tax groups saw positive growth, with the exception of Oil and Gas PPh which experienced a contraction due to moderation in oil and natural gas prices.

However, revenue growth at the end of the year was 5.9 percent, which is lower than the previous year due to falling commodity prices, a decline in the value of imports, and the non-recurrence of the Voluntary Disclosure Program (PPS) policy.

In the future, tax revenues will follow fluctuations in macroeconomic variables, especially commodity prices, domestic consumption, government spending, import activity and other variables. Therefore, tax revenues are estimated to achieve a greater realization than the 2023 APBN target of Rp 1,718 trillion.

The achievement of tax revenues was driven by stable economic growth. Apart from that, there is a spillover effect from the increase in commodity prices in 2022. Profit in 2022 on the Annual Tax Return which is submitted and the PPh payable paid in April 2023 also has a positive impact. At the end of 2023, revenue growth will be mainly supported by VAT and PPnBM, which is estimated to grow 10.9 percent to Rp 811.4 trillion in line with increased consumption. Furthermore, Income Tax is also projected to grow 8.6 percent to Rp 1,139.8 trillion. Meanwhile, PBB and other taxes are estimated to remain at Rp 37.7 trillion.

Apart from that, the strategy of providing various appropriate and measurable tax incentives is also expected to be able to accelerate recovery and increase the competitiveness of national investment, as well as spur economic transformation.

Source: The Finance Ministry