Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsFrom tug-of-war to teamwork: Co-designing affordable, high-quality care

Healthcare providers are facing a choice between continuing to react to insurer mandates or proactively shaping value-based arrangements through commercial, clinical and operational innovations.

Change text size

Gift Premium Articles

to Anyone

H

ealthcare providers across Indonesia and Southeast Asia are facing intensifying margin pressures. Prices for medical devices, pharmaceuticals and skilled labor keep rising, while aging populations drive higher utilization.

Historically, providers were able to pass a portion of this cost growth to private insurers. That model is fraying. Insurers’ margins are under sustained pressure, prompting more assertive cost controls and value-based contracting. The result is clear: Providers are being asked to deliver more value for less, a shift that rewards partnership, transparency and performance, not zero-sum tactics.

Across the region, private health insurers are tightening the reins. They are consolidating provider panels, negotiating tariff reductions, steering patients toward preferred networks and using data to manage outlier costs. For private providers, these measures translate into meaningful margin compression and a tougher negotiating climate. Hospitals, clinics and specialist centers now face a choice: continue reacting to insurer mandates or proactively shape value-based arrangements with commercial, clinical and operational innovations.

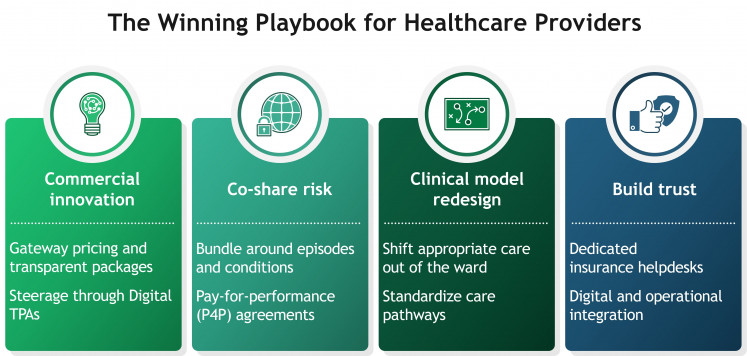

Providers have practical options to adapt without compromising care. Four moves, commercial innovation; risk-sharing; clinical model redesign; and digital or operational integration; can align incentives, protect quality and restore sustainable economics.

The winning playbook for healthcare providers (BCG/-)Commercial innovation

Use gateway pricing and transparent packages. Competitive rates for screenings and diagnostics can attract insured patients earlier and channel downstream care. This enables early identification and timely care of serious illnesses, reducing the cost of care for insurers, while generating financial upside for providers. Malaysia’s private sector provides instructive signals: Hospitals widely advertise health screening packages in partnership with health insurers and offer transparent, all-in surgical and maternity packages.

Leverage digital third-party administrators (TPAs) for steerage. TPAs are increasingly important partners for eligibility checks, claims rules and member navigation. AdMedika, one of the country’s largest TPAs, runs an e-claims web platform and a consumer mobile app that lets members find network providers and track claims in real time, strengthening steerage to preferred facilities and reducing friction at the point of care.

Make access easy. A convenient “front door” increases on-ramp utilization and in-network care. In the Philippines, HMOs are partnering with telehealth platforms to create always-on “front doors” that channel members to network providers. Maxicare’s tie-up with Doctor Anywhere enables 24/7 video consults for members, reinforcing in-network care and timely triage. Providers in Indonesia have the opportunity to tie up with such telehealth providers to provide frictionless access to insurer policyholders.

Co-share risk

Bundle around episodes and conditions. Providers can propose bundled prices for well-defined procedures (such as “door-to-rehab” knee replacements) or annual disease-management packages (such as for chronic knee osteoarthritis). In Malaysia for example, widespread use of clearly itemized surgical packages demonstrates operational readiness to price complete episodes, a foundation that can be adapted into contracted bundles with shared savings and quality guarantees.

Pay-for-performance (P4P) agreements. Providers can propose forward-looking contracts, which link a share of payment to quality and outcomes rather than volume alone. Typical measures include risk-adjusted complication and 30-day readmission rates, adherence to agreed care pathways (such as antibiotic or imaging appropriateness) and patient-reported outcome and experience measures (PROMs/PREMs). Structurally, providers and insurers set a baseline and target for each metric, define patient attribution and exclusions, agree a data window and audit rules, then settle a year-end “quality reconciliation”. Many start with upside-only bonuses to build confidence, then phase into two-sided risk with caps (such as 5-10 percent downside) once data quality and pathway compliance are stable. Governance sits with a joint clinical committee that reviews monthly dashboards; data flows come from pre-authorization and e-claims feeds plus standardized coding and, where relevant, PROMs collection.

Innovate the clinical model

Shift appropriate care out of the ward. From a clinical perspective, providers must ultimately reduce the total cost of care. Day surgery, ambulatory procedures and virtual wards have been proven to deliver equal or better outcomes at lower cost. In Singapore, the Health Ministry has endorsed and scaled virtual ward pilots across public clusters. Teams provide hospital-level care at home through tele consults and home visits for stable conditions like dengue, gastroenteritis or urinary tract infections, with evidence of bed-day substitution and strong patient experience, models that private insurers can support with tailored benefits.

Standardize care pathways. Evidence-based protocols, appropriate use of generics and biosimilars and disciplined supply-chain management reduce unwarranted variation in the cost and quality of care. When paired with bundled or capitated payments, these pathways turn clinical discipline into shared savings rather than unilateral cuts. Implementing these requires close clinician, administration collaboration and provider leadership that is bold and forward looking.

Build trust through digital and operational integration

Create dedicated insurance help desks. Patient-facing concierge counters for policy queries, benefits clarification and pre-authorization support can shorten length-of-stay, reduce denial risk and improve patient experience, strengthening providers’ negotiating position with payers.

Ensure digital and operational integration with insurers. Standardized e-billing, API-based pre-authorization and near real-time visibility on admissions is becoming the default across Southeast Asia. Private payers are setting the rails, and in Indonesia, TPAs like AdMedika have pushed e-claims, eligibility e-cards and provider portals. For providers, the direction of travel is clear: Pre-authorization, e-filing and structured bills are fast becoming prerequisites for panel status and cashless admission. The practical move is to get ahead, standardize bill formats, enable API-based pre-authorization from HIS, and provide patient status feeds to payers, to reduce disputes and days-sales-outstanding while strengthening negotiating power

It’s time to lead the conversation

The healthcare landscape in Southeast Asia, Indonesia in particular, is shifting fast. Providers that move first to co-design value-based contracts will shape the rules rather than be constrained by them. That means using transparent packages as the backbone of episode pricing, moving care to lower-cost settings and investing in interoperable authorization and claims rails.

Above all, it means partnering with insurers to define what “value” looks like: clear outcomes, appropriate use of resources and frictionless patient journeys. With commercial creativity, payment innovation, clinical discipline and digital execution, providers can protect quality and viability while helping payers keep premiums affordable. The opportunity is to turn today’s tug-of-war into tomorrow’s alliance, and to build a value-driven healthcare system that serves patients, payers and providers alike.

*****

Anurag Agrawal is managing director and partner at Boston Consulting Group (BCG), while Yishu Pi is project leader at BCG. Special thanks to Alan Ong, partner at BCG.