Popular Reads

Top Results

Can't find what you're looking for?

View all search resultsPopular Reads

Top Results

Can't find what you're looking for?

View all search resultsThe balance sheet of life: Knowing the three phases of personal finance

So, what phase are you in? And how is your financial condition?

Change text size

Gift Premium Articles

to Anyone

W

hat is a balance sheet? A financial document showing an entity’s financial structure at a moment in time, it shows what the entity owns and owes.

Combined with an income and cash flow statement it can be used to conduct fundamental analysis or calculate financial ratios. It has helped me in understanding more about a company’s financial condition. But, it is not impossible to apply the same analysis to a person.

However, unlike companies within the same industry that has a standard for comparison purposes, people do not. Even though we live under the same sky, each person has a different background, character, situation and purpose. The variables are just too great. That is why comparing one’s personal life to another will not be an apple-to-apple comparison.

Thus, instead of comparing, I would like to show what a person’s expected balance sheet looks like in different phases of life, which according to financial planning theory has three main phases.

Hold on.

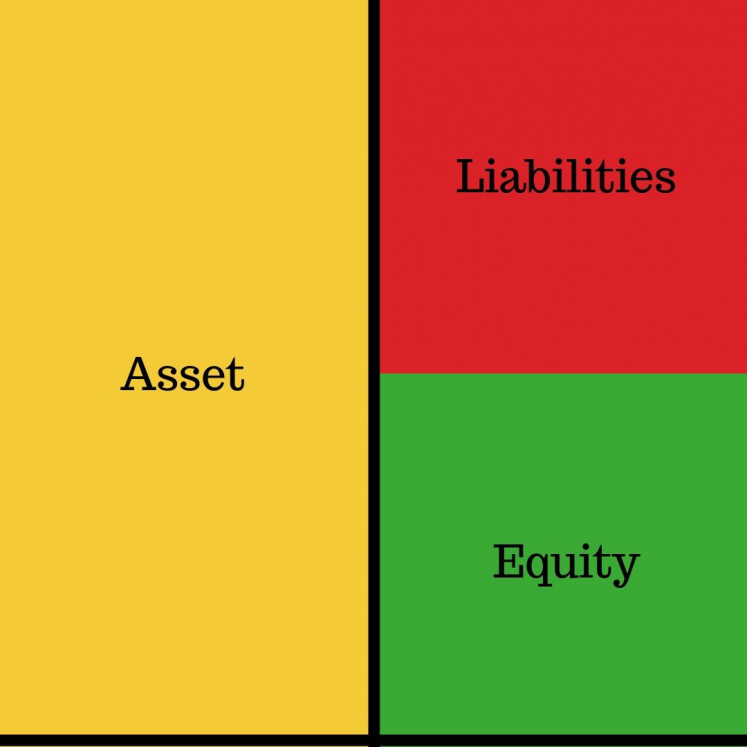

Before going further, let us look briefly into a balance sheet’s components. In general, it has two sides.

Asset = Liabilities + Equity (Pandu W. Soeprapto/File)On the left-side are assets: a resource that has the potential to generate cash flow, increase in value, or other financial benefits. For a person, an asset can be a house, car, cash, term deposit, bond, shares, pension fund, etc.

On the right-side: liabilities and equity. The former consist of debts, or obligations that need to be paid. The latter are funds you yourself contributed. Both represent the source of funds, or how you obtained an asset.

To summarize, what you have (assets) equals the amount of funds you spent, either using loans (liabilities) and/or your own money (equity). Thus, the sum of each side will always match with one another. That is why it is called a “balance” sheet.

What happens when assets are lower than the money spent? You seriously need to review your financial condition. In other words, your money did not become anything worthwhile.

Now, let us moves on to the phases in life.

Asset accumulation

This phase refers to the period when one starts to work and plan to build up wealth, and is generally around your youthful 20s. Is it possible to start this phase sooner? Why not, I take my hat off to anyone who started before 20.

What if later? Better late than never. It is a phase where someone begins their career, full of energy and excitement. Thus, it is valuable to start saving to prepare for your future, continuously learn the ropes of what you do and about investment, and add new skills.

In addition, this is, usually, the phase where you finally decided to step up your game and, after giving it a lot of thoughts, have a family. Then, you bought a house so that your family has a place to stay and feel secure, a car so that you can be more mobile in your endeavor, or simply to go picnic with family comfortably, seeking the best investment vehicles for your child’s education, pension, health, vacation, etc.

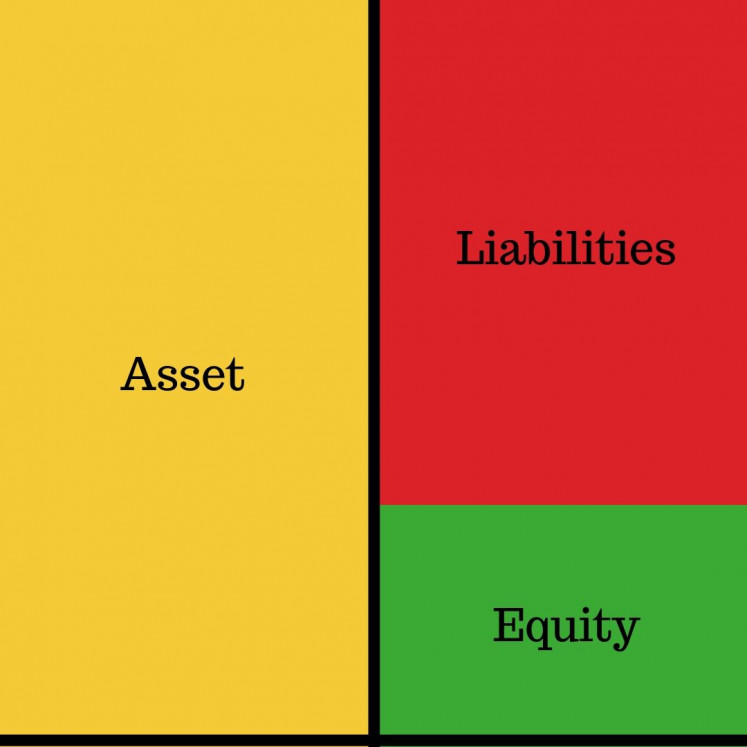

From the above explanation, your balance sheet of life during this phase might look like this:

Asset accumulation phase (Pandu W. Soeprapto/File)Your assets do increase, way more than before, because the house, car and investments are assets. However, your liabilities increase as well.

How come? As mentioned before, people start to buy a house and/or car in this phase, which cost quite a bit. Unfortunately, only a handful of people can purchase both assets using only their internal funds. Many people need to get loans (liabilities) to own a house and/or car. Thus, liabilities notably increase.

Read also: Latte factor and other small expenses that could lead your finances astray

Capital appreciation

The second phase starts between your mid-30s to late 40s. After a steady learning session during the first phase, as well as putting unimaginable efforts into developing a career, you are finally specialized in something. Your career is maturing, at the peak of it even. You are now earning a monthly income in an amount that you thought was only possible in a dream. Everything seems nice. Therefore, it should be the right time to start paying off your debts as soon as possible. Furthermore, you will also be glad knowing that your assets, that you bought in the previous phase, are increasing in value.

That is why, do not randomly acquire any asset and rely solely on others’ opinions. Spend some time to learn about the asset before actually purchasing it. The right asset will bear sweet fruit for you. The wrong asset will just be an expense, weighing you down.

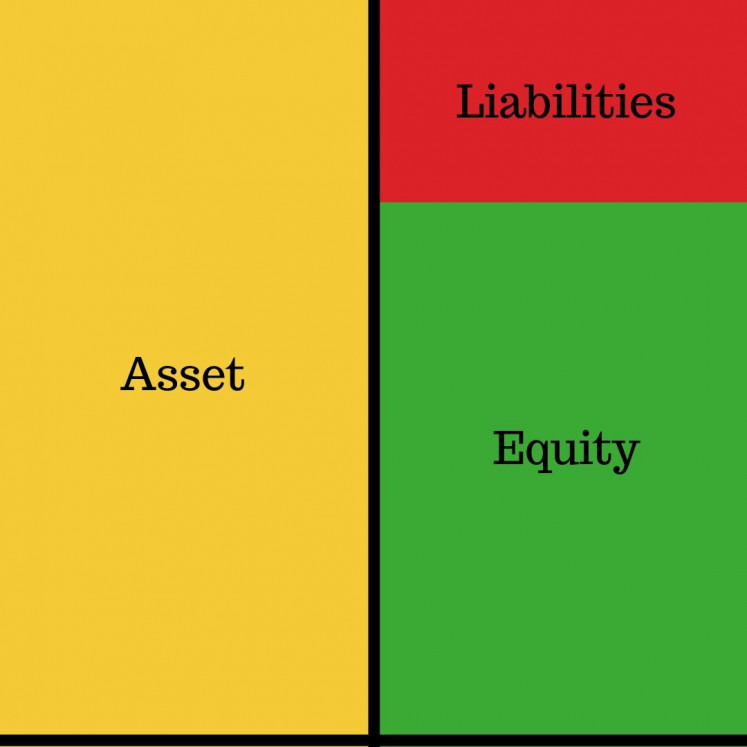

The condition for this phase can be shown as follow:

Capital appreciation phase (Pandu W. Soeprapto/File)The total value of your assets is likely to increase over time, and your loans are only a second away from being repaid, thanks to all those installments you diligently paid. You are now closer to a debt-free situation. Keep it up. You certainly can do it.

Capital distribution

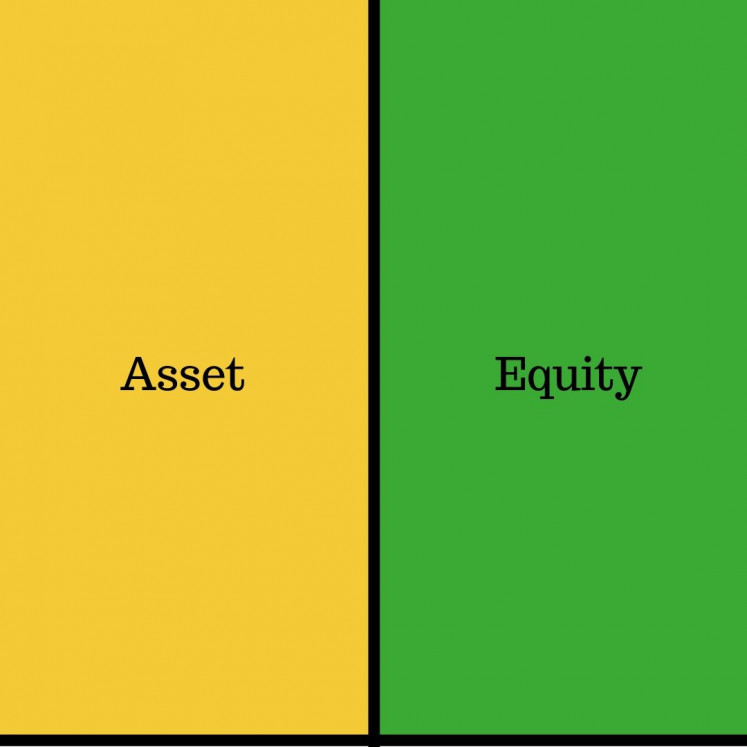

The last phase, marked when one retires, and starts enjoying money from the sources you set up in the first phase. Normally, you are no longer building wealth, but enjoying the results of your hard work. Thus, the ideal balance sheet should be like this.

Capital distribution phase (Pandu W. Soeprapto/File)Debt-free. All assets are your own. You do not need to be bothered by loan installments anymore. Enjoy, and be a guiding light for the next generation.

How long is this phase? It can be longer than you think, with the advancement of medical science it is not impossible for people to still live 30 years after retirement. That is not a short amount of time, is it? Therefore, plan your first phase well.

In the end, I would like to say that the balance sheets in phases of life are just a guideline. As I said before, each person is unique and may have a balance sheet of life that is totally different and unimaginable other than to the person him/herself. For instance, someone might not need to wait for retirement to enjoy their life in the distribution phase.

So, what phase are you in? And how is your financial condition? (kes)

***

Pandu W Soeprapto earned his bachelor’s degree from the Bandung Institute of Technology and master’s from Monash University, Australia. He currently works as an assistant vice president in corporate banking and has handled many financing projects in various sectors. He has a passion for teaching and loves to write. Find him on Instagram @pandu_wi_soe.